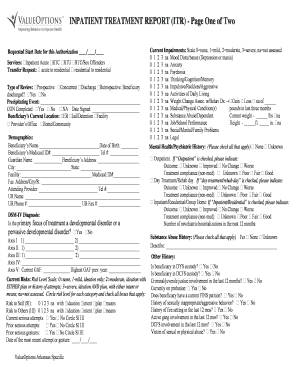

Value Options Itr Form

What is the Value Options Itr Form

The Value Options ITR Form is a crucial document used in the context of tax reporting and compliance. It is typically required for individuals who are claiming specific tax benefits or deductions related to value options. This form helps taxpayers report their income accurately and ensures that they meet the necessary legal obligations set forth by the Internal Revenue Service (IRS). Understanding the purpose of this form is essential for anyone navigating the complexities of tax filings in the United States.

How to use the Value Options Itr Form

Using the Value Options ITR Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents that support your claims. This may include income statements, receipts for deductions, and any relevant tax documents. Next, fill out the form carefully, ensuring that all information is accurate and complete. Once the form is filled out, review it for any errors before submission. Finally, submit the form according to the guidelines provided by the IRS, either electronically or by mail, depending on your preference and requirements.

Steps to complete the Value Options Itr Form

Completing the Value Options ITR Form requires attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including income and deduction records.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form, ensuring that all fields are completed accurately.

- Double-check your entries to avoid common mistakes, such as incorrect Social Security numbers or miscalculated figures.

- Sign and date the form to validate your submission.

- Submit the completed form as per the IRS guidelines, either electronically or via postal mail.

Legal use of the Value Options Itr Form

The legal use of the Value Options ITR Form is governed by IRS regulations. To ensure that the form is legally binding, it must be filled out truthfully and accurately. Any misrepresentation or errors can lead to penalties or audits. Additionally, the form must be submitted within the designated filing deadlines to maintain compliance with tax laws. Understanding the legal implications of this form is essential for taxpayers to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Value Options ITR Form are critical to ensure compliance with tax regulations. Typically, the IRS sets a deadline for submission that aligns with the annual tax filing season. It is essential to stay informed about these dates to avoid late fees or penalties. Mark your calendar with important dates, such as the start of the filing season and the final submission date, to ensure timely completion of your tax obligations.

Required Documents

To complete the Value Options ITR Form accurately, certain documents are required. These may include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses.

- Records of any tax credits you are claiming.

- Previous year’s tax returns for reference.

Having these documents ready will facilitate a smoother completion process and help ensure that your form is accurate.

Quick guide on how to complete value options itr form

Finalize Value Options Itr Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute to conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents swiftly without any hold-ups. Handle Value Options Itr Form on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

The simplest way to modify and eSign Value Options Itr Form effortlessly

- Locate Value Options Itr Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or black out confidential information with tools designed by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal authority as a traditional wet signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device of your choice. Modify and eSign Value Options Itr Form and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the value options itr form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Value Options Itr Form?

The Value Options Itr Form is a standardized document used for reporting specific financial information. It’s essential for individuals and businesses to ensure compliance with tax regulations. Understanding this form can help you manage your tax obligations more effectively.

-

How does airSlate SignNow integrate with the Value Options Itr Form?

airSlate SignNow allows users to easily create, send, and eSign the Value Options Itr Form. Our platform ensures a seamless experience, making it simple to manage your documents digitally. This integration helps streamline your workflow and reduces the chances of errors.

-

What are the benefits of using airSlate SignNow for the Value Options Itr Form?

Using airSlate SignNow for the Value Options Itr Form offers several benefits, including enhanced security, ease of use, and quicker turnaround times. Our eSignature solution ensures that your documents are signed legally and securely. You will also save time and reduce paperwork.

-

Is there a cost associated with using airSlate SignNow for the Value Options Itr Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet your business needs. Costs can vary based on features and the number of users. However, our solutions remain cost-effective compared to traditional document management methods.

-

Can I track the status of my Value Options Itr Form with airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities for your Value Options Itr Form. You can monitor the progress of your document in real time, ensuring you know exactly when it has been viewed and signed. This feature promotes transparency and accountability.

-

Is it easy to edit the Value Options Itr Form using airSlate SignNow?

Absolutely! airSlate SignNow offers an intuitive interface that allows you to easily edit the Value Options Itr Form. You can add custom fields, modify content, and make necessary adjustments without any hassle.

-

What types of integrations does airSlate SignNow offer for the Value Options Itr Form?

airSlate SignNow provides a wide range of integrations with various third-party applications to enhance the functionality of the Value Options Itr Form. Whether you're using CRM software or cloud storage, our integration options ensure a smooth workflow. This versatility helps improve collaboration.

Get more for Value Options Itr Form

- Using graphing skills answer key 45861667 form

- It40x form

- Notice of disposal nt form

- Post adoption contact and communication form final doc parental relocation child custody and visitation dss virginia

- Office loan agreement template form

- Office lottery pool agreement template form

- Monthly retainer contract template form

- Monthly service contract template form

Find out other Value Options Itr Form

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement