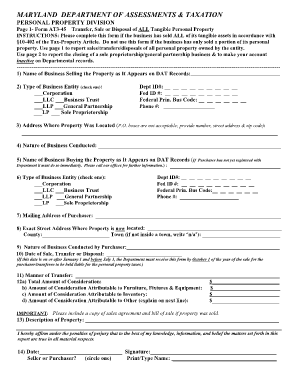

INSTRUCTIONS Please Complete This Form If the Business Has Sold ALL of Its Tangible Assets in Accordance with Dat State Md

What is the INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md

The form titled "INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md" is a legal document used by businesses in Maryland to formally declare the sale of all their tangible assets. This form is essential for compliance with state regulations and ensures that the transaction is documented appropriately. It serves to notify relevant authorities and stakeholders about the change in asset ownership, which can affect tax obligations and business operations.

Steps to complete the INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md

Completing this form involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the business and the assets sold. This includes the legal name of the business, the date of the sale, and a detailed list of the tangible assets. Next, fill out the form carefully, ensuring that all sections are completed. It is important to review the information for accuracy before submission. Finally, sign the form electronically or in person, as required, and submit it to the appropriate state agency.

Legal use of the INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md

This form is legally binding when completed correctly and submitted to the appropriate authorities. It is crucial for maintaining compliance with Maryland state laws regarding asset sales. The form serves as official documentation that can be referenced in future legal or financial matters, ensuring that all parties involved are aware of the transaction. Proper use of this form can help prevent disputes related to asset ownership and tax liabilities.

State-specific rules for the INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md

In Maryland, specific rules govern the sale of tangible assets, including the requirement to complete this form. These rules may vary based on the type of business entity and the nature of the assets sold. Businesses must comply with state tax regulations and may need to provide additional documentation depending on the assets involved. It is advisable to consult with a legal professional or a tax advisor to ensure full compliance with state laws.

Required Documents

To complete the form, certain documents are typically required. These may include proof of ownership of the tangible assets, a bill of sale, and any relevant financial statements. Additionally, businesses should have their tax identification number and any licenses or permits that pertain to the assets being sold. Having these documents readily available can streamline the completion and submission process.

Form Submission Methods (Online / Mail / In-Person)

The completed form can be submitted through various methods, depending on the preferences of the business and the requirements of the state agency. Options typically include online submission through a designated state portal, mailing the form to the appropriate office, or delivering it in person. Each method may have different processing times, so businesses should choose the option that best meets their needs.

Penalties for Non-Compliance

Failure to complete and submit the form as required can result in penalties for the business. These may include fines, additional taxes, or legal repercussions. Non-compliance can also lead to complications in future transactions involving the business's assets. It is essential to adhere to the requirements to avoid these potential issues and ensure that the business remains in good standing with state authorities.

Quick guide on how to complete instructions please complete this form if the business has sold all of its tangible assets in accordance with dat state md

Prepare INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md effortlessly on any device

Online document management has become favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents quickly without delays. Manage INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md on any device with airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

How to modify and eSign INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md effortlessly

- Locate INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you prefer to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions please complete this form if the business has sold all of its tangible assets in accordance with dat state md

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What steps should I take to complete the form regarding the sale of tangible assets?

To complete the form, ensure you follow the INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md. Begin by gathering all necessary details related to the sale and fill in each section accurately to avoid delays.

-

Are there any fees associated with using airSlate SignNow for document signing?

airSlate SignNow offers competitive pricing based on your business needs. You can review our pricing plans and choose the one that aligns with your requirements, which also includes facilitating the process of INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md.

-

Can I integrate airSlate SignNow with other software systems?

Yes, airSlate SignNow supports integration with a variety of software applications, which can enhance your workflow efficiency. Integrating these systems can help automate processes, including submitting the INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md.

-

What features does airSlate SignNow offer to streamline document signing?

airSlate SignNow offers a range of features such as templates, secure storage, and tracking capabilities. These features help in efficiently managing documents, making it easier to follow the INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md.

-

How can airSlate SignNow help businesses with compliance requirements?

airSlate SignNow ensures that your documents are compliant with various regulations, which is critical when dealing with asset sales. By following the INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md., you can be assured of maintaining compliance.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it ideal for small businesses. Following the INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md. is streamlined to suit businesses of all sizes.

-

What benefits can I expect from using airSlate SignNow for document management?

Using airSlate SignNow can signNowly improve your document management efficiency by streamlining the signing process, saving time and resources. This is particularly beneficial when adhering to INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md.

Get more for INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md

- Job interview scoring rubric michigan state agriscience msu form

- Nichq vanderbilt assessment follow up parent informant d5

- Self defence act form

- Affidavit of legitimation sample form

- Missouri probation and parole form

- Comal county driveway permit form

- Sample church bylaws ministrymaker form

- Montgomery public schools field trip permission form

Find out other INSTRUCTIONS Please Complete This Form If The Business Has Sold ALL Of Its Tangible Assets In Accordance With Dat State Md

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF