GRR Forms GR SS 4 GR 2678 and GR 8655 12212015xlsx Grcity 2015

What is the GRR Forms GR SS 4 GR 2678 And GR 82015xlsx Grcity

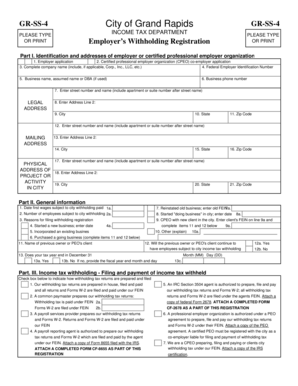

The GRR Forms GR SS 4 GR 2678 and GR 82015xlsx Grcity are specialized documents used for specific administrative purposes in the United States. These forms are essential for individuals and businesses to report certain information to government agencies. Understanding the purpose and requirements of these forms is crucial for compliance and effective processing.

How to use the GRR Forms GR SS 4 GR 2678 And GR 82015xlsx Grcity

Using the GRR Forms GR SS 4 GR 2678 and GR 82015xlsx Grcity involves several straightforward steps. First, ensure you have the correct version of the forms, which can be downloaded from authorized sources. Next, carefully read the instructions provided with each form to understand the information required. Fill out the forms completely and accurately, as incomplete submissions may lead to delays or rejections.

Steps to complete the GRR Forms GR SS 4 GR 2678 And GR 82015xlsx Grcity

Completing the GRR Forms GR SS 4 GR 2678 and GR 82015xlsx Grcity involves a few key steps:

- Download the forms from a reliable source.

- Review the instructions thoroughly to understand what information is needed.

- Gather any necessary documents that may be required to complete the forms.

- Fill out the forms, ensuring all information is accurate and complete.

- Sign and date the forms as required.

- Submit the forms according to the specified submission methods.

Legal use of the GRR Forms GR SS 4 GR 2678 And GR 82015xlsx Grcity

The legal use of the GRR Forms GR SS 4 GR 2678 and GR 82015xlsx Grcity is governed by specific regulations. These forms must be filled out accurately to ensure they are recognized as valid by relevant authorities. Compliance with federal and state laws is essential, as improper use can result in penalties or legal issues. Utilizing a reliable eSignature platform can enhance the legal standing of these documents.

Key elements of the GRR Forms GR SS 4 GR 2678 And GR 82015xlsx Grcity

Key elements of the GRR Forms GR SS 4 GR 2678 and GR 82015xlsx Grcity include:

- Identification information for the individual or business submitting the forms.

- Details regarding the specific purpose of the forms.

- Signature fields to validate the authenticity of the submission.

- Instructions for submission and any associated deadlines.

Form Submission Methods (Online / Mail / In-Person)

The GRR Forms GR SS 4 GR 2678 and GR 82015xlsx Grcity can typically be submitted through various methods, including:

- Online submission via designated government websites.

- Mailing the completed forms to the appropriate agency.

- In-person submission at specified locations, if applicable.

Eligibility Criteria

Eligibility criteria for using the GRR Forms GR SS 4 GR 2678 and GR 82015xlsx Grcity may vary based on the specific requirements of the forms. Generally, individuals or entities must meet certain conditions related to their status, such as residency, business type, or purpose of the form. It is important to review the eligibility requirements carefully to ensure compliance.

Quick guide on how to complete grr forms gr ss 4 gr 2678 and gr 8655 12212015xlsx grcity

Complete GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity without stress

- Obtain GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct grr forms gr ss 4 gr 2678 and gr 8655 12212015xlsx grcity

Create this form in 5 minutes!

How to create an eSignature for the grr forms gr ss 4 gr 2678 and gr 8655 12212015xlsx grcity

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity?

The GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity offers a comprehensive set of features, including customizable templates, electronic signatures, and secure document storage. Users can easily create, edit, and share forms digitally, streamlining their workflow and enhancing collaboration.

-

How does pricing work for GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity?

Pricing for GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity is flexible to accommodate various business sizes. airSlate SignNow offers competitive pricing plans that scale as your business grows, ensuring you get the most value for your investment.

-

What are the benefits of using GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity for my business?

Utilizing GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity allows businesses to save time and reduce paperwork. The platform enhances efficiency by facilitating quick document turnarounds, improving team collaboration, and ensuring compliance with e-signature laws.

-

Is GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity user-friendly?

Yes, GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity is designed with user experience in mind. Its intuitive interface makes it easy for users of all technical levels to create and manage documents effectively, ensuring a smooth transition to digital workflows.

-

Can GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity integrate with other tools?

Absolutely! GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity integrates seamlessly with various third-party applications. This allows users to connect their favorite productivity tools and streamline their processes, enhancing overall operational efficiency.

-

What industries can benefit from GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity?

GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity is versatile enough to benefit multiple industries, including finance, healthcare, real estate, and education. Any business needing efficient document management and electronic signatures can leverage this solution.

-

How secure are documents managed with GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity?

Security is a top priority for GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity. The platform employs robust encryption protocols and follows leading industry standards to ensure that all documents are safely stored and protected from unauthorized access.

Get more for GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity

- Fairbanks north star borough van tran application van tran co fairbanks ak form

- Dep guest pass form

- Beauty operator license hawaii form

- Ppn declaration form 448067507

- Four texts on socrates pdf form

- Wisconsin medicaid for the elderly blind or disabled application form

- Brand ambassador agreement digital docx form

- Errata sheet pdf 321457819 form

Find out other GRR Forms GR SS 4 GR 2678 And GR 8655 12212015xlsx Grcity

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple