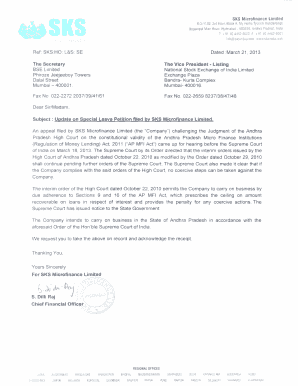

SKS Microfinance Limited Form

Understanding SKS Microfinance Limited

SKS Microfinance Limited, now known as Bharat Financial Inclusion Limited, is a prominent player in the microfinance sector in India. It focuses on providing financial services to underserved populations, primarily women, to empower them economically. The organization offers a range of products, including microloans, to help individuals start or expand small businesses. This approach not only aids in personal financial growth but also contributes to community development.

How to Utilize the SKS Microfinance Limited Form

To effectively use the SKS Microfinance Limited form, individuals must first ensure they meet the eligibility criteria set by the organization. The form typically requires personal identification information, financial details, and the purpose for which the loan is being requested. It is essential to provide accurate and complete information to facilitate the processing of the application.

Steps to Complete the SKS Microfinance Limited Form

Completing the SKS Microfinance Limited form involves several key steps:

- Gather necessary documents, such as identification proof and income statements.

- Fill out the form with accurate personal and financial details.

- Review the completed form for any errors or omissions.

- Submit the form through the designated method, whether online or in person.

Legal Use of the SKS Microfinance Limited Form

The SKS Microfinance Limited form is legally binding once it is duly filled and submitted. Compliance with local regulations and guidelines is crucial to ensure that the application is valid. The use of electronic signatures can enhance the legal standing of the document, provided that the signing process adheres to relevant eSignature laws.

Required Documents for the SKS Microfinance Limited Form

When applying for services through SKS Microfinance Limited, applicants must provide specific documents to support their application. Commonly required documents include:

- Government-issued identification (e.g., driver's license, passport).

- Proof of residence (e.g., utility bill, lease agreement).

- Income verification (e.g., pay stubs, bank statements).

- Business plan or purpose of the loan, if applicable.

Form Submission Methods

Applicants can submit the SKS Microfinance Limited form through various methods. These include:

- Online submission via the official website.

- Mailing the completed form to the designated address.

- In-person submission at local branches or offices.

Eligibility Criteria for SKS Microfinance Limited

To qualify for services from SKS Microfinance Limited, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Being a resident of the area served by SKS Microfinance Limited.

- Demonstrating a need for financial assistance, typically through a viable business plan.

- Meeting age requirements, usually being at least eighteen years old.

Quick guide on how to complete sks microfinance limited

Effortlessly prepare SKS Microfinance Limited on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage SKS Microfinance Limited on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign SKS Microfinance Limited with ease

- Find SKS Microfinance Limited and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your amendments.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and eSign SKS Microfinance Limited to guarantee excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sks microfinance limited

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SKS Microfinance Limited?

SKS Microfinance Limited is a leading microfinance institution in India that provides financial services to underserved communities. They focus on empowering women and promoting entrepreneurship by offering small loans and support. This enables clients to improve their livelihoods and achieve financial independence.

-

How does airSlate SignNow integrate with SKS Microfinance Limited?

airSlate SignNow offers seamless integration with SKS Microfinance Limited for efficient document management. This integration allows for easy e-signature capabilities on financial documents, enhancing the efficiency of loan processing and client onboarding. Businesses can streamline their operations while ensuring compliance and security.

-

What features does airSlate SignNow provide for SKS Microfinance Limited?

AirSlate SignNow includes features like electronic signatures, document tracking, and customizable templates that are specifically beneficial for SKS Microfinance Limited. These features help in automating the documentation process, making it easier for clients to access loans and services. This ultimately leads to faster transaction times and improved customer satisfaction.

-

What are the pricing options for using airSlate SignNow with SKS Microfinance Limited?

The pricing for airSlate SignNow varies based on the features and scale of use within SKS Microfinance Limited. They offer different plans that cater to various business sizes, ensuring cost-effectiveness while meeting the needs of clients. Prospective customers can choose a plan that best fits their operational requirements.

-

What benefits does airSlate SignNow provide to clients of SKS Microfinance Limited?

Clients of SKS Microfinance Limited benefit from enhanced efficiency and security when using airSlate SignNow. The platform simplifies the signing process, reduces paperwork, and ensures legal compliance with e-signatures. This leads to quicker access to funds and services for microfinance clients, fostering economic growth.

-

Can SKS Microfinance Limited use airSlate SignNow for international transactions?

Yes, SKS Microfinance Limited can utilize airSlate SignNow for international transactions. The platform supports global e-signature laws and facilitates secure document signing across borders. This capability allows SKS Microfinance Limited to expand its services to a broader audience beyond local clients.

-

Is airSlate SignNow user-friendly for SKS Microfinance Limited's clients?

AirSlate SignNow is designed to be user-friendly, making it accessible for all SKS Microfinance Limited's clients. The intuitive interface allows users with varying levels of technical skill to navigate the platform with ease. This ensures that clients can efficiently sign documents without technological barriers.

Get more for SKS Microfinance Limited

- How to fill interagency post employee position description form

- Far bar 2004 contract as is farbar cape coral title form

- Broadmoor baptist church 3101 nw 93rd st miami fl mail form

- Ravis county counseling amp education services ces referral form co travis tx

- Nurse form 1nys

- Medical form helene fuld college of nursing helenefuld

- Annual physical examination form

- Massage therapy client intake form

Find out other SKS Microfinance Limited

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online