No Tax Due Missouri Form

What is the No Tax Due Missouri

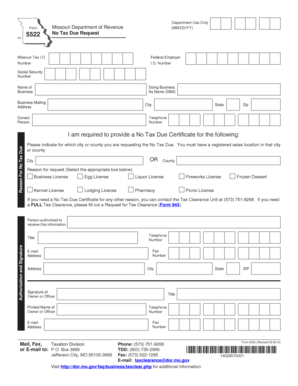

The No Tax Due Missouri form serves as a declaration that a taxpayer has no outstanding tax obligations to the state of Missouri. This form is particularly relevant for individuals or businesses that need to certify their tax status for various purposes, such as applying for loans, licenses, or permits. By submitting this form, taxpayers can confirm that they are in good standing with the Missouri Department of Revenue, thereby facilitating smoother transactions that require proof of tax compliance.

How to obtain the No Tax Due Missouri

To obtain the No Tax Due Missouri form, taxpayers can visit the official Missouri Department of Revenue website. The form is typically available for download in a fillable format, allowing users to complete it electronically. Alternatively, taxpayers may request a physical copy through the Department of Revenue’s offices. It is essential to ensure that the correct version of the form is used, as there may be updates or changes in requirements from time to time.

Steps to complete the No Tax Due Missouri

Completing the No Tax Due Missouri form involves several key steps:

- Gather necessary information, including taxpayer identification details and any relevant tax history.

- Access the form from the Missouri Department of Revenue website or obtain a physical copy.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the form via the designated method, whether online, by mail, or in person.

Legal use of the No Tax Due Missouri

The No Tax Due Missouri form is legally recognized as a valid document to confirm a taxpayer's compliance with state tax obligations. It can be used in various legal contexts, such as during audits, financial transactions, or when applying for government contracts. To ensure its legal standing, it is crucial that the form is completed accurately and submitted in accordance with Missouri tax laws.

Eligibility Criteria

Eligibility for filing the No Tax Due Missouri form generally includes individuals or businesses that have no outstanding tax liabilities with the state. This includes those who have filed their tax returns on time and have no pending payments. Additionally, certain exemptions may apply based on specific circumstances, such as being a non-resident or having a tax-exempt status. It is advisable to review the eligibility criteria outlined by the Missouri Department of Revenue to confirm qualification before filing.

Required Documents

When completing the No Tax Due Missouri form, taxpayers may need to provide supporting documentation to verify their tax status. This can include:

- Recent tax returns to demonstrate compliance.

- Any correspondence from the Missouri Department of Revenue regarding tax obligations.

- Identification details, such as Social Security numbers or Employer Identification Numbers.

Having these documents ready can streamline the process and ensure that the form is completed accurately.

Quick guide on how to complete no tax due missouri

Effortlessly Prepare No Tax Due Missouri on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to access the correct files and securely store them online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly and without delays. Handle No Tax Due Missouri on any device using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

How to Edit and Electronically Sign No Tax Due Missouri with Ease

- Find No Tax Due Missouri and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign No Tax Due Missouri to ensure clear communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the no tax due missouri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Missouri no tax due request?

A Missouri no tax due request is an official document that certifies a business has no outstanding tax liabilities with the state. This request is essential for companies looking to maintain compliance and secure necessary permits or licenses. Understanding the process for obtaining this document is crucial for business owners.

-

How can airSlate SignNow assist with filing a Missouri no tax due request?

airSlate SignNow streamlines the process of filing a Missouri no tax due request by allowing users to eSign and send documents quickly and efficiently. Our platform offers an intuitive interface, making it easy to complete all necessary forms. This reduces the time and effort involved signNowly.

-

What features does airSlate SignNow offer for document management?

With airSlate SignNow, users can enjoy features such as document templates, automated workflows, and secure cloud storage, tailored for efficient management of projects like a Missouri no tax due request. The platform allows for real-time collaboration and secure sharing, ensuring all relevant parties can access documents when needed.

-

Is airSlate SignNow cost-effective for small businesses managing a Missouri no tax due request?

Yes, airSlate SignNow is designed to be cost-effective, especially for small businesses that need to manage documents like a Missouri no tax due request. Our pricing plans are flexible, allowing businesses to choose an option that best fits their budget. This makes it accessible for all business sizes to benefit from our services.

-

Are there any integrations available with airSlate SignNow?

Absolutely, airSlate SignNow integrates with various platforms such as Google Drive, Dropbox, and major CRM systems. These integrations enhance the efficiency of managing your Missouri no tax due request by connecting your existing tools. This seamless workflow ensures that all documents are accessible from one central platform.

-

What are the benefits of using airSlate SignNow for signing documents?

Using airSlate SignNow for signing documents, including a Missouri no tax due request, offers several benefits such as fast turnaround, legally binding signatures, and enhanced security. Our electronic signature solutions help you eliminate delays associated with traditional signing methods. This facilitates quicker business operations and compliance.

-

Can airSlate SignNow accommodate multiple users for a Missouri no tax due request?

Yes, airSlate SignNow supports multiple user access, allowing teams to collaborate effectively when dealing with a Missouri no tax due request. Administrators can control user permissions, ensuring that only authorized personnel can handle sensitive documents. This feature promotes efficient collaboration and oversight within a business.

Get more for No Tax Due Missouri

- Moving day surprise running record form

- Notice of intended marriage form nt gov

- West virginia power of attorney form

- Motion application to intervene minnesota form

- Submission of eagle scout rank application and request form

- Hipaa baa agreement template form

- Gym membership agreement template form

- Hipaa business associate agreement template form

Find out other No Tax Due Missouri

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors