Layout 1 2024-2026

Understanding the Business Personal Property Return

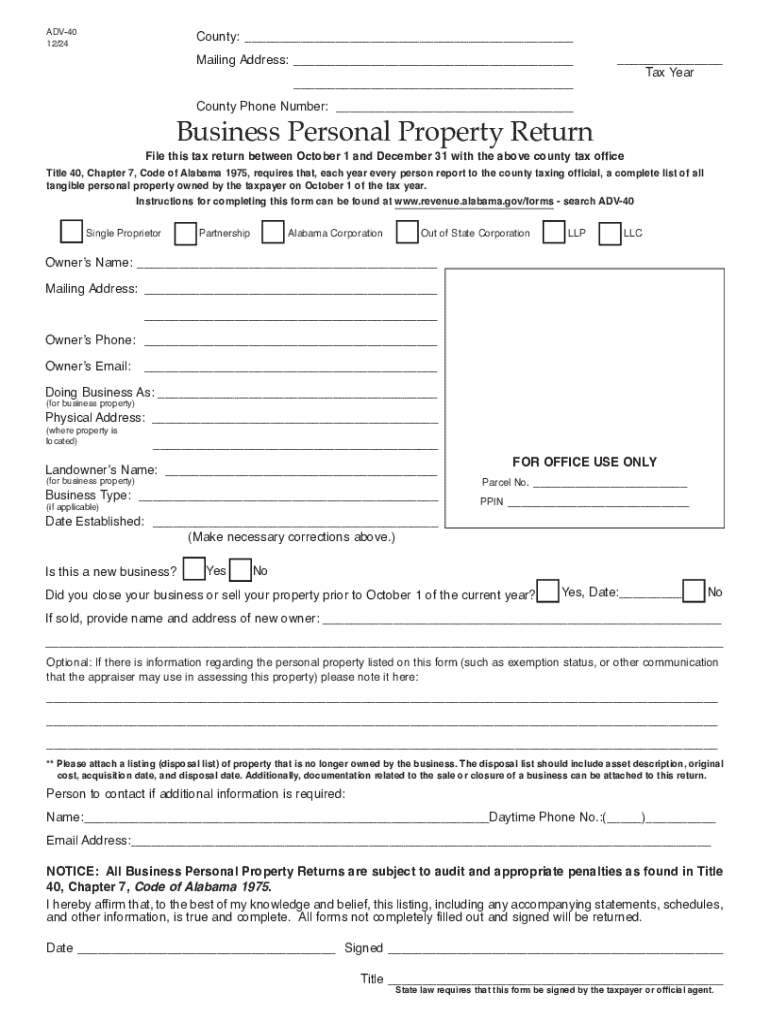

The business personal property return is a crucial document for businesses in the United States, used to report the value of personal property owned by a business. This includes items such as machinery, equipment, furniture, and other tangible assets that are not considered real estate. The information provided in this return helps local governments assess property taxes accurately.

Steps to Complete the Business Personal Property Return

Completing the business personal property return involves several key steps:

- Gather necessary documentation, including purchase receipts, previous tax returns, and any relevant financial statements.

- Determine the value of your business personal property, which may require depreciation calculations for older assets.

- Fill out the return form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness before submission.

- Submit the form by the designated deadline, either online or via mail, depending on your local jurisdiction's requirements.

Required Documents for Filing

When preparing to file a business personal property return, you will need several documents to support your claims:

- Purchase invoices or receipts for all personal property items.

- Previous years' returns to provide a reference for asset values.

- Financial statements that may help in determining the current value of assets.

- Depreciation schedules if applicable, to reflect the decrease in value of older assets.

Filing Deadlines and Important Dates

Each state has specific deadlines for filing the business personal property return, which can vary significantly. It is essential to be aware of these dates to avoid penalties:

- Most states require the return to be filed annually, often by April 15.

- Some jurisdictions may allow extensions, but it is crucial to apply for these extensions before the original deadline.

- Check with your local tax authority for any state-specific deadlines or requirements.

Penalties for Non-Compliance

Failing to file the business personal property return on time can result in various penalties, which may include:

- Late filing fees that accumulate over time.

- Increased property tax assessments due to estimated values being assigned by the local tax authority.

- Potential legal ramifications, including liens against your business property.

State-Specific Rules for the Business Personal Property Return

Each state has unique regulations governing the business personal property return. Understanding these rules is vital for compliance:

- Some states may exempt certain types of property or small businesses from filing.

- Local jurisdictions may have additional requirements, such as specific forms or additional documentation.

- Be aware of any changes in legislation that may affect filing requirements or deadlines.

Create this form in 5 minutes or less

Find and fill out the correct layout 1

Create this form in 5 minutes!

How to create an eSignature for the layout 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a business personal property return?

A business personal property return is a form that businesses file to report their personal property assets for tax purposes. This includes items like furniture, equipment, and inventory. Accurately completing this return is essential for compliance and can affect your business's tax liabilities.

-

How can airSlate SignNow help with my business personal property return?

airSlate SignNow streamlines the process of preparing and submitting your business personal property return by allowing you to easily create, send, and eSign necessary documents. Our platform ensures that all your forms are completed accurately and securely. This saves you time and reduces the risk of errors.

-

What features does airSlate SignNow offer for managing business personal property returns?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing your business personal property return. These tools help you maintain organization and ensure that all necessary documents are completed and submitted on time.

-

Is airSlate SignNow cost-effective for small businesses handling business personal property returns?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing their business personal property returns. Our pricing plans are flexible and cater to various business sizes, ensuring that you get the best value for your investment while simplifying your document management.

-

Can I integrate airSlate SignNow with other software for my business personal property return?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your business personal property return. This integration allows for efficient data transfer and ensures that all your financial information is up-to-date and accurate.

-

What are the benefits of using airSlate SignNow for my business personal property return?

Using airSlate SignNow for your business personal property return offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the entire process, allowing you to focus on your business while ensuring compliance with tax regulations.

-

How secure is airSlate SignNow when handling business personal property returns?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your documents, including business personal property returns. You can trust that your sensitive information is safe while using our platform for eSigning and document management.

Get more for Layout 1

- Instructions for form 1099 cap internal revenue service

- About form 1098 c contributions of motor vehicles irs

- Go to wwwirsgovform1120f for the latest information

- F8801pdf form 8801 department of the treasury internal

- Irs form 8898 ampquotstatement for individuals who begin or end

- Arizona form 600 d claim for unclaimed property azdor

- Form rev190 authorization to revenuestatemnus

- Instructions for form 720 rev june 2021 instructions for form 720 quarterly federal excise tax return

Find out other Layout 1

- How To Save eSignature in CRM

- How Do I Set Up eSignature in DropBox

- How To Set Up eSignature in DropBox

- How Can I Set Up eSignature in DropBox

- How Can I Save eSignature in CMS

- How To Set Up eSignature in Box

- How Do I Set Up eSignature in Box

- How Do I Save eSignature in SalesForce

- How To Save eSignature in SalesForce

- How To Set Up eSignature in Google Drive

- How Can I Set Up eSignature in Box

- How Do I Set Up eSignature in Google Drive

- How To Save eSignature in DropBox

- Can I Set Up eSignature in Box

- Help Me With Set Up eSignature in Google Drive

- How Can I Save eSignature in DropBox

- How To Save eSignature in Box

- How Can I Set Up eSignature in Google Drive

- How To Save eSignature in Google Drive

- Can I Set Up eSignature in Google Drive