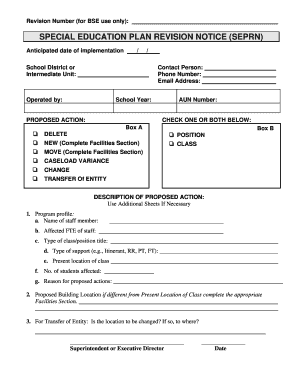

Seprn Form

What is the Seprn

The Seprn, or the Self-Employment Tax Payment Request Notice, is a crucial form for individuals who are self-employed in the United States. It serves as a notification for taxpayers to report and pay their self-employment taxes. This form is essential for ensuring compliance with federal tax obligations and helps self-employed individuals manage their tax responsibilities effectively.

How to use the Seprn

Using the Seprn involves a straightforward process. First, individuals must gather their financial information, including income and expenses related to their self-employment. Next, they complete the form by providing accurate details regarding their earnings and any deductions they may qualify for. Once completed, the Seprn can be submitted electronically or via mail, depending on the preference of the taxpayer. Utilizing a reliable eSignature solution can streamline this process, ensuring that the form is submitted securely and efficiently.

Steps to complete the Seprn

Completing the Seprn requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including income statements and expense receipts.

- Fill out the Seprn form with accurate information regarding your self-employment income.

- Include any applicable deductions to reduce your taxable income.

- Review the form for accuracy to avoid potential issues with the IRS.

- Submit the completed form through your chosen method, ensuring you keep a copy for your records.

Legal use of the Seprn

The legal use of the Seprn is governed by IRS regulations. To be considered valid, the form must be filled out accurately and submitted within the required deadlines. The form serves as a declaration of self-employment income and is subject to audits by the IRS. Ensuring compliance with all relevant laws and regulations is critical to avoid penalties and maintain good standing with tax authorities.

Key elements of the Seprn

Several key elements make up the Seprn form. These include:

- Taxpayer Information: This section requires personal details such as name, address, and Social Security number.

- Income Reporting: Taxpayers must report all sources of self-employment income accurately.

- Deductions: Eligible deductions can be claimed to lower taxable income, which is crucial for self-employed individuals.

- Signature: A valid signature is necessary to authenticate the submission of the form.

Who Issues the Form

The Seprn is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. As the governing body, the IRS provides guidelines and regulations for completing and submitting the form, ensuring that taxpayers understand their obligations and rights regarding self-employment taxes.

Quick guide on how to complete seprn

Finish Seprn effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Seprn on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The easiest method to modify and electronically sign Seprn with ease

- Find Seprn and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click the Done button to finalize your updates.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, time-consuming form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your requirements in document management in just a few clicks from a device of your choice. Revise and electronically sign Seprn to ensure clear communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the seprn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is seprn and how does it relate to airSlate SignNow?

Seprn is an electronic signature solution that allows users to sign documents securely and efficiently. AirSlate SignNow incorporates seprn technology to streamline the eSigning process, making it quick and easy for businesses to manage their document workflows.

-

What are the key features of airSlate SignNow's seprn offering?

The seprn feature in airSlate SignNow includes customizable templates, robust document tracking, and cloud storage for easy access. Additionally, users benefit from multiple signing methods, which enhance the flexibility and usability of the platform.

-

How does airSlate SignNow's seprn compare in pricing to other eSignature solutions?

AirSlate SignNow offers competitive pricing for its seprn services, making it a cost-effective solution for businesses of all sizes. With transparent pricing tiers, organizations can choose a plan that best meets their needs without hidden fees.

-

What benefits does using the seprn feature provide to businesses?

Utilizing seprn within airSlate SignNow accelerates the document signing process, reducing turnaround times signNowly. This efficiency allows businesses to focus on growth while ensuring that their transactions remain secure and compliant.

-

Can the seprn feature be integrated with other software?

Yes, airSlate SignNow's seprn feature offers various integrations with popular business applications like Salesforce, Google Drive, and Microsoft Office. These integrations enhance productivity by allowing seamless document management across different platforms.

-

Is the seprn feature secure for sensitive documents?

AirSlate SignNow ensures the security of documents signed using the seprn feature by implementing advanced encryption and authentication measures. This makes it a reliable choice for businesses handling sensitive and confidential information.

-

What types of documents can be signed using seprn in airSlate SignNow?

The seprn feature in airSlate SignNow allows users to sign a wide range of document types, including contracts, agreements, and forms. This versatility supports various industries and use cases, empowering businesses to manage their documentation effectively.

Get more for Seprn

- Form 32a statement of intended evidence

- Certificate of completion consumers energy residential trade form

- Eng form 6042 1 medical information sheet jun 2012 eng form 6042 1 medical information sheet jun 2012 publications usace army

- Form hhs 697 foreign activities questionnaire hhs

- First b notice word form

- Post manufacture window tint medical exemption form

- Chess score sheet excel form

- Land allotment forms riico

Find out other Seprn

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself