299 Tax Form

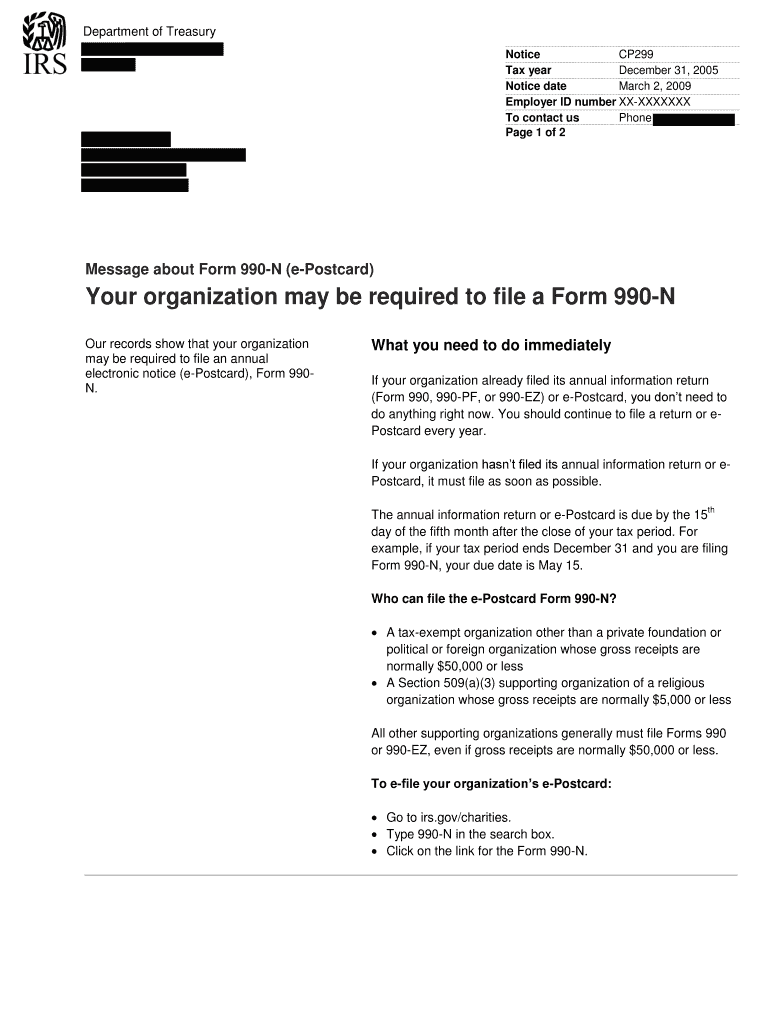

What is the 299 Tax Form

The 299 tax form, often referred to as the IRS Gove, is a document used primarily for reporting specific financial information to the Internal Revenue Service (IRS). This form is essential for entities that need to disclose various types of income, deductions, or credits. Understanding its purpose is crucial for compliance with federal tax regulations.

How to Use the 299 Tax Form

Using the 299 tax form involves several steps to ensure accurate reporting. First, gather all necessary financial records, including income statements and any relevant deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is advisable to consult IRS guidelines to confirm that you are using the correct version of the form and that you are meeting all requirements. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Steps to Complete the 299 Tax Form

Completing the 299 tax form requires attention to detail. Follow these steps:

- Review the instructions for the 299 tax form to understand the requirements.

- Collect all necessary documents, such as W-2s, 1099s, and any receipts for deductions.

- Fill out the form, ensuring that all fields are completed accurately.

- Double-check your entries for any errors or omissions.

- Submit the form electronically through an authorized platform or mail it to the appropriate IRS address.

Legal Use of the 299 Tax Form

The legal use of the 299 tax form is vital for ensuring compliance with federal tax laws. This form must be filled out truthfully and accurately to avoid penalties. When submitted, it serves as a formal declaration of income and deductions, which can be audited by the IRS. Adhering to the legal requirements associated with this form protects taxpayers from potential legal issues and ensures that they fulfill their tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the 299 tax form are crucial to avoid late fees and penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, if you are filing for a business entity, the deadlines may vary. It is important to check the IRS calendar for any updates or changes to these dates to ensure timely submission.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 299 tax form. These guidelines outline the necessary information required, acceptable filing methods, and any additional documentation that may be needed. Familiarizing yourself with these guidelines helps ensure compliance and reduces the risk of errors that could lead to audits or penalties.

Quick guide on how to complete 299 tax form

Complete 299 Tax Form effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can locate the correct form and securely store it online. airSlate SignNow offers all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage 299 Tax Form on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign 299 Tax Form seamlessly

- Locate 299 Tax Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, monotonous form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 299 Tax Form and ensure excellent communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 299 tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to IRS GOVE?

airSlate SignNow is a cloud-based eSignature solution that simplifies the process of sending and signing documents electronically. It integrates seamlessly with IRS GOVE requirements, ensuring compliance and efficiency for businesses when dealing with tax-related forms.

-

How does airSlate SignNow ensure compliance with IRS GOVE?

airSlate SignNow is designed to meet legal standards for eSignatures, specifically aligning with IRS GOVE regulations. This compliance guarantees that your digitally signed documents are valid and secure, providing peace of mind for businesses when handling sensitive tax information.

-

What pricing options are available for airSlate SignNow services?

airSlate SignNow offers a variety of pricing plans tailored to fit different business needs and budgets. Each plan provides access to features that are essential for meeting IRS GOVE requirements, allowing companies to choose the most cost-effective solution for their document signing needs.

-

Can airSlate SignNow integrate with other tools to enhance IRS GOVE processes?

Yes, airSlate SignNow can integrate with various applications such as CRM systems and document management tools to streamline workflows. This integration supports efficient handling of IRS GOVE-related documents, making it easier for businesses to manage their paperwork.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features like document templates, customizable workflows, and secure storage to manage documents effectively. These features are crucial for adhering to IRS GOVE standards, allowing businesses to organize and access their important documents conveniently.

-

How secure is airSlate SignNow when it comes to handling IRS GOVE documents?

Security is a top priority for airSlate SignNow, which utilizes advanced encryption and secure access protocols to protect your documents. This level of security is essential for businesses that need to handle IRS GOVE documents safely and maintain compliance.

-

What benefits can businesses gain from using airSlate SignNow with IRS GOVE?

Using airSlate SignNow allows businesses to streamline their document signing processes and reduce turnaround times, especially for IRS GOVE documents. This efficiency not only saves time but also decreases operational costs, making it a valuable tool for any organization.

Get more for 299 Tax Form

Find out other 299 Tax Form

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile