St3 Form

What is the St3 Form

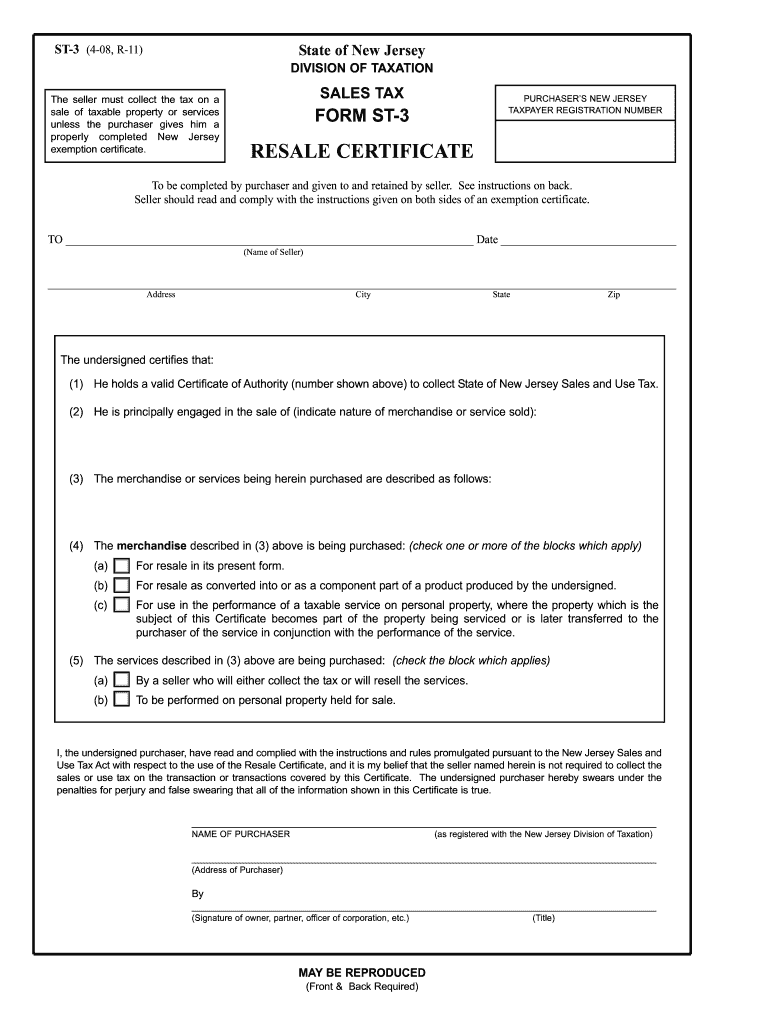

The St3 Form is a specific document used primarily for tax purposes in the United States. It is designed to assist individuals and businesses in reporting certain financial information to the IRS. This form is essential for ensuring compliance with tax regulations and can impact tax liabilities significantly. Understanding the St3 Form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the St3 Form

Using the St3 Form involves several key steps. First, gather all necessary financial documents and information relevant to the reporting period. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the preferred method. Utilizing digital tools can streamline this process and enhance accuracy.

Steps to complete the St3 Form

Completing the St3 Form requires attention to detail. Follow these steps for proper completion:

- Begin by entering your personal or business information at the top of the form.

- Fill out the financial sections, ensuring that all figures are accurate and reflect your records.

- Review the form for completeness, checking for any missing information or discrepancies.

- Sign and date the form to validate it.

- Choose your submission method: online or by mail.

Legal use of the St3 Form

The St3 Form is legally binding when completed and submitted according to IRS guidelines. It is essential to ensure that all information is truthful and accurate, as providing false information can lead to significant legal repercussions. Compliance with federal and state tax laws is mandatory, and the St3 Form plays a crucial role in this process. Utilizing a reliable eSignature solution can enhance the legal standing of the document by providing a verifiable signature.

Filing Deadlines / Important Dates

Filing deadlines for the St3 Form can vary based on the type of taxpayer and the specific tax year. Generally, it is advisable to submit the form by the annual tax filing deadline, which is typically April 15 for individual taxpayers. Businesses may have different deadlines based on their fiscal year. Staying informed about these dates is critical to avoid penalties and ensure compliance.

Required Documents

To complete the St3 Form accurately, certain documents are required. These may include:

- Previous tax returns for reference.

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Any other relevant financial documentation.

Gathering these documents beforehand can simplify the completion process and ensure accuracy.

Form Submission Methods

The St3 Form can be submitted through various methods. Taxpayers have the option to file online using e-filing systems, which can expedite processing and reduce errors. Alternatively, the form can be mailed to the appropriate IRS address. In-person submission may also be available at certain IRS offices. Choosing the right method depends on personal preference and the specific requirements of the filing situation.

Quick guide on how to complete st3 form

Effortlessly Prepare St3 Form on Any Device

Managing documents online has gained traction among both businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as it allows you to access the correct version and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without interruptions. Handle St3 Form on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Edit and eSign St3 Form Effortlessly

- Locate St3 Form and click on Get Form to begin.

- Use the available tools to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the specialized tools offered by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors requiring new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign St3 Form and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st3 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the St3 Form and how can it be used with airSlate SignNow?

The St3 Form is a specific document used in various business contexts, and airSlate SignNow allows you to easily create, send, and eSign this form digitally. With our platform, you can streamline the workflow associated with the St3 Form, ensuring quick and secure transactions.

-

Is there a cost associated with using airSlate SignNow for the St3 Form?

Yes, airSlate SignNow offers a variety of pricing plans to fit different business needs, including options for handling the St3 Form. Our competitive pricing ensures that you receive a cost-effective solution without compromising on features or support.

-

What features does airSlate SignNow offer for managing the St3 Form?

airSlate SignNow provides multiple features for the St3 Form, including customizable templates, automated reminders, and secure cloud storage. These features enhance efficiency and accuracy, making it easier for businesses to manage their documentation processes.

-

Can I integrate other tools with airSlate SignNow to use the St3 Form?

Absolutely! airSlate SignNow supports integration with numerous third-party applications, which allows you to manage the St3 Form alongside your existing tools. This seamless integration helps streamline workflows and enhances data management across your business.

-

What are the benefits of using airSlate SignNow for the St3 Form?

Using airSlate SignNow for the St3 Form provides numerous benefits, including increased efficiency, enhanced security, and improved collaboration. Our platform simplifies the eSigning process, saving time and reducing the risk of errors while keeping your documents safe.

-

How secure is my data when using airSlate SignNow for the St3 Form?

airSlate SignNow prioritizes your data security with robust encryption and compliance with industry standards. When using our platform for the St3 Form, you can trust that your information is protected and handled with the utmost security.

-

Can I customize the St3 Form using airSlate SignNow?

Yes, airSlate SignNow allows you to customize the St3 Form to suit your specific business needs. You can easily adjust fields, add branding elements, and modify templates to ensure the form aligns perfectly with your operational requirements.

Get more for St3 Form

- Online individual income tax extension filing form

- Application for missouri salvage business license form

- Form 2643 missouri tax registration application yumpu

- Supports waiver louisiana department of health and form

- Uc 018 unemployment tax and wage report form

- Form r 10606 supplemental worksheet for credit for taxes

- Treasury ampamp income tax officelansing mi official website form

- For official use only 625168085 form

Find out other St3 Form

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself