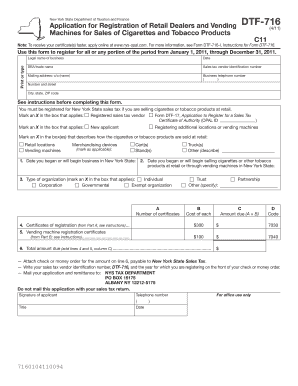

Dtf 716 Form

What is the DTF 716?

The DTF 716 form, officially known as the "New York State Certificate of Exemption," is a crucial document used for claiming exemption from sales tax in specific situations. This form is primarily utilized by businesses and individuals in New York who qualify for sales tax exemptions, such as certain non-profit organizations, government entities, and other specified exemptions. Understanding the DTF 716 is essential for ensuring compliance with state tax regulations while taking advantage of applicable tax benefits.

How to use the DTF 716

Using the DTF 716 form involves several straightforward steps. First, ensure that you meet the eligibility criteria for exemption. Next, accurately fill out the form, providing all required information, including the name and address of the purchaser, the nature of the exemption, and any relevant tax identification numbers. Once completed, submit the form to the seller from whom you are purchasing goods or services. It is important to retain a copy of the completed form for your records, as it may be needed for future reference or audits.

Steps to complete the DTF 716

Completing the DTF 716 form requires careful attention to detail. Follow these steps:

- Gather necessary information, including your tax identification number and details about the exemption.

- Fill in the purchaser's name and address accurately.

- Clearly state the reason for the exemption, ensuring it aligns with the categories listed on the form.

- Sign and date the form to validate the information provided.

- Submit the form to the seller before making a purchase, and keep a copy for your records.

Legal use of the DTF 716

The DTF 716 form is legally binding when filled out correctly and submitted in accordance with New York State tax laws. It serves as proof of exemption from sales tax, and improper use or submission of the form can lead to penalties. To ensure compliance, it is crucial to understand the specific exemptions applicable to your situation and to use the form only for legitimate purposes. Familiarizing yourself with the legal implications can protect you from potential audits or fines.

Required Documents

When filling out the DTF 716 form, certain documents may be required to substantiate your claim for exemption. These can include:

- A valid tax identification number, such as a federal Employer Identification Number (EIN).

- Documentation supporting the exemption claim, such as a letter from a government agency or proof of non-profit status.

- Any additional forms or certificates that may be relevant to your specific exemption category.

Form Submission Methods

The DTF 716 form can be submitted in various ways, depending on your preference and the seller's requirements. Common submission methods include:

- In-person delivery to the seller at the time of purchase.

- Mailing the completed form to the seller prior to the transaction.

- Submitting the form electronically if the seller accepts digital submissions.

Quick guide on how to complete dtf 716

Easily Prepare Dtf 716 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the needed form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly and without complications. Manage Dtf 716 on any platform using airSlate SignNow's Android or iOS applications and enhance your document-based processes today.

How to edit and eSign Dtf 716 effortlessly

- Find Dtf 716 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Dtf 716 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf 716

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DTF 716 feature in airSlate SignNow?

The DTF 716 feature in airSlate SignNow allows users to seamlessly integrate document signing capabilities with their existing workflows. It enhances user experience by providing a straightforward method to eSign documents while ensuring compliance and security.

-

How much does airSlate SignNow with DTF 716 cost?

The pricing for airSlate SignNow utilizing the DTF 716 feature is competitive and designed to accommodate businesses of all sizes. Customers can explore flexible pricing plans that support their needs, ensuring they only pay for what they use.

-

What are the key benefits of using DTF 716 in airSlate SignNow?

DTF 716 in airSlate SignNow offers multiple benefits, including improved efficiency in document management, enhanced security for sensitive information, and easy compliance with legal standards. It allows users to streamline their signing processes, saving time and resources.

-

Can I integrate DTF 716 with other applications?

Yes, DTF 716 in airSlate SignNow can be easily integrated with various applications to enhance functionality. This integration capability enables businesses to connect their existing systems and ensure a smooth workflow, optimizing document signing processes.

-

Is DTF 716 suitable for large enterprises?

Absolutely! DTF 716 in airSlate SignNow is specifically designed to cater to the needs of large enterprises. It provides robust features that support high-volume signing processes and ensures the scalability required for extensive business operations.

-

What kind of support is available for DTF 716 users?

airSlate SignNow provides comprehensive support for DTF 716 users, including a dedicated customer service team and extensive online resources. Users can access tutorials, FAQs, and personalized assistance to ensure they are maximizing the use of DTF 716.

-

Can DTF 716 help reduce document turnaround time?

Yes, implementing DTF 716 in airSlate SignNow signNowly reduces document turnaround time. By streamlining the signing process, users can complete transactions faster, resulting in increased productivity and quicker decision-making.

Get more for Dtf 716

Find out other Dtf 716

- Search eSign Form iPad

- Send eSignature PDF Online

- How To Send eSignature PDF

- Send eSignature Word Online

- Send eSignature PDF iPad

- Send eSignature Word iOS

- Send eSignature Word iPad

- How To Send eSignature Word

- How To Send eSignature Document

- Send eSignature Document Simple

- Send eSignature PPT Myself

- Fax eSignature PDF Now

- Fax eSignature PPT Online

- Fax eSignature Form Android

- Invite eSignature PDF Safe

- Invite eSignature Presentation Online

- Invite eSignature Presentation Free

- How To Invite eSignature Presentation

- How Do I Invite eSignature Presentation

- Invite eSignature Presentation Android