NJ 1080E Election to Participate in a Composite Return 2024-2026

Understanding the NJ 1080E Election to Participate in a Composite Return

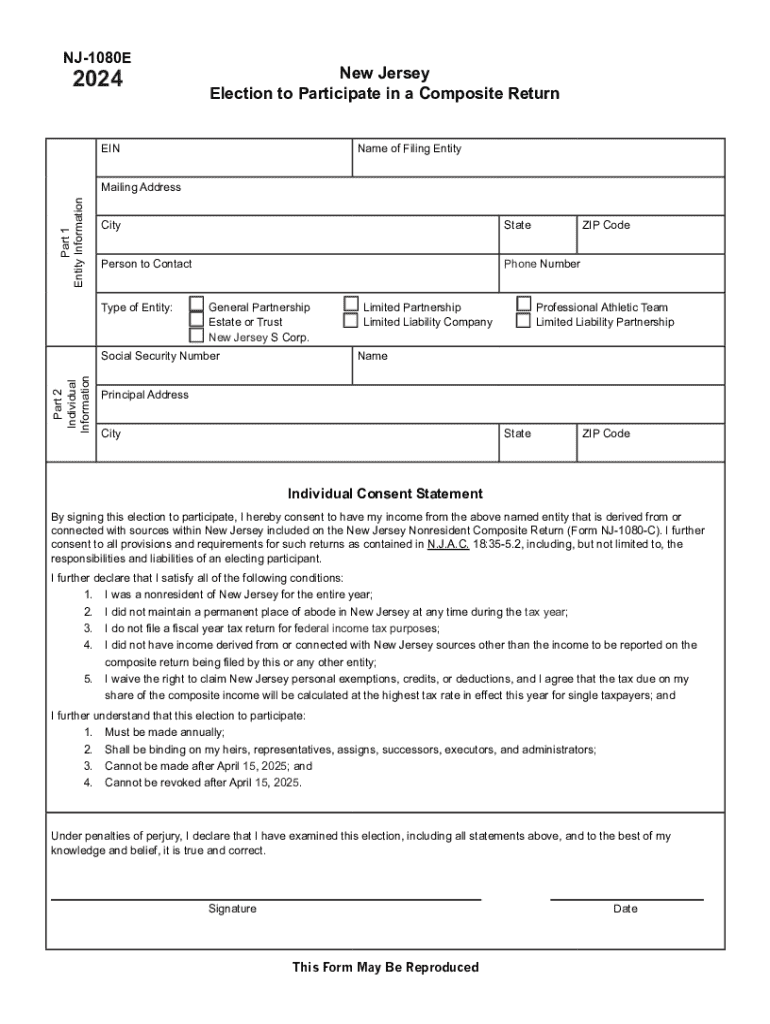

The NJ 1080E Election allows certain non-resident taxpayers to participate in a composite return filed by a New Jersey business entity. This option simplifies the tax filing process for individuals who earn income in New Jersey but do not reside there. By electing to participate, taxpayers can avoid filing a separate New Jersey tax return, as the business entity will report their income on their behalf.

Eligibility for this election typically includes non-resident partners, shareholders, or members of a business entity that operates in New Jersey. It's important to note that this election is specifically designed for those who meet the criteria set forth by the New Jersey Division of Taxation.

Steps to Complete the NJ 1080E Election

Completing the NJ 1080E Election involves several key steps:

- Determine eligibility: Confirm that you qualify as a non-resident taxpayer and that your business entity is eligible to file a composite return.

- Gather required information: Collect all necessary documentation, including income details and identification information.

- Fill out the NJ 1080E form: Accurately complete the form with the required information, ensuring all sections are filled out correctly.

- Submit the form: Follow the submission guidelines provided by the New Jersey Division of Taxation to ensure your election is processed.

Each step is crucial for ensuring compliance and avoiding potential penalties.

Required Documents for the NJ 1080E Election

To successfully file the NJ 1080E Election, taxpayers must prepare several documents:

- Completed NJ 1080E form.

- Proof of income earned in New Jersey.

- Identification information, such as Social Security numbers for all participants.

- Any additional documentation requested by the New Jersey Division of Taxation.

Having these documents ready will facilitate a smoother filing process.

Filing Deadlines for the NJ 1080E Election

Filing deadlines for the NJ 1080E Election are critical to ensure compliance. Typically, the election must be made by the due date of the composite return. For most taxpayers, this means the election is due on or before April fifteenth of the year following the tax year in question. However, specific deadlines may vary based on the business entity’s fiscal year. It is advisable to check the New Jersey Division of Taxation's website for the most current deadlines.

Legal Use of the NJ 1080E Election

The NJ 1080E Election is governed by New Jersey tax law and is legally binding once filed. Taxpayers must ensure that all information provided is accurate and truthful to avoid legal repercussions. Misrepresentation or failure to comply with the election's requirements can lead to penalties, including fines and interest on unpaid taxes. It is recommended to consult with a tax professional if there are any uncertainties regarding eligibility or compliance.

Examples of Using the NJ 1080E Election

Consider a scenario where a non-resident partner in an LLC earns income from a New Jersey-based business. By electing to participate in the NJ 1080E, the partner can simplify their tax obligations. Instead of filing a separate New Jersey tax return, the LLC will report the partner's income on the composite return, allowing for a streamlined process. This election is particularly beneficial for individuals with limited income from New Jersey sources, as it reduces the administrative burden of multiple filings.

Create this form in 5 minutes or less

Find and fill out the correct nj 1080e election to participate in a composite return

Create this form in 5 minutes!

How to create an eSignature for the nj 1080e election to participate in a composite return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an NJ composite return?

An NJ composite return is a tax return filed by a partnership or S corporation on behalf of its non-resident partners or shareholders. This return simplifies the tax process for non-residents by allowing them to report their income from New Jersey sources collectively. By using airSlate SignNow, businesses can easily manage and eSign documents related to NJ composite returns.

-

How does airSlate SignNow help with NJ composite returns?

airSlate SignNow streamlines the process of preparing and submitting NJ composite returns by providing an easy-to-use platform for document management. Users can quickly send, receive, and eSign necessary tax documents, ensuring compliance and accuracy. This efficiency helps businesses save time and reduce errors associated with NJ composite returns.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan includes features that facilitate the management of NJ composite returns and other document workflows. You can choose a plan that best fits your budget and requirements for handling NJ composite returns.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing its functionality for managing NJ composite returns. These integrations allow users to connect their existing tools, such as accounting software, to streamline the tax filing process. This ensures that all relevant data is easily accessible when preparing NJ composite returns.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features designed for efficient document management, including eSigning, templates, and automated workflows. These features are particularly beneficial for businesses dealing with NJ composite returns, as they simplify the process of collecting signatures and organizing documents. With airSlate SignNow, you can enhance your document management strategy for NJ composite returns.

-

Can airSlate SignNow help with compliance for NJ composite returns?

Absolutely! airSlate SignNow helps ensure compliance with New Jersey tax regulations when filing NJ composite returns. The platform's features allow users to track document status and maintain accurate records, which are essential for meeting compliance requirements. By using airSlate SignNow, businesses can confidently manage their NJ composite returns.

-

Is airSlate SignNow user-friendly for new users?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for new users. The intuitive interface allows users to quickly learn how to manage documents related to NJ composite returns without extensive training. This ease of use helps businesses efficiently handle their tax documentation.

Get more for NJ 1080E Election To Participate In A Composite Return

- Def14a secgov form

- Proxy statementsstrategy amp f form

- Sec info dfa investment dimensions group inc n 30d form

- Form s 8 pos sec

- 6 k deswell industries inc secgov form

- Report supporting the amendments to the endesa sa board form

- Topic no 427 stock optionsinternal revenue service form

- Companies that have changed their defined benefit pension form

Find out other NJ 1080E Election To Participate In A Composite Return

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure