ABL 29A the South Carolina Department of Revenue Sctax Form

Understanding the ABL 29A The South Carolina Department Of Revenue Sctax

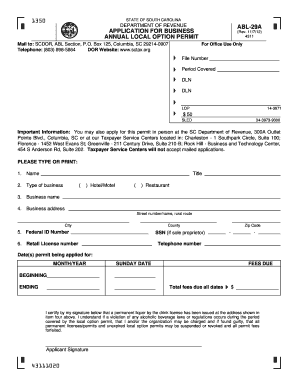

The ABL 29A form is a specific document issued by the South Carolina Department of Revenue, primarily used for tax purposes. This form is essential for businesses and individuals who need to report specific tax-related information to the state. It serves as a declaration of certain financial activities and is crucial for compliance with state tax laws. Understanding its purpose and requirements is vital for accurate reporting and avoiding potential penalties.

Steps to Complete the ABL 29A The South Carolina Department Of Revenue Sctax

Completing the ABL 29A form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Pay close attention to any specific instructions provided by the South Carolina Department of Revenue. Once completed, review the form for errors before submission.

Legal Use of the ABL 29A The South Carolina Department Of Revenue Sctax

The ABL 29A form holds legal significance as it is used to report tax information to the state. To be considered legally binding, the form must be completed accurately and submitted within the designated timeframe. Compliance with state regulations is crucial, as any discrepancies or late submissions may result in penalties. Utilizing a reliable digital platform for completion and submission can enhance security and ensure compliance with legal standards.

Obtaining the ABL 29A The South Carolina Department Of Revenue Sctax

The ABL 29A form can be obtained directly from the South Carolina Department of Revenue's official website or through authorized state offices. It is available in both digital and paper formats, allowing users to choose the method that best suits their needs. For those preferring a digital approach, accessing the form online can streamline the process of filling it out and submitting it electronically.

Key Elements of the ABL 29A The South Carolina Department Of Revenue Sctax

Key elements of the ABL 29A form include sections for personal identification, financial information, and specific tax-related queries. Each section is designed to capture essential data required for accurate tax reporting. Understanding these elements is crucial for ensuring that all necessary information is provided, which helps in avoiding delays or issues with the submission process.

Filing Deadlines for the ABL 29A The South Carolina Department Of Revenue Sctax

Filing deadlines for the ABL 29A form are set by the South Carolina Department of Revenue and are critical to adhere to for compliance. Typically, these deadlines align with the overall tax filing schedule for the state. It is important to stay informed about any changes to these deadlines to avoid penalties for late submissions. Marking these dates on a calendar can help ensure timely filing.

Quick guide on how to complete abl 29a the south carolina department of revenue sctax

Complete ABL 29A The South Carolina Department Of Revenue Sctax effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents promptly without delays. Handle ABL 29A The South Carolina Department Of Revenue Sctax on any device using the airSlate SignNow apps for Android or iOS and enhance any document-oriented process today.

The simplest way to edit and eSign ABL 29A The South Carolina Department Of Revenue Sctax with ease

- Locate ABL 29A The South Carolina Department Of Revenue Sctax and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or conceal sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your updates.

- Choose how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searching, or errors that need new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Edit and eSign ABL 29A The South Carolina Department Of Revenue Sctax and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the abl 29a the south carolina department of revenue sctax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ABL 29A from The South Carolina Department Of Revenue?

ABL 29A is a specific form required by The South Carolina Department Of Revenue (Sctax) for businesses to report certain transactions. This form provides essential details to ensure compliance with state tax regulations, helping businesses maintain transparency and accuracy in their reporting.

-

How does airSlate SignNow simplify the completion of ABL 29A?

AirSlate SignNow streamlines the process of filling out and submitting the ABL 29A form by providing an intuitive platform for eSigning and document management. With its easy-to-use interface, businesses can quickly complete the form and ensure it is sent to The South Carolina Department Of Revenue (Sctax) efficiently.

-

What are the pricing options for using airSlate SignNow for ABL 29A?

AirSlate SignNow offers flexible pricing plans designed to accommodate various business needs. By utilizing the platform for ABL 29A submissions, businesses can save time and costs associated with paper processing, while also benefiting from competitive pricing tailored to different volumes of document handling.

-

What features does airSlate SignNow provide for submitting ABL 29A to Sctax?

AirSlate SignNow includes features such as eSignature capabilities, document templates, and secure cloud storage, making it ideal for managing ABL 29A submissions to The South Carolina Department Of Revenue (Sctax). These features enhance productivity and ensure that important documents are kept organized and easily accessible.

-

Are there integrations available with airSlate SignNow for ABL 29A processing?

Yes, airSlate SignNow offers several integrations with popular business apps that can enhance the processing of ABL 29A forms. These integrations streamline workflows, enabling businesses to manage submissions to The South Carolina Department Of Revenue (Sctax) seamlessly alongside their existing systems.

-

What are the benefits of using airSlate SignNow for ABL 29A filings?

Using airSlate SignNow for ABL 29A filings provides numerous benefits, including faster processing times, improved accuracy, and enhanced compliance with The South Carolina Department Of Revenue (Sctax) requirements. Additionally, businesses can eliminate paper-related issues, reduce costs, and maintain a digital trail of their submissions.

-

Is airSlate SignNow secure for submitting ABL 29A to Sctax?

Absolutely, airSlate SignNow prioritizes security, employing encryption and compliance standards to protect sensitive information when submitting ABL 29A to The South Carolina Department Of Revenue (Sctax). This ensures that all documents are handled securely, providing peace of mind for businesses.

Get more for ABL 29A The South Carolina Department Of Revenue Sctax

Find out other ABL 29A The South Carolina Department Of Revenue Sctax

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement