St Petersburg Business Tax Receipt Form

What is the St Petersburg Business Tax Receipt

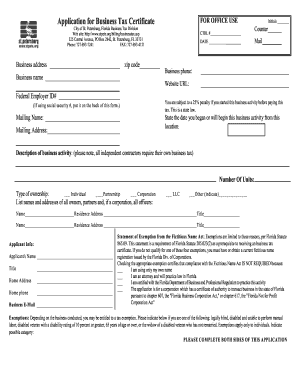

The St Petersburg Business Tax Receipt is an official document required for businesses operating within the city of St Petersburg, Florida. This receipt serves as proof that a business has registered with the local government and has paid the necessary business taxes. It is essential for legal compliance and is often required when opening a bank account, applying for permits, or engaging in contracts. The receipt reflects the business's adherence to local regulations and its commitment to contributing to the community.

How to obtain the St Petersburg Business Tax Receipt

To obtain the St Petersburg Business Tax Receipt, businesses must first register with the City of St Petersburg. This process typically involves submitting an application form along with any required documentation, such as proof of ownership and identification. Once the application is processed and approved, the business will receive the tax receipt. It is advisable to check with the local tax office for any specific requirements or additional documentation that may be needed.

Steps to complete the St Petersburg Business Tax Receipt

Completing the St Petersburg Business Tax Receipt involves several key steps:

- Gather necessary information, such as business name, address, and ownership details.

- Fill out the required application form accurately, ensuring all information is complete.

- Submit the application along with any required documents to the appropriate city department.

- Pay the associated fees, which may vary based on the type of business.

- Await confirmation of receipt issuance, which may take a few days to process.

Legal use of the St Petersburg Business Tax Receipt

The St Petersburg Business Tax Receipt is legally binding and serves as evidence of compliance with local business regulations. It may be required in various legal contexts, such as when entering contracts, applying for loans, or during audits. Ensuring that the receipt is current and valid is crucial, as failure to maintain compliance can lead to penalties or fines.

Key elements of the St Petersburg Business Tax Receipt

Key elements of the St Petersburg Business Tax Receipt include:

- Business name and address

- Owner's name and contact information

- Tax receipt number

- Effective date of the receipt

- Expiration date, if applicable

These elements help verify the legitimacy of the business and its compliance with local tax obligations.

Penalties for Non-Compliance

Non-compliance with the requirements for obtaining or renewing the St Petersburg Business Tax Receipt can result in various penalties. These may include fines, legal action, or the inability to operate legally within the city. It is important for business owners to stay informed about renewal deadlines and ensure all taxes are paid on time to avoid these consequences.

Quick guide on how to complete st petersburg business tax receipt

Complete St Petersburg Business Tax Receipt seamlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents promptly without any hold-ups. Manage St Petersburg Business Tax Receipt on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign St Petersburg Business Tax Receipt effortlessly

- Locate St Petersburg Business Tax Receipt and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you choose. Modify and eSign St Petersburg Business Tax Receipt and facilitate excellent communication during every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st petersburg business tax receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a St Petersburg business tax receipt?

A St Petersburg business tax receipt is a legal document that permits a business to operate within the city of St Petersburg. It confirms that the business has paid the required taxes and fees mandated by local authorities. Obtaining this receipt is crucial for ensuring compliance and avoiding potential fines.

-

How can airSlate SignNow help streamline the process of obtaining a St Petersburg business tax receipt?

airSlate SignNow allows you to eSign and send documents electronically, making it easier to manage paperwork required for your St Petersburg business tax receipt. With our user-friendly platform, you can quickly obtain necessary signatures, reducing delays and helping you stay compliant. This efficiency saves time and ensures you can focus on running your business.

-

What are the costs involved in acquiring a St Petersburg business tax receipt?

The costs for a St Petersburg business tax receipt can vary based on your business type and size. It's important to budget for application fees, renewal costs, and any additional charges the city may impose. Utilizing airSlate SignNow can help keep your documentation organized and potentially reduce administrative costs.

-

Are there any specific features of airSlate SignNow that assist with business tax receipts?

Yes, airSlate SignNow offers features that facilitate the swift creation and management of documents related to business tax receipts. Our platform supports templates, automated reminders, and secure storage, ensuring all your documentation is handled efficiently. This streamlines the process of obtaining your St Petersburg business tax receipt with minimal hassle.

-

Can I integrate airSlate SignNow with other tools to manage my St Petersburg business tax receipt?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and applications, allowing for a more comprehensive management system. You can connect it with accounting software, CRM systems, and document storage solutions to ensure all aspects of your St Petersburg business tax receipt workflow are synchronized and efficient.

-

What benefits does eSigning provide for the St Petersburg business tax receipt process?

eSigning with airSlate SignNow speeds up the process of obtaining your St Petersburg business tax receipt by eliminating the need for in-person signatures. This not only saves time but also enhances document security and tracking. With eSigning, you can ensure that all parties can review and approve documents quickly, keeping your business compliant.

-

Is airSlate SignNow suitable for all businesses needing a St Petersburg business tax receipt?

Yes, airSlate SignNow is designed to support businesses of all sizes and types needing a St Petersburg business tax receipt. Whether you're a sole proprietor or managing a larger company, our platform provides flexible solutions for all your signing and document management needs. We cater to a diverse array of industries, making compliance easier for everyone.

Get more for St Petersburg Business Tax Receipt

- Youth safety plan form

- Pinamungajan obo building permit requirements form

- Form 13 14

- In the know caregiver training pdf form

- Dhs form 7001 cis ombudsman case problem submission form keywords ombudsman uscis cisomb cis ombudsman dhs dhs form 7001 case

- Scotiabank student gic program faqs geebee education form

- Fit2work form

- Interlocal agreement template form

Find out other St Petersburg Business Tax Receipt

- Sign Tennessee Rental property lease agreement Free

- Sign West Virginia Rental property lease agreement Computer

- How Can I Sign Montana Rental lease contract

- Can I Sign Montana Rental lease contract

- How To Sign Minnesota Residential lease agreement

- How Can I Sign California Residential lease agreement form

- How To Sign Georgia Residential lease agreement form

- Sign Nebraska Residential lease agreement form Online

- Sign New Hampshire Residential lease agreement form Safe

- Help Me With Sign Tennessee Residential lease agreement

- Sign Vermont Residential lease agreement Safe

- Sign Rhode Island Residential lease agreement form Simple

- Can I Sign Pennsylvania Residential lease agreement form

- Can I Sign Wyoming Residential lease agreement form

- How Can I Sign Wyoming Room lease agreement

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online