Schedule 141 Form

What is the Schedule 141?

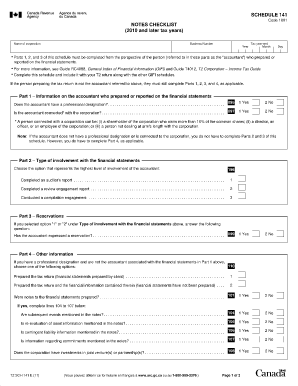

The Schedule 141, also known as the T2 Schedule 141, is a form used by corporations in Canada to report their income and expenses for tax purposes. This form is specifically designed for Canadian corporations that need to provide detailed information about their financial activities. It is part of the T2 Corporation Income Tax Return and is essential for ensuring compliance with the Canada Revenue Agency (CRA) regulations.

The Schedule 141 focuses on specific tax credits and deductions that corporations may be eligible for, allowing them to reduce their overall tax liability. Understanding this form is crucial for corporate tax planning and compliance.

How to use the Schedule 141

Using the Schedule 141 involves several steps to ensure accurate reporting of financial information. First, gather all necessary documentation related to your corporation's income and expenses. This includes financial statements, receipts, and any relevant tax documents.

Next, fill out the Schedule 141 by entering the required information in the designated fields. It is important to follow the instructions carefully to avoid errors that could lead to delays or penalties. Once completed, the form should be submitted along with the T2 Corporation Income Tax Return.

Steps to complete the Schedule 141

Completing the Schedule 141 requires careful attention to detail. Here are the steps to follow:

- Collect all relevant financial documents, including income statements and expense receipts.

- Access the Schedule 141 form, either in paper format or digitally.

- Begin filling out the form by entering your corporation's name, business number, and other identifying information.

- Provide detailed information regarding your corporation's income, including sales and other revenue sources.

- List all eligible expenses and deductions that apply to your corporation.

- Review the completed form for accuracy and completeness.

- Submit the Schedule 141 along with your T2 return by the applicable filing deadline.

Legal use of the Schedule 141

The Schedule 141 is a legally binding document when completed and submitted correctly. To ensure its legal validity, it must comply with the regulations set forth by the Canada Revenue Agency. This includes providing accurate information and adhering to deadlines.

Additionally, using an electronic signature solution, such as airSlate SignNow, can enhance the legal standing of your submission. By utilizing a trusted eSignature platform, you can ensure that your Schedule 141 is executed securely and in compliance with relevant eSignature laws.

Key elements of the Schedule 141

The Schedule 141 contains several key elements that are essential for accurate reporting. These include:

- Identification Information: This section requires the corporation's name, business number, and contact details.

- Income Reporting: Corporations must report all sources of income, including sales and investment income.

- Expense Deductions: This section allows corporations to list all eligible expenses that can reduce taxable income.

- Tax Credits: Corporations can claim various tax credits that apply to their specific situation.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 141 are crucial for compliance. Generally, the T2 Corporation Income Tax Return, along with the Schedule 141, must be filed within six months after the end of the corporation's fiscal year. However, certain corporations may have different deadlines based on their specific circumstances.

It is important to stay informed about any changes in tax regulations that may affect filing dates. Late submissions can result in penalties and interest charges, making timely filing essential for all corporations.

Quick guide on how to complete schedule 141

Effortlessly Prepare Schedule 141 on Any Device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Schedule 141 on any device using the airSlate SignNow Android or iOS applications and enhance your document-centric processes today.

How to Edit and Electronically Sign Schedule 141 with Ease

- Locate Schedule 141 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal authority as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Schedule 141 to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule 141

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is schedule 141 in the context of airSlate SignNow?

Schedule 141 is a feature offered by airSlate SignNow that allows users to efficiently organize and manage their document signing tasks. It enables users to streamline the signing process and improve workflow efficiency, ensuring timely completion of important documents.

-

How much does it cost to use schedule 141 with airSlate SignNow?

The cost of utilizing schedule 141 within airSlate SignNow varies based on your selected plan. Users can choose from various pricing tiers that cater to different business needs, ensuring that schedule 141 remains a cost-effective solution for document management.

-

What are the key features of schedule 141?

Schedule 141 includes features such as automated reminders, customizable workflows, and integration with popular applications. These features help users to manage their documents more efficiently and enhance collaboration among team members.

-

How does schedule 141 benefit businesses?

By implementing schedule 141, businesses can signNowly reduce the time spent on document signing processes. It enhances productivity, minimizes errors, and provides a clearer overview of document statuses, translating to improved operational efficiency.

-

Can schedule 141 integrate with other software tools?

Yes, schedule 141 is designed to easily integrate with various software tools commonly used by businesses, such as CRM systems and project management platforms. This ensures a seamless workflow and enhances the overall usability of airSlate SignNow.

-

Is there a trial period for testing schedule 141?

airSlate SignNow typically offers a free trial period that allows users to explore features, including schedule 141, without any financial commitment. This trial helps prospective customers assess the benefits and functionalities of the solution tailored to their needs.

-

How secure is the schedule 141 feature in airSlate SignNow?

The security of schedule 141 is a top priority for airSlate SignNow. The platform employs robust encryption and compliance measures to protect sensitive document data, ensuring that users can manage their documents with confidence and security.

Get more for Schedule 141

Find out other Schedule 141

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now