Printable Form 2039 Summons

What is the Printable Form 2039 Summons

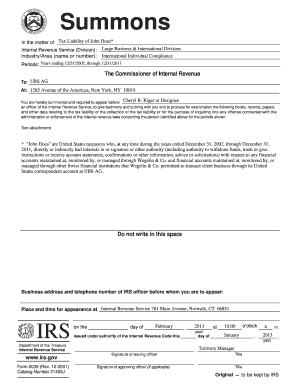

The Printable Form 2039 Summons is an official document issued by the IRS, used primarily for the purpose of gathering information or requiring the appearance of a taxpayer or third party for examination. This form is often utilized in situations where the IRS seeks to verify information related to tax filings or compliance. Understanding its function is crucial for anyone who receives it, as it outlines the specific requirements and obligations of the recipient.

How to Use the Printable Form 2039 Summons

Using the Printable Form 2039 Summons involves several key steps. First, carefully read the instructions provided with the summons to understand the information being requested. Next, gather all necessary documents and information that pertain to the summons. It is important to respond within the specified timeframe to avoid penalties. If you need assistance, consider consulting a tax professional to ensure compliance with the IRS requirements.

Steps to Complete the Printable Form 2039 Summons

Completing the Printable Form 2039 Summons requires attention to detail. Start by filling in your personal information accurately, including your name, address, and taxpayer identification number. Next, provide the information requested by the IRS, ensuring that all entries are clear and legible. Review the completed form for any errors before submission. Finally, sign and date the form where indicated, as your signature verifies the accuracy of the information provided.

Legal Use of the Printable Form 2039 Summons

The legal use of the Printable Form 2039 Summons is governed by IRS regulations. It is essential to understand that this form is a formal request from the IRS, and failure to comply can result in legal consequences. The summons must be treated with seriousness, and all requested information should be provided truthfully and completely to avoid potential penalties or further legal action.

Filing Deadlines / Important Dates

Filing deadlines for the Printable Form 2039 Summons are critical to ensure compliance with IRS requests. Typically, the summons will specify a deadline by which the requested information must be submitted. It is important to adhere to this timeline, as late submissions can lead to penalties or additional scrutiny from the IRS. Keeping track of these important dates is essential for effective tax management.

Penalties for Non-Compliance

Non-compliance with the Printable Form 2039 Summons can result in significant penalties. The IRS may impose fines or seek further legal action if the requested information is not provided within the stipulated timeframe. Additionally, failure to comply may lead to complications in your tax situation, including audits or additional assessments. Understanding the potential consequences of non-compliance is vital for any taxpayer receiving this form.

Quick guide on how to complete printable form 2039 summons

Effortlessly Prepare printable form 2039 summons on Any Device

The management of documents online has gained signNow traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and store it securely online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage 2039 form on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related processes today.

How to Modify and eSign form 2039 with Ease

- Find irs form 2039 and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information carefully and click on the Done button to save your modifications.

- Select how you wish to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing additional document copies. airSlate SignNow meets your document management needs with a few clicks from any device you prefer. Modify and eSign irs summons and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to irs summons

Create this form in 5 minutes!

How to create an eSignature for the printable form 2039 summons

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form 2039

-

What is a 2039 form and why is it important?

The 2039 form is a crucial document used to streamline various business processes, making it easier for companies to maintain compliance and manage their paperwork efficiently. By utilizing the 2039 form, businesses can enhance their operational workflow and reduce the risk of errors in documentation.

-

How can airSlate SignNow help with the 2039 form?

airSlate SignNow provides a straightforward and cost-effective solution for sending and eSigning your 2039 form. With our user-friendly interface, you can easily manage and track the status of your documents, ensuring a hassle-free signing experience for all parties involved.

-

Is there a cost associated with using airSlate SignNow for the 2039 form?

Yes, airSlate SignNow offers various pricing plans that accommodate different business needs for managing the 2039 form. Our plans are designed to be budget-friendly while providing all the essential features required to effectively handle your document workflows.

-

What features does airSlate SignNow offer for the 2039 form?

airSlate SignNow offers several features for the 2039 form, including customizable templates, real-time tracking, and automated reminders. These tools help users maximize efficiency while ensuring that all signatures are collected promptly and securely.

-

Can I integrate airSlate SignNow with other applications to manage the 2039 form?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications, allowing for easy management of the 2039 form alongside your existing tools. This integration simplifies the document signing process and enhances overall productivity.

-

What are the benefits of using airSlate SignNow for the 2039 form?

The primary benefits of using airSlate SignNow for the 2039 form include enhanced security, reduced processing time, and improved document tracking. These advantages signNowly streamline the signing process, making it more efficient for all involved parties.

-

How secure is the 2039 form when using airSlate SignNow?

Security is paramount when handling the 2039 form in airSlate SignNow. We employ industry-leading encryption and authentication methods to ensure that your documents remain private and protected at all times.

Get more for irs form 2039

Find out other irs summons

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation