EFO00196 ST 133 Sales Tax Exempt 5 27 09 Form

What is the EFO00196 ST 133 Sales Tax Exempt 5 27 09

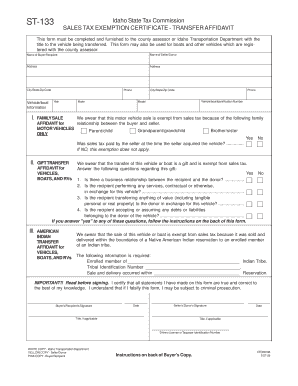

The EFO00196 ST 133 Sales Tax Exempt 5 27 09 form is a specific document used in the United States to certify that a purchaser is exempt from sales tax for certain transactions. This form is particularly relevant for businesses and individuals who qualify for tax-exempt status under state law. It serves as a formal declaration that the buyer does not need to pay sales tax on eligible purchases, which can significantly reduce overall costs for exempt organizations, such as non-profits or government entities.

Steps to complete the EFO00196 ST 133 Sales Tax Exempt 5 27 09

Completing the EFO00196 ST 133 Sales Tax Exempt 5 27 09 form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including the buyer's name, address, and tax identification number. Next, specify the type of exempt organization and the reason for the exemption. Carefully review the form for any required signatures, which may include both the purchaser and a representative of the exempt organization. Finally, ensure that the completed form is submitted to the seller or appropriate authority as required.

Legal use of the EFO00196 ST 133 Sales Tax Exempt 5 27 09

The legal use of the EFO00196 ST 133 Sales Tax Exempt 5 27 09 form is governed by state tax regulations. To be valid, the form must be filled out accurately and submitted in accordance with state laws. It is crucial to understand that misuse of this form, such as claiming exemption without proper eligibility, can lead to penalties, including back taxes and fines. Therefore, it is essential for users to verify their eligibility and maintain proper documentation to support their tax-exempt status.

Key elements of the EFO00196 ST 133 Sales Tax Exempt 5 27 09

Key elements of the EFO00196 ST 133 Sales Tax Exempt 5 27 09 form include the identification of the purchaser, the reason for the exemption, and the specific items or services being purchased. Additionally, the form typically requires a signature from an authorized representative of the exempt organization, affirming the accuracy of the information provided. It is important to ensure that all sections of the form are completed to avoid delays or complications in processing.

Eligibility Criteria

Eligibility criteria for using the EFO00196 ST 133 Sales Tax Exempt 5 27 09 form vary by state but generally include being a recognized non-profit organization, government entity, or other qualifying institution. Organizations must provide proof of their exempt status, which may include documentation such as a federal tax exemption letter or state-issued exemption certificate. Understanding these criteria is essential for ensuring compliance and avoiding potential issues with tax authorities.

Examples of using the EFO00196 ST 133 Sales Tax Exempt 5 27 09

Examples of using the EFO00196 ST 133 Sales Tax Exempt 5 27 09 form include a non-profit organization purchasing office supplies for its operations or a government agency acquiring equipment for public service. In both cases, the form allows these entities to make purchases without incurring sales tax, thereby maximizing their limited budgets. Each transaction must be properly documented to maintain compliance with state tax regulations.

Quick guide on how to complete efo00196 st 133 sales tax exempt 5 27 09

Effortlessly prepare EFO00196 ST 133 Sales Tax Exempt 5 27 09 on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your files quickly and without delays. Handle EFO00196 ST 133 Sales Tax Exempt 5 27 09 across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to edit and eSign EFO00196 ST 133 Sales Tax Exempt 5 27 09 with ease

- Locate EFO00196 ST 133 Sales Tax Exempt 5 27 09 and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Verify all the information and click the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and eSign EFO00196 ST 133 Sales Tax Exempt 5 27 09 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the efo00196 st 133 sales tax exempt 5 27 09

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EFO00196 ST 133 Sales Tax Exempt 5 27 09 form?

The EFO00196 ST 133 Sales Tax Exempt 5 27 09 form is a tax exemption certificate used by businesses in Massachusetts to claim sales tax exemption. Using this form, eligible entities can purchase goods without incurring sales tax. It is crucial for businesses to correctly complete this form to ensure compliance and avoid unnecessary tax payments.

-

How can airSlate SignNow help with the EFO00196 ST 133 Sales Tax Exempt 5 27 09 process?

airSlate SignNow streamlines the EFO00196 ST 133 Sales Tax Exempt 5 27 09 process by allowing businesses to easily fill out, sign, and send the form electronically. This reduces paperwork and accelerates the approval process, making it easier to manage tax-exempt purchases. With our platform, you can store and access your documents securely at any time.

-

Is there a cost associated with using airSlate SignNow for the EFO00196 ST 133 Sales Tax Exempt 5 27 09 form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users, ranging from small businesses to enterprises. Our subscription includes access to eSigning features and templates for documents like the EFO00196 ST 133 Sales Tax Exempt 5 27 09 form. You can choose a plan that fits your budget while enjoying the benefits of a streamlined signing process.

-

What features does airSlate SignNow offer for the EFO00196 ST 133 Sales Tax Exempt 5 27 09 form?

airSlate SignNow provides features such as customizable templates, electronic signatures, and real-time tracking for the EFO00196 ST 133 Sales Tax Exempt 5 27 09 form. These features enhance the signing experience and ensure that all documents are completed quickly and efficiently. Users can also integrate the platform with other tools for added convenience.

-

Can I integrate airSlate SignNow with other software to manage the EFO00196 ST 133 Sales Tax Exempt 5 27 09 form?

Absolutely! airSlate SignNow offers seamless integrations with a variety of popular business applications. This allows businesses to automate workflows and efficiently manage the EFO00196 ST 133 Sales Tax Exempt 5 27 09 form alongside their other operations, enhancing productivity and collaboration.

-

What are the benefits of using airSlate SignNow for the EFO00196 ST 133 Sales Tax Exempt 5 27 09 form?

Using airSlate SignNow for the EFO00196 ST 133 Sales Tax Exempt 5 27 09 form brings numerous benefits, including reduced processing times, improved accuracy in documentation, and enhanced compliance. Our platform simplifies the complexity of tax exemption paperwork, enabling businesses to focus on their core operations while ensuring tax savings.

-

Is airSlate SignNow secure for handling sensitive documents like the EFO00196 ST 133 Sales Tax Exempt 5 27 09 form?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Your documents, including the EFO00196 ST 133 Sales Tax Exempt 5 27 09 form, are protected against unauthorized access. This ensures that sensitive information remains confidential while enabling secure sharing and collaboration.

Get more for EFO00196 ST 133 Sales Tax Exempt 5 27 09

- Hostplus compliance letter 398246587 form

- Florida purchase form

- Missouri unemployment tax registration form

- Synapse inventory control form synthes

- Pet cremation authorization life cycle pet cremation form

- United kingdom background check consent form verified

- Discrepant material report template form

- Inventory for client and agency planning instructor dhs state il form

Find out other EFO00196 ST 133 Sales Tax Exempt 5 27 09

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form