Form 990 Schedule L

What is the Form 990 Schedule L

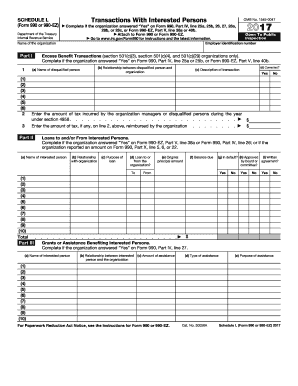

The Form 990 Schedule L is a supplementary document required by the Internal Revenue Service (IRS) for certain tax-exempt organizations. This form provides detailed information about transactions between the organization and its interested parties, including officers, directors, and key employees. The purpose of Schedule L is to enhance transparency and accountability by disclosing potential conflicts of interest and ensuring that the organization adheres to IRS regulations.

How to use the Form 990 Schedule L

To utilize the Form 990 Schedule L effectively, organizations must first determine if they meet the criteria for filing this schedule. If the organization has engaged in transactions with interested parties, it must complete Schedule L as part of its annual Form 990 filing. The organization should gather relevant information about the transactions, including amounts, dates, and the nature of the relationships involved. This information is then reported in the designated sections of the form, ensuring compliance with IRS guidelines.

Steps to complete the Form 990 Schedule L

Completing the Form 990 Schedule L involves several key steps:

- Identify interested parties: Determine who qualifies as an interested party, including board members, officers, and key employees.

- Gather transaction details: Collect information on all transactions with these parties, including amounts and descriptions.

- Fill out the form: Input the gathered information into the appropriate sections of Schedule L, ensuring accuracy and completeness.

- Review for compliance: Check the completed form against IRS guidelines to ensure all required disclosures are made.

- Submit with Form 990: Include Schedule L with the organization’s annual Form 990 submission to the IRS.

Legal use of the Form 990 Schedule L

The legal use of the Form 990 Schedule L is critical for maintaining compliance with IRS regulations. Organizations must ensure that all reported transactions are accurate and reflect true dealings with interested parties. Failure to disclose required information can result in penalties, including fines or loss of tax-exempt status. Proper completion and submission of Schedule L not only fulfill legal obligations but also promote transparency and trust with stakeholders.

Key elements of the Form 990 Schedule L

The Form 990 Schedule L includes several key elements that organizations must address:

- Transactions with interested parties: Detailed reporting of any financial transactions, loans, or compensation.

- Conflict of interest policies: Disclosure of the organization's policies regarding conflicts of interest.

- Compensation disclosures: Information on compensation paid to key employees and board members.

- Loans and advances: Reporting of any loans made to or received from interested parties.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Form 990 Schedule L to ensure timely submission. Generally, Form 990 and its schedules are due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the deadline is May 15. Extensions may be available, but it is crucial to file any requests for extensions before the original deadline.

Quick guide on how to complete form 990 schedule l

Effortlessly Prepare Form 990 Schedule L on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to receive the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 990 Schedule L on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The Easiest Way to Edit and eSign Form 990 Schedule L with Ease

- Locate Form 990 Schedule L and click on Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Finished button to save your adjustments.

- Choose your preferred method to send your form, be it via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 990 Schedule L and ensure optimal communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 990 schedule l

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 990 Schedule L and why is it important?

Form 990 Schedule L is a critical attachment required by the IRS for nonprofit organizations. It discloses transactions between the organization and related parties, including compensation and loans. Understanding Form 990 Schedule L is essential for compliance and transparency, ensuring that nonprofits meet regulatory requirements.

-

How can airSlate SignNow help with completing Form 990 Schedule L?

airSlate SignNow streamlines the process of completing Form 990 Schedule L by allowing users to fill out and sign documents electronically. This efficient platform ensures that all necessary signatures are obtained and that documents are securely stored. With airSlate SignNow, you can simplify the management of your nonprofit's compliance paperwork.

-

What features does airSlate SignNow offer for managing Form 990 Schedule L?

airSlate SignNow provides a range of features to assist with Form 990 Schedule L, including customizable templates, real-time collaboration, and secure eSignature options. Users can easily track the status of documents and receive notifications when forms are signed. These features enhance workflow efficiency and reduce the risk of errors.

-

Is airSlate SignNow affordable for small nonprofits handling Form 990 Schedule L?

Yes, airSlate SignNow is designed to be a cost-effective solution, making it accessible for small nonprofits managing Form 990 Schedule L. With flexible pricing plans and no hidden fees, organizations can select a package that fits their budget. This affordability enables nonprofits to comply with regulations without breaking the bank.

-

Can I integrate airSlate SignNow with other software for Form 990 Schedule L processing?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and nonprofit management software, enhancing the process of handling Form 990 Schedule L. Integrating these tools allows users to consolidate workflows and ensure that all financial data is accurately aligned with IRS requirements.

-

What are the benefits of using airSlate SignNow for Form 990 Schedule L?

Using airSlate SignNow for Form 990 Schedule L provides numerous benefits, including increased efficiency, enhanced security, and improved compliance tracking. The platform reduces paperwork and manual errors while ensuring that documents are easily accessible and securely signed. This ultimately saves time and resources for your nonprofit organization.

-

How does airSlate SignNow ensure the security of Form 990 Schedule L documents?

airSlate SignNow prioritizes security with advanced encryption and secure cloud storage for all documents, including Form 990 Schedule L. The platform complies with industry-standard security protocols to protect sensitive information. Users can be confident that their data is safe and compliant with regulatory standards.

Get more for Form 990 Schedule L

Find out other Form 990 Schedule L

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later