Self Employment Certificate 2014

What is the Self Employment Certificate

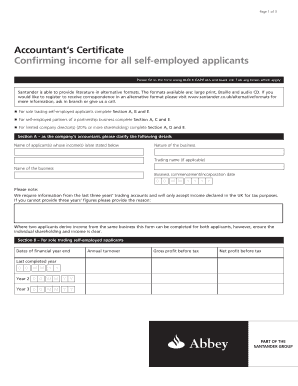

The Self Employment Certificate serves as a formal document that verifies an individual's status as self-employed. This certificate is often required for various purposes, including applying for loans, securing contracts, or fulfilling tax obligations. It provides proof of income and employment status, which can be essential for freelancers, independent contractors, and small business owners. In the United States, this document may also be referred to as an accountants certificate form, particularly when issued by a certified accountant.

How to Obtain the Self Employment Certificate

To obtain a Self Employment Certificate, individuals typically need to follow a straightforward process. First, gather necessary documentation, such as tax returns, business licenses, and any other proof of income. Next, contact a certified public accountant (CPA) or a tax professional who can assist in preparing the certificate. The accountant will review the documentation and may require additional information to ensure accuracy. Once completed, the accountant will issue the certificate, which can then be used for various official purposes.

Steps to Complete the Self Employment Certificate

Completing the Self Employment Certificate involves several key steps. Start by collecting all relevant financial documents, including:

- Tax returns for the previous one to two years

- Business registration or license

- Invoices or payment records from clients

Once you have the necessary documents, consult with a CPA or tax professional to ensure everything is in order. They will guide you through the process of filling out the accountants certificate form accurately. After the form is filled out, review it for any errors before finalizing it with the accountant's signature and seal.

Legal Use of the Self Employment Certificate

The Self Employment Certificate holds legal significance in various contexts. It is often required by financial institutions when applying for loans or credit, as it verifies income and employment status. Additionally, some government agencies may require this certificate for tax purposes or to determine eligibility for certain programs. It is important to ensure that the certificate is completed accurately and complies with relevant regulations to avoid any legal issues.

Key Elements of the Self Employment Certificate

Several key elements must be included in the Self Employment Certificate to ensure its validity. These elements typically include:

- The name and contact information of the self-employed individual

- A clear statement of self-employment status

- Details of the business or services provided

- The accountant's information, including their qualifications and signature

- The date of issuance

Including these details helps establish the authenticity of the certificate and provides necessary information for any parties requesting it.

IRS Guidelines

The Internal Revenue Service (IRS) recognizes the importance of the Self Employment Certificate for tax purposes. Self-employed individuals must report their income accurately, and having this certificate can simplify the process. The IRS requires that self-employed individuals file Schedule C (Form 1040) to report income and expenses. Maintaining proper documentation, including the Self Employment Certificate, can help ensure compliance with IRS guidelines and facilitate smoother tax filings.

Quick guide on how to complete self employment certificate 40689876

Complete Self Employment Certificate seamlessly on any gadget

Digital document management has become widely accepted by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the proper form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents rapidly and without hindrance. Handle Self Employment Certificate on any device utilizing airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to alter and eSign Self Employment Certificate effortlessly

- Locate Self Employment Certificate and click Get Form to initiate.

- Utilize our available tools to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes only moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method to send your form, via email, SMS, or link invitation, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Self Employment Certificate to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct self employment certificate 40689876

Create this form in 5 minutes!

How to create an eSignature for the self employment certificate 40689876

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an accountants certificate form?

An accountants certificate form is a document that provides confirmation of financial information from a certified accountant. This form is essential for businesses that need to verify their financial standing or compliance with regulatory requirements. Using airSlate SignNow, you can easily create, send, and eSign your accountants certificate form securely.

-

How does airSlate SignNow simplify the process of obtaining an accountants certificate form?

With airSlate SignNow, the process of obtaining an accountants certificate form is streamlined and efficient. Our platform allows you to customize the form, send it to your accountant for signature, and track the status in real-time. This leads to faster turnaround times and helps improve your document management efficiency.

-

Is there a cost associated with using airSlate SignNow for accountants certificate forms?

Yes, airSlate SignNow offers a range of pricing plans to suit various business needs when handling accountants certificate forms. Our pricing is cost-effective and designed to provide excellent value, allowing you to manage all your documentation processes without overspending. You can choose from different tiers that offer additional features based on your requirements.

-

What features does airSlate SignNow offer for accountants certificate forms?

airSlate SignNow provides a variety of features for accountants certificate forms, including customizable templates, cloud storage, and secure electronic signatures. You can also utilize workflow automation to streamline document approvals. These features ensure that your certificate forms are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for accountants certificate forms?

Absolutely! airSlate SignNow integrates seamlessly with various software applications to enhance the management of accountants certificate forms. Popular integrations include CRM systems, project management tools, and cloud storage services, making it easier to manage all aspects of your documentation in one platform.

-

How secure is airSlate SignNow when handling accountants certificate forms?

Security is a top priority at airSlate SignNow. We employ robust security measures such as encryption, secure data storage, and compliance with industry standards to protect your accountants certificate forms. You can trust our platform to keep your sensitive information safe throughout the signing process.

-

What benefits can I expect from using airSlate SignNow for accountants certificate forms?

Using airSlate SignNow for accountants certificate forms can signNowly improve efficiency, reduce processing time, and enhance accuracy. You'll benefit from a user-friendly interface that simplifies document handling while ensuring compliance with legal standards. Additionally, our platform reduces paperwork, allowing you to focus more on your core business activities.

Get more for Self Employment Certificate

- Miami dade condo complaint form

- Grade tracker pdf form

- Chapter 6 earth science answer key form

- Eldoret cancer registry form afcrn

- Authorization for prescribing advanced practice nurse health tn form

- Uslegalforms com

- Use this form for fegli 3999 open enrollment office of personnel opm

- Sample safety program vehicle safety program template form

Find out other Self Employment Certificate

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online