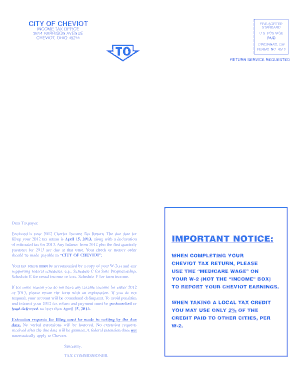

Cheviot Tax Forms

What are the Cheviot Tax Forms?

The Cheviot tax forms are specific documents required by the City of Cheviot for various tax-related purposes. These forms are essential for residents and businesses to report income, claim deductions, and fulfill their tax obligations. They may include forms for income tax, property tax, and other local taxes. Understanding the purpose of each form is crucial for ensuring compliance with local tax laws and regulations.

How to Obtain the Cheviot Tax Forms

Obtaining the Cheviot tax forms is a straightforward process. Residents can access these forms through the official City of Cheviot website or by visiting the local tax office. Additionally, some forms may be available at public libraries or community centers. It is important to ensure that you are using the most current version of the forms to avoid any issues during submission.

Steps to Complete the Cheviot Tax Forms

Completing the Cheviot tax forms involves several key steps:

- Gather necessary documentation, such as income statements, previous tax returns, and identification.

- Carefully read the instructions provided with the forms to understand the requirements.

- Fill out the forms accurately, ensuring all information is complete and correct.

- Review the completed forms for any errors or omissions.

- Sign and date the forms as required.

Legal Use of the Cheviot Tax Forms

The Cheviot tax forms are legally binding documents when filled out and submitted according to the guidelines set by the City of Cheviot. To ensure their legal standing, it is essential to comply with all applicable laws and regulations. This includes providing accurate information and submitting the forms by the designated deadlines. Failure to comply may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Timely filing of the Cheviot tax forms is critical to avoid penalties. Important dates to remember include:

- The annual filing deadline for income tax forms, typically April 15.

- Quarterly estimated tax payment deadlines for self-employed individuals.

- Specific deadlines for property tax payments, which may vary by year.

Penalties for Non-Compliance

Failure to file the Cheviot tax forms on time or submitting inaccurate information can result in penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid taxes, increasing the overall amount owed.

- Potential legal action for persistent non-compliance.

Quick guide on how to complete cheviot tax forms

Prepare Cheviot Tax Forms effortlessly on any device

Digital document management has gained popularity among enterprises and individuals alike. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, as you can easily find the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hindrances. Manage Cheviot Tax Forms on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The simplest method to modify and electronically sign Cheviot Tax Forms without hassle

- Find Cheviot Tax Forms and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Cheviot Tax Forms to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cheviot tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are cheviot tax forms and why are they important?

Cheviot tax forms are essential documents used for reporting income and deductions to tax authorities. Properly completing these forms can help ensure compliance with tax regulations and minimize your tax liability.

-

How can airSlate SignNow help with cheviot tax forms?

airSlate SignNow streamlines the process of filling out and signing cheviot tax forms by providing an easy-to-use platform. This not only saves time but also ensures that your forms are completed accurately and securely.

-

Are there any costs associated with using airSlate SignNow for cheviot tax forms?

Yes, airSlate SignNow offers various pricing plans to cater to different needs. Each plan provides cost-effective solutions, allowing businesses to efficiently manage cheviot tax forms without overspending.

-

Can I integrate airSlate SignNow with my existing software for cheviot tax forms?

Absolutely! airSlate SignNow is designed to integrate seamlessly with various software applications. This integration allows you to manage cheviot tax forms alongside your other business processes for increased efficiency.

-

What features does airSlate SignNow offer for managing cheviot tax forms?

airSlate SignNow offers features such as template creation, automatic reminders, and eSignature capabilities specifically tailored for cheviot tax forms. These tools enhance your workflow and reduce the risk of errors.

-

Is it safe to use airSlate SignNow for my cheviot tax forms?

Yes, airSlate SignNow prioritizes security with features like data encryption and secure cloud storage. Your cheviot tax forms and sensitive information remain protected throughout the signing process.

-

How can airSlate SignNow benefit my business's efficiency with cheviot tax forms?

By using airSlate SignNow, your business can signNowly speed up the completion and submission of cheviot tax forms. This efficiency allows your team to focus on core business activities rather than paperwork.

Get more for Cheviot Tax Forms

Find out other Cheviot Tax Forms

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word