Form Ss 4439 2001-2026

What is the Form SS-4439?

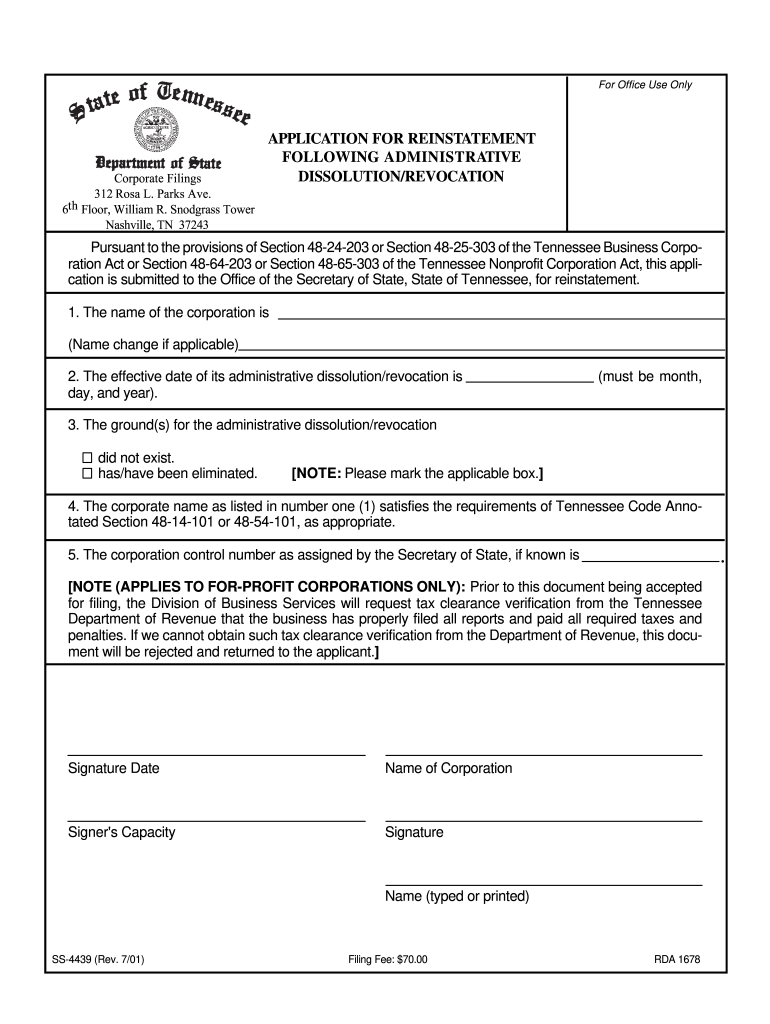

The SS-4439 form, also known as the Application for Reinstatement, is a document required by the Tennessee Department of Revenue. This form is specifically used to request a tax clearance letter, which is essential for businesses seeking to reinstate their corporate status or terminate their business operations in compliance with state regulations. The tax clearance letter confirms that all tax obligations have been met and that the business is in good standing with the state.

How to Use the Form SS-4439

To effectively use the SS-4439 form, businesses must ensure that they fill it out completely and accurately. This includes providing necessary details such as the business name, address, and tax identification number. Once the form is completed, it should be submitted to the Tennessee Department of Revenue along with any required supporting documents. Proper use of this form ensures that the application for tax clearance is processed smoothly, allowing businesses to maintain compliance with state laws.

Steps to Complete the Form SS-4439

Completing the SS-4439 form involves several key steps:

- Gather all relevant business information, including the legal name and address.

- Provide the tax identification number and any applicable account numbers.

- Clearly state the purpose of the application, whether for reinstatement or termination.

- Attach any required documentation that supports the application.

- Review the form for accuracy and completeness before submission.

Required Documents

When submitting the SS-4439 form, certain documents may be required to support the application. These can include:

- Proof of tax payments or compliance.

- Previous tax returns or filings.

- Any correspondence with the Tennessee Department of Revenue regarding tax status.

Having these documents ready can expedite the processing of the tax clearance letter.

Legal Use of the Form SS-4439

The SS-4439 form is legally binding and must be used in accordance with Tennessee state laws. It serves as a formal request to the Department of Revenue for a tax clearance letter, which is necessary for various business activities, including reinstatement and termination. Failure to use this form correctly may result in delays or denial of the application, impacting the business's legal standing.

Eligibility Criteria

To be eligible to use the SS-4439 form, a business must meet specific criteria set by the Tennessee Department of Revenue. Primarily, the business must have previously registered with the state and must not have outstanding tax liabilities. Additionally, the business should be in good standing and must provide all necessary information and documentation when submitting the form.

Quick guide on how to complete application for reinstatement following administrative dissolutionrevocation ss 4439 tennessee

Manage Form Ss 4439 anytime, anywhere

Your routine company procedures might require extra attention when handling state-specific business documents. Regain your working hours and reduce the paper costs linked to document-focused procedures with airSlate SignNow. airSlate SignNow offers you a wide range of pre-made business documents, such as Form Ss 4439, that you can utilize and share with your business associates. Manage your Form Ss 4439 effortlessly with powerful editing and electronic signature tools and send it straight to your recipients.

How to obtain Form Ss 4439 in just a few clicks:

- Select a form relevant to your state.

- Click Learn More to access the document and ensure its accuracy.

- Click Get Form to start working on it.

- Form Ss 4439 will open right away in the editor. No additional steps are necessary.

- Utilize airSlate SignNow’s advanced editing tools to complete or modify the form.

- Click the Sign feature to create your unique signature and electronically sign your document.

- Once finished, click on Done, save changes, and access your document.

- Distribute the form via email or SMS, or use a link-to-fill method with your associates or allow them to download the document.

airSlate SignNow signNowly reduces the time spent managing Form Ss 4439 and enables you to find essential documents in one location. An extensive collection of forms is organized and designed to cover vital business functions necessary for your enterprise. The sophisticated editor minimizes the risk of mistakes, allowing you to easily rectify errors and review your documents on any device before sending them. Start your free trial today to discover all the benefits of airSlate SignNow for your daily business workflows.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How do I get admission to Bhawanipur Education Society College if I have missed the last date for filling out the application form for the UG programme?

You can contact to the Dean of the college or system control room of http://college.So that they can help you further and in most of the cases they consider these things.

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

Create this form in 5 minutes!

How to create an eSignature for the application for reinstatement following administrative dissolutionrevocation ss 4439 tennessee

How to generate an electronic signature for your Application For Reinstatement Following Administrative Dissolutionrevocation Ss 4439 Tennessee online

How to make an electronic signature for your Application For Reinstatement Following Administrative Dissolutionrevocation Ss 4439 Tennessee in Google Chrome

How to create an eSignature for signing the Application For Reinstatement Following Administrative Dissolutionrevocation Ss 4439 Tennessee in Gmail

How to make an electronic signature for the Application For Reinstatement Following Administrative Dissolutionrevocation Ss 4439 Tennessee right from your smartphone

How to make an eSignature for the Application For Reinstatement Following Administrative Dissolutionrevocation Ss 4439 Tennessee on iOS devices

How to generate an electronic signature for the Application For Reinstatement Following Administrative Dissolutionrevocation Ss 4439 Tennessee on Android

People also ask

-

What is a certificate of tax clearance tennessee?

A certificate of tax clearance tennessee is an official certification from the state confirming that a business has paid all due taxes and has no outstanding tax obligations. This document is often required for various business functions, including applying for loans or permits, ensuring compliance with state regulations.

-

How can airSlate SignNow help me obtain a certificate of tax clearance tennessee?

With airSlate SignNow, you can easily prepare and send the necessary documents required to request a certificate of tax clearance tennessee electronically. Our intuitive platform simplifies the process, allowing you to collect signatures and ensure that all documentation is properly handled in a timely manner.

-

What are the costs associated with obtaining a certificate of tax clearance tennessee?

The costs for a certificate of tax clearance tennessee can vary based on the specific requirements of your request and any associated administrative fees. Utilizing airSlate SignNow's services can help save you money on printing and mailing costs while streamlining the overall process.

-

How long does it take to receive a certificate of tax clearance tennessee?

The timeframe for obtaining a certificate of tax clearance tennessee can range from a few days to several weeks, depending on state processing times. However, using airSlate SignNow allows you to quickly gather all your required signatures and documents, potentially speeding up the overall process.

-

What features does airSlate SignNow offer for managing a certificate of tax clearance tennessee?

airSlate SignNow offers a range of features for managing your certificate of tax clearance tennessee, including secure eSigning, document templates, and real-time tracking. These tools help ensure that you can efficiently manage your documents, reducing the likelihood of errors and delays.

-

Is airSlate SignNow compliant for requesting a certificate of tax clearance tennessee?

Yes, airSlate SignNow is compliant with industry standards and regulations, making it an ideal choice for requesting a certificate of tax clearance tennessee. Our platform adheres to legal requirements for electronic signatures and document management, ensuring your submissions are valid and recognized.

-

Can I integrate airSlate SignNow with other systems when requesting a certificate of tax clearance tennessee?

Absolutely! airSlate SignNow offers various integrations with popular business applications, allowing you to streamline your workflows when requesting a certificate of tax clearance tennessee. This flexibility enables you to work seamlessly across different platforms, enhancing overall productivity.

Get more for Form Ss 4439

Find out other Form Ss 4439

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document