Form 14258

What is the Form 14258

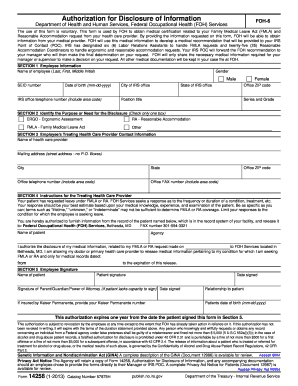

The Form 14258 is a document utilized primarily for tax purposes in the United States. It serves as a means for taxpayers to provide specific information required by the Internal Revenue Service (IRS). This form is particularly relevant for individuals or businesses seeking to clarify their tax obligations or to report certain financial activities. Understanding the purpose and function of the Form 14258 is essential for ensuring compliance with tax regulations.

How to use the Form 14258

Using the Form 14258 involves several steps that ensure accurate completion and submission. First, gather all necessary financial documents and information relevant to the form. This may include income statements, expense records, and any other pertinent financial data. Next, fill out the form carefully, ensuring that all required fields are completed accurately. Once the form is filled out, review it for any errors or omissions before submitting it to the IRS. Utilizing digital tools, such as eSignature solutions, can streamline this process, making it easier to complete and submit the form securely.

Steps to complete the Form 14258

Completing the Form 14258 involves a systematic approach to ensure all information is correctly provided. Here are the steps to follow:

- Gather necessary documents, including income and expense records.

- Obtain the Form 14258 from the IRS website or through authorized channels.

- Fill in your personal information, including name, address, and Social Security number.

- Provide detailed financial information as required by the form.

- Review the completed form for accuracy and completeness.

- Sign the form electronically or physically, as applicable.

- Submit the form to the IRS through the appropriate channels, such as online submission or mail.

Legal use of the Form 14258

The legal use of the Form 14258 is governed by IRS regulations and guidelines. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated time frames. Utilizing electronic signatures through compliant platforms enhances the legal standing of the document, as it adheres to established eSignature laws, such as the ESIGN Act and UETA. It is important to keep copies of the submitted form and any related documentation for your records, as they may be needed for future reference or in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Form 14258 can vary based on individual circumstances, such as the taxpayer's filing status and the type of financial information being reported. Generally, forms must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. However, extensions may apply in certain situations. It is crucial to stay informed about specific deadlines to avoid penalties and ensure compliance with IRS regulations.

Required Documents

To successfully complete the Form 14258, certain documents are required. These may include:

- Income statements, such as W-2s or 1099s.

- Expense records, including receipts and invoices.

- Any prior tax returns that may provide context for the current filing.

- Identification documents, such as a Social Security card or taxpayer identification number.

Having these documents readily available will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete form 14258

Complete Form 14258 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Form 14258 on any device using airSlate SignNow's Android or iOS apps and simplify your document-related tasks today.

The easiest way to modify and electronically sign Form 14258 with ease

- Obtain Form 14258 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 14258 and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14258

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 14256 and why is it important?

Form 14256 is a key document used in various business processes, particularly for compliance and record-keeping. Understanding how to correctly complete and manage form 14256 can streamline operations and ensure regulatory adherence, making it an essential tool for organizations.

-

How can airSlate SignNow help with form 14256?

airSlate SignNow simplifies the process of sending and eSigning form 14256. With its user-friendly interface, businesses can easily manage their documents electronically, reducing paperwork while ensuring that form 14256 is completed accurately and efficiently.

-

What features does airSlate SignNow offer for managing form 14256?

airSlate SignNow offers a variety of features tailored for handling form 14256, including customizable templates, automated workflows, and the ability to eSign securely. These tools not only save time but also enhance the overall accuracy of document management tasks.

-

Is there a cost associated with using airSlate SignNow for form 14256?

Yes, airSlate SignNow comes with different pricing plans to suit various business needs, including those specifically needing to manage form 14256. The pricing structure is designed to be cost-effective, ensuring that all businesses can access the tools they need without overspending.

-

Can airSlate SignNow integrate with other applications for form 14256?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing users to manage form 14256 alongside other business tools. This interoperability enhances productivity and ensures a smooth flow of information across your systems.

-

What are the benefits of using airSlate SignNow for form 14256?

Using airSlate SignNow for form 14256 provides numerous benefits, including increased efficiency, enhanced accuracy, and reduced turnaround time. Additionally, the secure eSigning feature helps maintain the integrity of your documents while ensuring compliance.

-

How secure is the eSigning process for form 14256 with airSlate SignNow?

The eSigning process for form 14256 with airSlate SignNow is highly secure, featuring encryption and authentication measures that protect your sensitive information. Users can confidently send and sign form 14256 knowing that their data is protected from unauthorized access.

Get more for Form 14258

- Placing request dundee form

- Bupa reimbursement form

- International footwear association form

- Lost paycheck form stony brook university naples cc sunysb

- Sub central broward county phone number form

- Downloadrepossessed affidavit dispostion of motor vehicle under form

- Student officer agreement form

- Genetics and probability worksheet 3 answers form

Find out other Form 14258

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free