Nv Dept of Taxation Form 2010

What is the Nv Dept Of Taxation Form

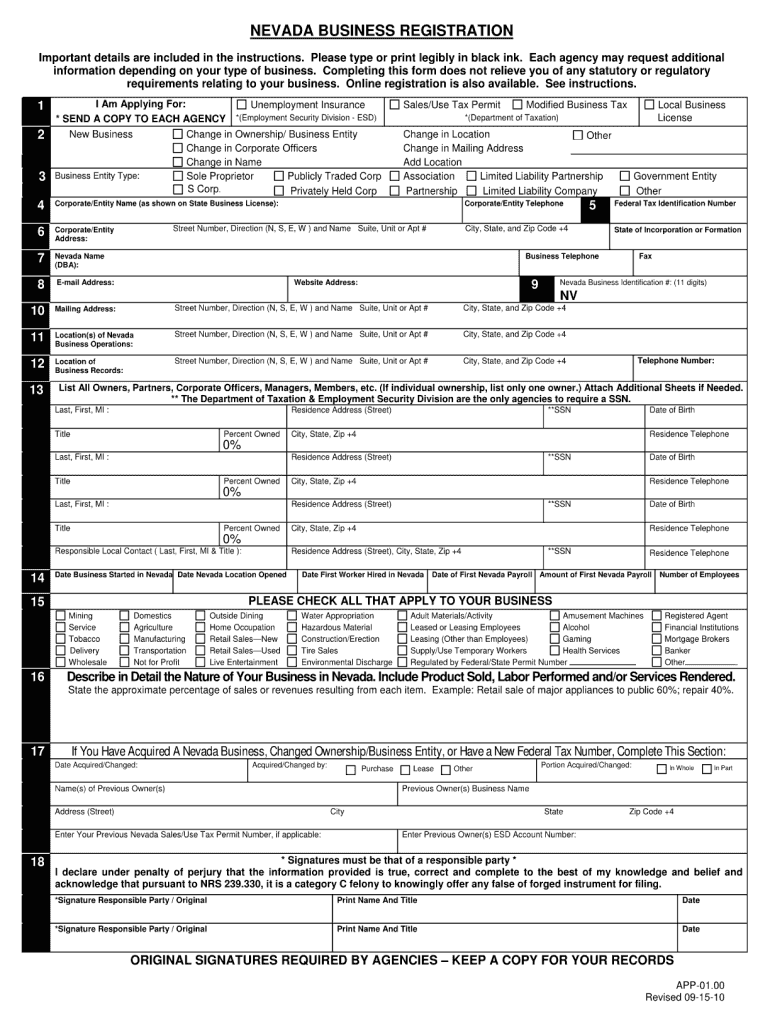

The Nv Dept Of Taxation Form is a crucial document used for various tax-related purposes within the state of Nevada. This form is designed to collect necessary information from taxpayers, ensuring compliance with state tax laws. It serves as a means for individuals and businesses to report their income, claim deductions, and fulfill their tax obligations. Understanding the specific purpose of this form is essential for accurate completion and submission.

How to use the Nv Dept Of Taxation Form

Using the Nv Dept Of Taxation Form involves several steps to ensure that all required information is accurately provided. First, gather all necessary documents, such as income statements and previous tax returns, which may be needed to complete the form. Next, carefully read the instructions accompanying the form to understand the required fields and any specific guidelines. Once the form is filled out, review it for accuracy before submission to avoid any potential issues with the tax authorities.

Steps to complete the Nv Dept Of Taxation Form

Completing the Nv Dept Of Taxation Form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts for deductions.

- Read the instructions provided with the form to understand each section's requirements.

- Fill in personal information, such as your name, address, and Social Security number.

- Report your income accurately, ensuring all sources are included.

- Claim any applicable deductions or credits as outlined in the instructions.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submitting it to the appropriate tax authority.

Legal use of the Nv Dept Of Taxation Form

The legal use of the Nv Dept Of Taxation Form is governed by state tax laws. It is essential for taxpayers to complete this form accurately to ensure compliance with Nevada's tax regulations. Submitting incorrect or incomplete information can lead to penalties, fines, or audits. Therefore, understanding the legal implications of the information provided on the form is vital for maintaining compliance and avoiding legal issues.

Form Submission Methods

The Nv Dept Of Taxation Form can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online: Many taxpayers opt to submit their forms electronically through the Nevada Department of Taxation's website, ensuring a faster processing time.

- Mail: Completed forms can be printed and mailed to the designated address provided in the form instructions.

- In-Person: Taxpayers may also choose to deliver their forms in person at local tax offices for immediate processing.

Required Documents

To complete the Nv Dept Of Taxation Form accurately, certain documents are typically required. These may include:

- W-2 forms from employers.

- 1099 forms for additional income sources.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any other documentation specified in the form instructions.

Quick guide on how to complete nv dept of taxation 2010 form

Control Nv Dept Of Taxation Form from anywhere, at any time

Your daily business operations may require additional focus when addressing state-specific business documentation. Reclaim your work hours and reduce the costs associated with paperwork procedures using airSlate SignNow. airSlate SignNow provides you with numerous pre-uploaded business documents, including Nv Dept Of Taxation Form, that you can utilize and distribute to your business associates. Manage your Nv Dept Of Taxation Form seamlessly with powerful editing and eSignature capabilities and deliver it directly to your recipients.

Steps to obtain Nv Dept Of Taxation Form in just a few clicks:

- Select a document relevant to your state.

- Click Learn More to access the document and ensure its accuracy.

- Click Get Form to begin using it.

- Nv Dept Of Taxation Form will automatically load in the editor. No further steps required.

- Utilize airSlate SignNow’s sophisticated editing tools to complete or modify the form.

- Click on the Sign tool to create your personalized signature and eSign your document.

- When ready, click Done, save changes, and access your document.

- Distribute the form via email or SMS, or use a link-to-fill option with partners or enable them to download the document.

airSlate SignNow signNowly streamlines your management of Nv Dept Of Taxation Form and enables you to find important documents in one centralized location. A comprehensive catalog of forms is organized and designed to address crucial business processes necessary for your organization. The enhanced editor reduces the chances of errors, as you can easily amend mistakes and review your documents on any device before submission. Begin your free trial today to discover all the advantages of airSlate SignNow for your everyday business workflows.

Create this form in 5 minutes or less

Find and fill out the correct nv dept of taxation 2010 form

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

If one is employed to a company, why does one have to fill in a Tax form when taxation is taken out of one's pay cheque automatically every month?

TAX EVASION IS ILLEGAL, TAX AVOIDANCE IS NOT!!!!!!IRS's game IRS's rules. Get a good Personal Tax Practitioner who is available year round that you trust, so when making financial decisions you can call and see how it will effect you tax wise and know the best way to implement it.Income tax reporting is voluntary. The IRS years ago felt that the American people as a whole were not being as forth coming as they should with income information. At this point IRS changed the rules by pitting the burden of proof on employers to report how much money they paid to each employee. This also helped IRS to balance businesses deductions against the populations income reporting. W-2's, 1099, a, b, c, misc, 1098 etc. is IRS's way of getting advanced information on the major things that happen to everyone in regards moneys earned and paid that effect personal & business taxes. Taxes withheld are only a percentage of your income and may not necessarily match the amount of taxes owed.Never for get that while the government is the government it is still a business that has to make money to operate. It forecast its earnings each year based on average working age and salaries of the population.Did you ever ask yourself why it is a IRS rule that taxes have to be filed within 3 years of the due date? IRS pays 6% simple interest on any refund held in their possession after the end of the filing season for that year. Years ago people who knew they had a refund just would not file for years, thus costing the IRS a lot of money when they did file. Now if you do not file within the 3 year time limit and you have a refund, guess who gets it? Yes, the IRS gets it. They confiscate your money for not doing something that they tell you is voluntary in the first place.The key thing to remember in reporting taxes is 1. Are your earnings below the reporting line? (yes) then 2. Were any taxes withheld federal or state? (Yes). Then file all w-2's to insure you get refunded all of the taxes that were withheld.If (No) to the same questions above no need to file IRS will have the same information and know you were below the filing requirement.

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

Create this form in 5 minutes!

How to create an eSignature for the nv dept of taxation 2010 form

How to make an electronic signature for the Nv Dept Of Taxation 2010 Form in the online mode

How to generate an eSignature for the Nv Dept Of Taxation 2010 Form in Google Chrome

How to make an eSignature for signing the Nv Dept Of Taxation 2010 Form in Gmail

How to make an eSignature for the Nv Dept Of Taxation 2010 Form straight from your smart phone

How to generate an electronic signature for the Nv Dept Of Taxation 2010 Form on iOS devices

How to create an electronic signature for the Nv Dept Of Taxation 2010 Form on Android devices

People also ask

-

What is the Nv Dept Of Taxation Form and why do I need it?

The Nv Dept Of Taxation Form is an essential document required for various tax-related processes in Nevada. It serves to ensure compliance with state tax regulations, making it crucial for both individuals and businesses. Using airSlate SignNow, you can easily fill out and eSign this form, streamlining your tax submissions.

-

How does airSlate SignNow facilitate the completion of the Nv Dept Of Taxation Form?

With airSlate SignNow, completing the Nv Dept Of Taxation Form is straightforward. Our platform allows you to fill in the necessary fields electronically, reducing the chances of errors. Plus, you can eSign the form instantly, ensuring that your submissions are timely and compliant.

-

Is there a cost associated with using airSlate SignNow for the Nv Dept Of Taxation Form?

Yes, there is a pricing structure for using airSlate SignNow, which offers various plans to meet your needs. You can choose a plan that fits your budget and requirements for processing the Nv Dept Of Taxation Form. Each plan includes features that enhance your document management experience.

-

What features does airSlate SignNow offer for the Nv Dept Of Taxation Form?

airSlate SignNow provides several features designed to simplify the management of the Nv Dept Of Taxation Form. These include customizable templates, the ability to request signatures, and integration with other applications. This enhances your workflow and ensures that all tax-related documents are organized and accessible.

-

Can I integrate airSlate SignNow with other software for managing the Nv Dept Of Taxation Form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications. This means you can easily connect your existing systems to manage the Nv Dept Of Taxation Form alongside your other business operations, enhancing efficiency and collaboration.

-

How secure is airSlate SignNow when handling the Nv Dept Of Taxation Form?

Security is a top priority at airSlate SignNow. We implement state-of-the-art encryption and security protocols to protect your sensitive information when handling the Nv Dept Of Taxation Form. Our platform ensures that your documents are safe from unauthorized access and data bsignNowes.

-

What benefits can I expect from using airSlate SignNow for the Nv Dept Of Taxation Form?

Using airSlate SignNow for the Nv Dept Of Taxation Form offers numerous benefits, including time savings and increased accuracy. The platform simplifies the process of filling out and eSigning documents, allowing you to focus more on your core business activities. Additionally, it helps ensure compliance with tax regulations.

Get more for Nv Dept Of Taxation Form

- Ultherapy consent form suncoast plastic surgery suncoastplasticsurgery

- To download payment renewal and cdh forms cisec

- Creek high school parking form

- Fingerprint and photograph verification form safe haven offshore

- To download our professional application ncafed ncafed form

- Epilepsy society seizure diary form

- St1 21 monthly variable schedule calendar form

- Northeastern university student financial services home form

Find out other Nv Dept Of Taxation Form

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter