St 120 Form

What is the St 120

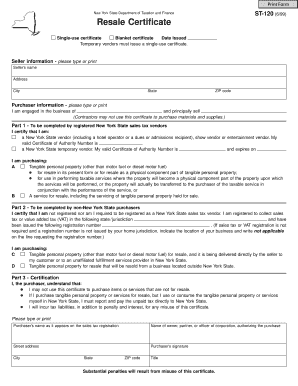

The St 120 form is a document used in the United States, primarily for tax purposes. It serves as a certificate of exemption from sales and use tax for certain purchases. This form is essential for businesses and individuals who qualify for tax exemptions, allowing them to avoid paying sales tax on eligible transactions. Understanding the St 120 is crucial for ensuring compliance with tax regulations while maximizing potential savings.

How to use the St 120

To use the St 120 form effectively, individuals or businesses must first determine their eligibility for a sales tax exemption. Once eligibility is confirmed, the form should be completed with accurate information regarding the purchaser and the specific transaction. The completed St 120 must then be presented to the seller at the time of purchase. It is important to retain a copy for personal records, as it may be required for future reference or audits.

Steps to complete the St 120

Completing the St 120 form involves several straightforward steps:

- Gather necessary information, including the purchaser's details and the nature of the purchase.

- Fill out the form accurately, ensuring all required fields are completed.

- Sign and date the form to validate the exemption claim.

- Provide the completed form to the seller at the point of sale.

- Keep a copy for your records to support the exemption in case of future inquiries.

Legal use of the St 120

The legal use of the St 120 form hinges on the accurate representation of the purchaser's eligibility for tax exemption. Misuse of the form, such as claiming exemptions when not eligible, can lead to penalties. It is crucial to understand the specific regulations governing the use of the St 120 to ensure compliance with state tax laws. The form must be used only for legitimate transactions that qualify under the relevant tax codes.

Key elements of the St 120

Key elements of the St 120 form include:

- Purchaser Information: Name, address, and contact details of the individual or business claiming the exemption.

- Seller Information: Name and address of the seller to whom the form is presented.

- Description of Purchase: Detailed information about the items or services being purchased.

- Exemption Reason: A clear explanation of why the purchase qualifies for a sales tax exemption.

- Signature: The signature of the purchaser or an authorized representative to validate the form.

Who Issues the Form

The St 120 form is typically issued by state tax authorities. Each state may have its own version of the form and specific guidelines for its use. It is important for users to obtain the correct form from the appropriate state agency to ensure compliance with local tax laws. Always check with the relevant state tax department for the most current version and any updates to the form's requirements.

Quick guide on how to complete st 120 16034950

Effortlessly create St 120 on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents promptly without delays. Handle St 120 on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related workflow today.

The simplest method to modify and electronically sign St 120 with ease

- Locate St 120 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal weight as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to distribute your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign St 120 to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 120 16034950

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 120 and how does it work?

The st 120 is a powerful feature within airSlate SignNow that simplifies the process of sending and signing documents electronically. By utilizing this tool, businesses can create, send, and manage documents efficiently while ensuring secure electronic signatures. It offers an intuitive interface that makes document handling straightforward for users.

-

How much does the st 120 feature cost?

The pricing for the st 120 feature varies based on the plan you choose within airSlate SignNow. Each plan is designed to cater to different business sizes and needs, ensuring a cost-effective solution. You can find specific pricing details on the airSlate SignNow website, which outlines various subscription options.

-

What are the key benefits of using the st 120?

Using the st 120 in airSlate SignNow allows for faster document turnaround times, reducing the need for physical paperwork. It enhances productivity by enabling teams to sign and send documents from anywhere, while also providing secure cloud storage and tracking capabilities. Overall, it streamlines the workflow for businesses.

-

Can the st 120 integrate with other software tools?

Yes, the st 120 integrates seamlessly with various software tools such as CRM systems, payment processors, and project management platforms. This allows businesses to create a cohesive workflow by connecting airSlate SignNow with their existing tools, enhancing efficiency and data management. Check the integrations page on the airSlate website for a full list.

-

Is the st 120 suitable for small businesses?

Absolutely! The st 120 is designed to be user-friendly and cost-effective, making it an ideal choice for small businesses. It provides all the essential features needed for document management without overwhelming complexity, allowing small teams to benefit from advanced eSigning capabilities.

-

What document types can the st 120 handle?

The st 120 can handle a wide range of document types, including contracts, agreements, and forms. Whether you need to send a single document or manage bulk uploads, airSlate SignNow allows you to work with various formats, ensuring flexibility in your document management processes.

-

What security features are included with the st 120?

Security is a top priority for airSlate SignNow, especially with the st 120 feature. It includes encryption, secure access controls, and compliance with leading data protection regulations. These measures ensure that your documents remain safe and confidential throughout the signing process.

Get more for St 120

Find out other St 120

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors