R 1202 Form

What is the R 1202

The R 1202 form is a specific document used primarily for tax purposes in the United States. It is designed to collect certain information from taxpayers, which may include details about income, deductions, and credits. Understanding the purpose of the R 1202 is crucial for ensuring compliance with tax regulations and for accurate reporting. This form is typically used by individuals and businesses to report specific financial information to the Internal Revenue Service (IRS).

How to use the R 1202

Using the R 1202 form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all sections are completed as required. It is important to review the information for accuracy before submission. Once completed, the R 1202 can be submitted electronically or via mail, depending on your preference and the specific instructions provided by the IRS.

Steps to complete the R 1202

Completing the R 1202 form involves a systematic approach:

- Gather necessary documents, including income statements and prior tax returns.

- Fill out personal information, including your name, address, and Social Security number.

- Report income details accurately, ensuring that all sources of income are included.

- Detail any deductions or credits you are eligible for, providing supporting documentation as needed.

- Review the completed form for accuracy and completeness.

- Submit the form electronically through the IRS website or mail it to the appropriate address.

Legal use of the R 1202

The R 1202 form must be used in accordance with IRS guidelines to ensure its legal validity. This includes adhering to deadlines for submission and ensuring that all information reported is truthful and accurate. Failing to comply with these regulations can result in penalties or legal repercussions. It is essential to understand the legal implications of the information provided on the form, as inaccuracies can lead to audits and additional scrutiny from tax authorities.

Filing Deadlines / Important Dates

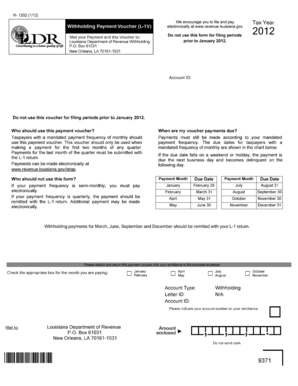

Filing deadlines for the R 1202 form are critical to ensure compliance with tax regulations. Typically, the form must be submitted by April 15 of the tax year, unless an extension is granted. It is important to keep track of any changes to these deadlines, as they can vary based on specific circumstances or changes in tax law. Marking these dates on your calendar can help avoid late submissions and potential penalties.

Required Documents

To complete the R 1202 form, several documents are typically required. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any relevant documentation supporting claims for credits or deductions.

Having these documents ready will streamline the process of completing the R 1202 and help ensure accuracy.

Quick guide on how to complete r 1202

Complete R 1202 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage R 1202 on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign R 1202 with ease

- Locate R 1202 and click Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign R 1202 and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r 1202

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is r 1202 and how does it relate to airSlate SignNow?

r 1202 refers to a specific feature or integration within airSlate SignNow that enhances document management and e-signature processes. Utilizing r 1202 allows businesses to streamline their workflows, making it easier to send and eSign documents quickly and efficiently.

-

How much does it cost to use airSlate SignNow with r 1202?

Pricing for airSlate SignNow with r 1202 varies depending on the subscription plan you choose. Typically, the plans are designed to provide cost-effective options for businesses of all sizes, ensuring you get the best value for your investment in e-signature solutions.

-

What features are included in the r 1202 package?

The r 1202 package includes a variety of features such as customizable templates, multi-party e-signatures, and secure document storage. These features are designed to enhance user experience and facilitate seamless document workflows for your business.

-

Can r 1202 integrate with other software tools I currently use?

Yes, r 1202 is built to integrate smoothly with various software tools including CRM systems, project management platforms, and cloud storage services. This ensures that you can incorporate airSlate SignNow into your existing technology stack, streamlining your operations signNowly.

-

What are the benefits of using airSlate SignNow with r 1202?

Using airSlate SignNow with r 1202 offers numerous benefits such as increased efficiency, reduced paper consumption, and enhanced security for your documents. With r 1202, businesses can expect faster turnaround times for document signing and improved compliance with industry regulations.

-

Is it easy to use airSlate SignNow with r 1202 for new users?

Absolutely! airSlate SignNow with r 1202 is designed with user-friendliness in mind. New users can quickly learn how to send and eSign documents thanks to its intuitive interface, providing a seamless onboarding experience that minimizes disruptions.

-

What types of documents can I eSign using r 1202?

You can eSign a wide variety of document types using r 1202, including contracts, agreements, consent forms, and more. This versatility ensures that airSlate SignNow meets your document signing needs across multiple industries and use cases.

Get more for R 1202

Find out other R 1202

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship