Form 8941 for Fillable

What is the Form 8941?

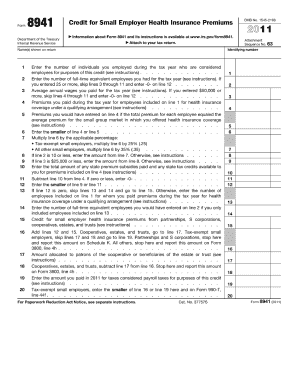

The Form 8941 is a tax form used by eligible small businesses to claim the credit for small employer health insurance premiums. This form is essential for businesses that provide health insurance to their employees, allowing them to receive a tax credit that can significantly reduce their overall tax liability. Understanding the purpose and requirements of Form 8941 is crucial for business owners looking to maximize their tax benefits.

How to use the Form 8941

Using Form 8941 involves several key steps to ensure proper completion and submission. First, gather necessary information about your business and the health insurance premiums paid. Next, fill out the form accurately, providing details such as the number of employees and the total premiums paid. It is important to follow the IRS instructions carefully to avoid errors that could delay processing or result in penalties.

Steps to complete the Form 8941

Completing Form 8941 requires attention to detail. Here are the steps to follow:

- Provide your business name, address, and Employer Identification Number (EIN).

- Indicate the number of full-time equivalent employees during the tax year.

- Calculate the total premiums paid for employee health insurance.

- Complete the credit calculation section, following the IRS guidelines.

- Sign and date the form before submission.

Each step is crucial for ensuring that the form is filled out correctly and that the credit is claimed appropriately.

Legal use of the Form 8941

The legal use of Form 8941 is governed by IRS regulations. To be eligible for the credit, businesses must meet specific criteria, including having fewer than twenty-five full-time equivalent employees and paying average annual wages below a certain threshold. Additionally, the health insurance must be provided to employees and not solely to owners or shareholders. Compliance with these regulations is essential to avoid penalties and ensure that the credit is valid.

Filing Deadlines / Important Dates

Filing deadlines for Form 8941 align with the general tax filing deadlines for businesses. Typically, the form must be submitted by the due date of the business's tax return, including extensions. It is important to keep track of these dates to ensure timely submission and avoid any potential penalties for late filing.

Required Documents

To complete Form 8941, certain documents are required. These include:

- Records of health insurance premiums paid.

- Documentation of employee count and wages.

- Any prior year tax returns, if applicable.

Having these documents readily available will streamline the process of filling out the form and ensure accuracy in the information provided.

Examples of using the Form 8941

Form 8941 can be utilized in various scenarios. For instance, a small business with ten employees that pays a total of $30,000 in health insurance premiums may use the form to claim a tax credit. Similarly, a startup providing health benefits to its employees can also benefit from this credit. Each case highlights the importance of understanding the form's application to maximize available tax benefits.

Quick guide on how to complete form 8941 for fillable

Complete Form 8941 For Fillable effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Form 8941 For Fillable on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and eSign Form 8941 For Fillable with ease

- Locate Form 8941 For Fillable and click Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, monotonous form searching, or mistakes that require additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Alter and eSign Form 8941 For Fillable and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8941 for fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8941 and why is it important?

Form 8941 is a tax credit form used by businesses to claim a portion of the expenses incurred in providing health insurance to employees. Understanding how to complete form 8941 accurately can lead to signNow tax savings for your business, making it essential for eligible employers.

-

How can airSlate SignNow help with filling out form 8941?

airSlate SignNow provides an intuitive platform for digital document creation and eSigning, which can facilitate the process of filling out form 8941. With our easy-to-use tools, you can create, edit, and sign the form electronically, ensuring compliance and accuracy.

-

What are the pricing plans for airSlate SignNow when handling forms like 8941?

airSlate SignNow offers flexible pricing plans based on the features you need, with options suitable for both small businesses and larger enterprises. By choosing the right plan, you can efficiently manage the creation and eSigning of forms like 8941 without incurring excessive costs.

-

Is eSigning form 8941 legally binding?

Yes, eSigning form 8941 using airSlate SignNow is legally binding and complies with the ESIGN Act. Our platform uses secure technology to ensure that all signatures meet legal standards, providing peace of mind when submitting important tax documents.

-

Can I integrate airSlate SignNow with other software for managing form 8941?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, enhancing your workflow when managing form 8941. This means you can sync documents, automate actions, and streamline your processes across platforms.

-

What features does airSlate SignNow provide for managing form 8941?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure storage to manage form 8941 efficiently. These tools help ensure that your form is completed and signed correctly, reducing the chance of errors and maximizing your tax benefits.

-

Are there any security measures in place for handling form 8941 with airSlate SignNow?

Yes, airSlate SignNow prioritizes security with robust measures in place to protect your sensitive information when handling form 8941. Our platform employs encryption, secure access controls, and compliance with industry standards to safeguard your data.

Get more for Form 8941 For Fillable

Find out other Form 8941 For Fillable

- eSignature Document Easy

- How Can I eSignature Form

- eSignature PPT Secure

- Can I eSignature Form

- eSignature Presentation Now

- eSignature Presentation Myself

- eSignature Presentation Free

- How To eSignature Presentation

- eSignature Presentation Fast

- eSignature Presentation Simple

- eSignature Presentation Easy

- How Do I eSignature Presentation

- How To Electronic signature PDF

- Electronic signature PDF Computer

- Electronic signature PDF Online

- Electronic signature PDF Now

- How Do I Electronic signature PDF

- Electronic signature PDF Free

- Electronic signature PDF Secure

- How Can I Electronic signature PDF