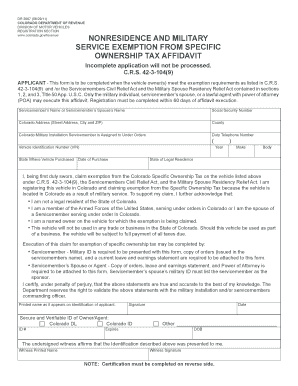

NONRESIDENCE and MILITARY SERVICE EXEMPTION from Form

What is the nonresidence and military service exemption from form?

The nonresidence and military service exemption from form is a specific provision that allows certain individuals, particularly military personnel and nonresidents, to be exempt from certain state tax obligations. This exemption is designed to ensure that those serving in the military or residing outside the state are not unfairly taxed by a state they do not primarily reside in. This form is crucial for maintaining compliance with tax laws while protecting the rights of service members and nonresident taxpayers.

Key elements of the nonresidence and military service exemption from form

Understanding the key elements of the nonresidence and military service exemption from form is essential for proper compliance. Key elements include:

- Eligibility Criteria: The exemption typically applies to military members stationed outside their home state and individuals who reside in one state but work in another.

- Documentation: Proper documentation is required to substantiate the claim for exemption, which may include military orders or proof of residency.

- Filing Requirements: Taxpayers must file the appropriate forms with their state tax authority to claim the exemption.

How to use the nonresidence and military service exemption from form

Using the nonresidence and military service exemption from form involves several steps to ensure compliance and proper submission. Follow these steps:

- Gather Required Documents: Collect necessary documents such as proof of military service or residency status.

- Complete the Form: Fill out the form accurately, ensuring all information is correct and complete.

- Submit the Form: File the form with the appropriate state tax authority, either online, by mail, or in person, depending on state regulations.

Steps to complete the nonresidence and military service exemption from form

Completing the nonresidence and military service exemption from form requires careful attention to detail. Here are the steps:

- Identify your eligibility based on residency and military status.

- Obtain the correct form from your state’s tax authority.

- Fill out the form, providing accurate personal information and supporting documentation.

- Review the completed form for accuracy before submission.

- Submit the form according to your state’s guidelines and keep a copy for your records.

Legal use of the nonresidence and military service exemption from form

The legal use of the nonresidence and military service exemption from form is governed by state tax laws and federal regulations. It is important to understand that:

- The exemption is legally binding when properly filed and supported by adequate documentation.

- Failure to comply with filing requirements can result in penalties or back taxes owed.

- Consulting with a tax professional may be beneficial to navigate complex tax situations.

Who issues the form?

The nonresidence and military service exemption from form is typically issued by the state tax authority where the exemption is being claimed. Each state may have its own version of the form, and it is important to use the correct form for your state to ensure compliance with local tax laws.

Quick guide on how to complete nonresidence and military service exemption from

Effortlessly Prepare NONRESIDENCE AND MILITARY SERVICE EXEMPTION FROM on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It presents an ideal environmentally-friendly substitute for traditional printed and signed files, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, edit, and electronically sign your documents quickly, without any holdups. Manage NONRESIDENCE AND MILITARY SERVICE EXEMPTION FROM on any device using airSlate SignNow's Android or iOS applications and enhance your document-based processes today.

The Easiest Way to Edit and eSign NONRESIDENCE AND MILITARY SERVICE EXEMPTION FROM Effortlessly

- Find NONRESIDENCE AND MILITARY SERVICE EXEMPTION FROM and click on Get Form to commence.

- Leverage the tools we offer to complete your document.

- Mark important sections of the documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred delivery method for the form, whether it be via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign NONRESIDENCE AND MILITARY SERVICE EXEMPTION FROM while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nonresidence and military service exemption from

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1049 form used for?

The 1049 form is a document used in various financial transactions, often related to tax reporting or compliance. It provides essential information on income, expenses, and other relevant details for accurate reporting. Understanding what is 1049 form can help businesses ensure compliance and avoid potential tax issues.

-

How can I create a 1049 form using airSlate SignNow?

Creating a 1049 form with airSlate SignNow is simple and efficient. You can upload or design your form within our platform, making it easy to customize according to your needs. With our intuitive interface, you'll quickly understand what is 1049 form and how to manage it effectively.

-

Is airSlate SignNow compliant with 1049 form requirements?

Yes, airSlate SignNow is fully compliant with the requirements for the 1049 form. Our platform adheres to all necessary legal standards, ensuring that your documents are secure and meet IRS guidelines. When using airSlate SignNow, you can confidently manage what is 1049 form for your business.

-

What features does airSlate SignNow offer for managing the 1049 form?

AirSlate SignNow offers a variety of features designed to simplify the management of the 1049 form. Some of these include document templates, electronic signatures, and secure cloud storage. These tools help users streamline their processes while ensuring they properly understand what is 1049 form.

-

Can airSlate SignNow integrate with other tools for processing the 1049 form?

Absolutely! AirSlate SignNow integrates with numerous applications, such as CRMs and accounting software, to facilitate the processing of the 1049 form. This interoperability allows you to easily import and export data, making it easier to work with what is 1049 form in broader business contexts.

-

What are the pricing options for airSlate SignNow when using the 1049 form?

AirSlate SignNow offers competitive pricing options tailored to various business needs, including features necessary for handling the 1049 form. You can choose from different subscription plans that best suit your volume of document management. Understanding what is 1049 form and how it interacts with our pricing will help you find the right fit.

-

What are the benefits of using airSlate SignNow for the 1049 form?

Using airSlate SignNow for the 1049 form provides multiple benefits, including enhanced efficiency, cost-effectiveness, and improved document security. By digitizing your processes, you can signNowly reduce the time spent on paperwork while ensuring compliance and accuracy. Knowing what is 1049 form is key to maximizing these advantages.

Get more for NONRESIDENCE AND MILITARY SERVICE EXEMPTION FROM

- Broward county noc form

- Small estate affidavit 1991 form

- Idaho out checklist form

- Georgia eligibility form

- Fresno county written exam study guide form

- Quotnumbers 10 to 100quot spelling quiz esl kids lab form

- Gwinnett police open records fillable form

- Closing disclosure this form is a statement of final loan

Find out other NONRESIDENCE AND MILITARY SERVICE EXEMPTION FROM

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online