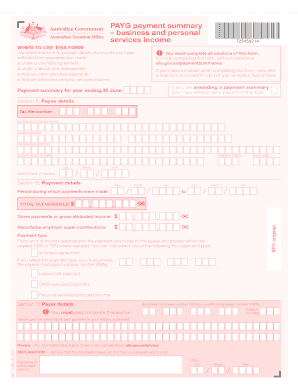

Business and Personal Services Income Payment Summary Form

What is the Business And Personal Services Income Payment Summary

The Business and Personal Services Income Payment Summary is a crucial document used to report income earned from various business and personal services. This summary is particularly relevant for self-employed individuals and businesses that provide services to clients. It serves as a record of payments received, which is essential for tax reporting and compliance with IRS regulations. The summary helps ensure that all income is accurately reported, facilitating the proper calculation of taxes owed.

How to Use the Business And Personal Services Income Payment Summary

Using the Business and Personal Services Income Payment Summary involves a few straightforward steps. First, gather all relevant income information for the reporting period. This includes payments received from clients or customers for services rendered. Next, accurately fill out the summary with the total amounts received, ensuring that all entries are correct to avoid discrepancies. Finally, retain a copy for your records and submit it as required by tax authorities, ensuring compliance with tax regulations.

Steps to Complete the Business And Personal Services Income Payment Summary

Completing the Business and Personal Services Income Payment Summary requires careful attention to detail. Follow these steps:

- Collect all payment records for the relevant period.

- Fill in your business name, address, and taxpayer identification number.

- List each client or customer along with the corresponding payment amounts.

- Calculate the total income received during the period.

- Review the summary for accuracy before submission.

Legal Use of the Business And Personal Services Income Payment Summary

The Business and Personal Services Income Payment Summary is legally recognized as a valid document for reporting income. It must be completed accurately to ensure compliance with tax laws. The IRS requires that all income be reported, and failure to do so can lead to penalties. Using a reliable digital solution, like signNow, can help ensure that the document is filled out correctly and securely signed, meeting all legal requirements.

Key Elements of the Business And Personal Services Income Payment Summary

Several key elements must be included in the Business and Personal Services Income Payment Summary to ensure its validity:

- Business Information: Include the business name, address, and taxpayer identification number.

- Client Details: List the names and addresses of clients or customers.

- Payment Amounts: Clearly state the total income received from each client.

- Total Income: Summarize the total income for the reporting period.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Business and Personal Services Income Payment Summary. It is essential to follow these guidelines to ensure compliance and avoid potential issues with tax authorities. The IRS recommends maintaining accurate records of all income and expenses, as well as keeping copies of all submitted forms for at least three years. Familiarizing yourself with the latest IRS updates regarding reporting requirements can help you stay compliant.

Quick guide on how to complete business and personal services income payment summary

Effortlessly Prepare Business And Personal Services Income Payment Summary on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can easily find the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without delays. Manage Business And Personal Services Income Payment Summary on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The Easiest Way to Edit and eSign Business And Personal Services Income Payment Summary with Ease

- Find Business And Personal Services Income Payment Summary and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information thoroughly and then click the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form hunting, or errors necessitating the printing of new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your preference. Modify and eSign Business And Personal Services Income Payment Summary and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business and personal services income payment summary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a business and personal services income payment summary?

A business and personal services income payment summary is a document that summarizes the income earned by businesses and individuals for providing services during a financial year. This summary is essential for tax reporting purposes and helps ensure compliance with local tax regulations.

-

How can airSlate SignNow help with business and personal services income payment summaries?

airSlate SignNow allows users to efficiently create, send, and eSign business and personal services income payment summaries. With our platform, you can streamline the process of generating these documents, ensuring accuracy and compliance while saving time and reducing paperwork.

-

What are the pricing options for airSlate SignNow services?

airSlate SignNow offers various pricing plans to accommodate different business needs. Plans include basic functionality for individuals up to advanced options for larger teams, all designed to help manage documents like business and personal services income payment summaries efficiently.

-

Does airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow integrates seamlessly with various platforms such as CRM systems, cloud storage solutions, and accounting software. These integrations enhance workflow efficiency, making it easier to manage and distribute your business and personal services income payment summaries.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides advanced features such as templates, customizable workflows, and secure electronic signatures that simplify document management. These features allow you to create and manage business and personal services income payment summaries quickly and efficiently.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow uses advanced encryption technologies to ensure that all documents, including business and personal services income payment summaries, are securely stored and transmitted. We prioritize security to protect your sensitive information.

-

Can I track the status of my business and personal services income payment summary with airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking features for all your documents, including business and personal services income payment summaries. You can easily see when documents are sent, viewed, and signed, ensuring a transparent process.

Get more for Business And Personal Services Income Payment Summary

- Grievance form atu local 587

- Pizza order form template

- Form 385 1 r e fillable

- I have made a gift of form

- How to store food properly quiz sheet form

- Imm 5488 e document checklist for a work permit applied form

- Final judgement and decree of divorce with minor children form

- Loan novation agreement template form

Find out other Business And Personal Services Income Payment Summary

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request