Michigan Ifta Tax Filling Services Form

What is the Michigan Ifta Tax Filling Services Form

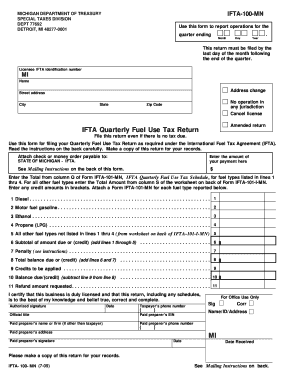

The Michigan Ifta Tax Filling Services Form is a crucial document for businesses that operate commercial vehicles across state lines. This form is part of the International Fuel Tax Agreement (IFTA), which simplifies the reporting of fuel use by motor carriers. It allows carriers to report fuel taxes to a single jurisdiction rather than filing separate returns in each state they operate. Understanding this form is essential for compliance and efficient tax management.

How to use the Michigan Ifta Tax Filling Services Form

Using the Michigan Ifta Tax Filling Services Form involves several steps to ensure accurate completion and submission. First, gather all necessary information regarding your fuel purchases, miles traveled in each jurisdiction, and any other relevant data. Next, fill out the form with precise details, ensuring that all calculations are correct. After completing the form, review it thoroughly for accuracy before submitting it to the appropriate state agency. Utilizing digital tools can streamline this process, making it easier to manage and submit your form electronically.

Steps to complete the Michigan Ifta Tax Filling Services Form

Completing the Michigan Ifta Tax Filling Services Form requires careful attention to detail. Follow these steps:

- Collect data on fuel purchases and mileage for each jurisdiction.

- Fill in the identification details of your business, including the IFTA account number.

- Report total miles traveled in each state and the fuel consumed.

- Calculate the total tax due, considering the rates applicable in each jurisdiction.

- Review all entries for accuracy and completeness.

- Submit the form electronically or by mail to the Michigan Department of Treasury.

Key elements of the Michigan Ifta Tax Filling Services Form

Several key elements must be included in the Michigan Ifta Tax Filling Services Form to ensure its validity:

- Business Information: This includes the name, address, and IFTA account number of the business.

- Mileage Records: Accurate reporting of miles traveled in each jurisdiction is essential.

- Fuel Purchase Details: Documenting fuel purchases helps in calculating tax liabilities.

- Calculations: Ensure that all calculations for taxes owed are correct and based on current rates.

- Signature: A valid signature is required to authenticate the form.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Michigan Ifta Tax Filling Services Form is critical to avoid penalties. Typically, the form must be filed quarterly, with specific due dates for each quarter. For example, the deadlines usually fall on the last day of the month following the end of each quarter. Keeping track of these dates ensures timely submissions and compliance with state regulations.

Penalties for Non-Compliance

Failing to comply with the requirements of the Michigan Ifta Tax Filling Services Form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential audits. It is essential for businesses to stay informed about their obligations and ensure timely and accurate submissions to avoid these consequences.

Quick guide on how to complete michigan ifta tax filling services form

Accomplish Michigan Ifta Tax Filling Services Form effortlessly on any gadget

Digital document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed materials, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Michigan Ifta Tax Filling Services Form on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The simplest way to modify and eSign Michigan Ifta Tax Filling Services Form with ease

- Obtain Michigan Ifta Tax Filling Services Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Move past concerns about lost or misplaced files, tedious form searching, or mistakes requiring new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Adjust and eSign Michigan Ifta Tax Filling Services Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan ifta tax filling services form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan Ifta Tax Filing Services Form?

The Michigan Ifta Tax Filing Services Form is a document required by businesses operating commercial vehicles to report and pay fuel taxes across state lines. It simplifies the process of tracking and remitting taxes owed, ensuring compliance with Michigan tax regulations. Utilizing this form is essential for businesses to maintain good standing and avoid penalties.

-

How can airSlate SignNow help with the Michigan Ifta Tax Filing Services Form?

airSlate SignNow streamlines the process of completing and submitting the Michigan Ifta Tax Filing Services Form by providing an intuitive eSignature platform. With our solution, businesses can easily fill out the form, obtain necessary signatures, and ensure timely submissions. This reduces the hassle of manual documentation and improves efficiency in tax filing.

-

What are the costs associated with using airSlate SignNow for Michigan Ifta Tax Filing Services Form?

airSlate SignNow offers competitive pricing plans designed to meet the needs of businesses of all sizes. Our pricing includes access to features specifically tailored for handling the Michigan Ifta Tax Filing Services Form, along with a range of other eSignature capabilities. Visit our pricing page to find the plan that best suits your business needs.

-

Is the Michigan Ifta Tax Filing Services Form easy to fill out with airSlate SignNow?

Yes, the Michigan Ifta Tax Filing Services Form is designed for ease of use within airSlate SignNow's platform. The user-friendly interface guides users through each step, making it simple to input required information. Our platform also allows for corrections and resubmissions without starting from scratch.

-

What features does airSlate SignNow provide for the Michigan Ifta Tax Filing Services Form?

airSlate SignNow provides a range of features for the Michigan Ifta Tax Filing Services Form, including customizable templates, automated workflows, and secure eSignature capabilities. These features help businesses streamline their tax filing processes while maintaining accuracy and compliance. Our platform also offers tracking and notifications to ensure timely filings.

-

Can airSlate SignNow integrate with other accounting software for the Michigan Ifta Tax Filing Services Form?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, making it easier to manage the Michigan Ifta Tax Filing Services Form alongside your other financial tasks. Integration helps keep your data consistent and simplifies the overall filing process, saving you time and resources.

-

What are the benefits of using airSlate SignNow for Michigan Ifta Tax Filing Services Form?

Using airSlate SignNow for the Michigan Ifta Tax Filing Services Form brings numerous benefits, such as increased accuracy, efficiency, and compliance. Our solution reduces the risk of errors associated with manual entry and ensures that your submissions are tracked and documented. Additionally, it provides an audit trail for accountability.

Get more for Michigan Ifta Tax Filling Services Form

- Lageso antragsbogen form

- Chemical application record year grower name field form

- Klein oak high school course request form

- Wh 192 oregongov oregon form

- Encroachment permit application city of st helena form

- Estr j pdf form

- Commercial offer form

- Prosimy wypeni formularz drukowanymi literami i zwrci pod niej wskazany adres jednostki zus

Find out other Michigan Ifta Tax Filling Services Form

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online