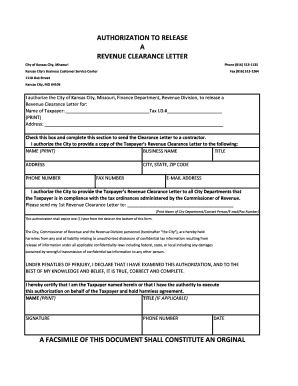

Authorization to Release a Revenue Clearance Letter City of Kansas Kcmo Form

Understanding the Authorization Letter for Tax Clearance

The authorization letter for tax clearance is a formal document that allows a designated individual or entity to obtain tax clearance on behalf of another person or business. This letter is essential for ensuring that all tax obligations have been met before certain transactions, such as selling property or applying for loans, can proceed. It serves as a legal instrument that provides the necessary permission for the tax authority to release information regarding an individual's or business's tax status.

Key Elements of the Authorization Letter for Tax Clearance

When drafting an authorization letter for tax clearance, it is crucial to include specific elements to ensure its validity. These elements typically include:

- Sender's Information: The full name, address, and contact information of the person granting authorization.

- Recipient's Information: The name and address of the individual or entity receiving the authorization.

- Tax Authority Details: The name of the tax agency or department involved.

- Clearance Purpose: A detailed statement outlining the reason for the request, such as property sale or loan application.

- Signature: The signature of the person granting the authorization, which may need to be notarized depending on state regulations.

Steps to Complete the Authorization Letter for Tax Clearance

Completing the authorization letter for tax clearance involves several straightforward steps:

- Gather necessary information, including your tax identification number and that of the recipient.

- Draft the letter, ensuring all key elements are included as outlined above.

- Review the letter for accuracy and completeness.

- Sign the letter, and if required, have it notarized.

- Submit the letter to the appropriate tax authority along with any required forms or documentation.

Legal Use of the Authorization Letter for Tax Clearance

The authorization letter for tax clearance is legally binding when it meets the necessary requirements set forth by state and federal regulations. It must be properly signed and may need to be notarized to ensure its legitimacy. This letter grants the recipient the authority to act on behalf of the sender, making it essential for transactions that require confirmation of tax compliance.

Obtaining the Authorization Letter for Tax Clearance

To obtain an authorization letter for tax clearance, individuals or businesses can either draft their own letter or use templates available online. It is important to customize the letter to fit specific circumstances and ensure all required information is included. Consulting with a tax professional or legal advisor can also provide guidance on the necessary content and format to ensure compliance with local laws.

Quick guide on how to complete authorization to release a revenue clearance letter city of kansas kcmo

Effortlessly Prepare Authorization To Release A Revenue Clearance Letter City Of Kansas Kcmo on Any Device

Managing documents online has become increasingly popular with businesses and individuals alike. It offers a superb eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without delays. Manage Authorization To Release A Revenue Clearance Letter City Of Kansas Kcmo on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

How to Modify and eSign Authorization To Release A Revenue Clearance Letter City Of Kansas Kcmo with Ease

- Locate Authorization To Release A Revenue Clearance Letter City Of Kansas Kcmo and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

No more worries about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Adjust and eSign Authorization To Release A Revenue Clearance Letter City Of Kansas Kcmo to facilitate effective communication at every step of your document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the authorization to release a revenue clearance letter city of kansas kcmo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an authorization letter for tax clearance?

An authorization letter for tax clearance is a formal document that allows an individual or entity to grant another party the authority to retrieve tax clearance documents on their behalf. This letter ensures that the process is compliant with tax regulations and that only authorized persons can access sensitive tax information.

-

How can airSlate SignNow help with authorization letters for tax clearance?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning authorization letters for tax clearance. Its user-friendly interface allows you to generate customized templates and ensure that all necessary parties can sign the document electronically, streamlining the clearance process.

-

Is there a cost associated with using airSlate SignNow for authorization letters for tax clearance?

Yes, airSlate SignNow offers various pricing plans tailored to business needs. The cost depends on the features required and the number of users, but it remains a cost-effective solution for managing documents, including authorization letters for tax clearance.

-

What features does airSlate SignNow offer for managing authorization letters for tax clearance?

airSlate SignNow includes features like customizable document templates, real-time tracking of document status, and integrated eSignature capabilities, which are particularly useful for authorization letters for tax clearance. These tools ensure that you can manage the entire signing process efficiently and securely.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, such as authorization letters for tax clearance, offers several benefits. Businesses can automate workflows, reduce processing time, and enhance security. Additionally, the platform ensures that all documents are legally compliant and easily accessible.

-

Can I integrate airSlate SignNow with other applications to manage tax documents?

Yes, airSlate SignNow seamlessly integrates with various applications such as CRM tools, document management systems, and cloud storage platforms. This integration capability allows you to easily manage and send authorization letters for tax clearance alongside other business documents.

-

How secure is airSlate SignNow when handling authorization letters for tax clearance?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and compliance protocols that protect sensitive information, including authorization letters for tax clearance. Users can trust that their documents are secure throughout the signing process.

Get more for Authorization To Release A Revenue Clearance Letter City Of Kansas Kcmo

- Pathology request form fairview

- Property inspection checklist 3518queenavenuenorth form

- Kashmir affairs division form

- Ca form 3539 instructions

- Statement of no loss template form

- Osap request for an exceptional circumstances review form

- Micro needling consent form patientpopmicroneedling consent form fill out and sign printable microneedling with skinpenpatient

- Birth certificates volusia county health department florida form

Find out other Authorization To Release A Revenue Clearance Letter City Of Kansas Kcmo

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template