Form P 706 Wisconsin Department of Revenue Dor State Wi

What is the Form P 706 Wisconsin Department Of Revenue Dor State Wi

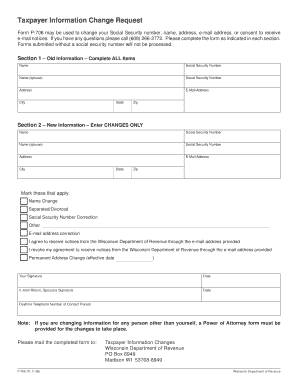

The Form P 706 is a crucial document issued by the Wisconsin Department of Revenue. It is primarily used for reporting specific tax information related to estates and trusts. This form enables the Department to assess the tax obligations of estates and ensures compliance with state tax laws. Understanding its purpose is essential for individuals managing estates or trusts in Wisconsin, as proper completion can affect tax liabilities and legal standing.

How to use the Form P 706 Wisconsin Department Of Revenue Dor State Wi

Using the Form P 706 involves several steps to ensure accurate reporting. First, gather all necessary financial information related to the estate or trust, including income, deductions, and any applicable credits. Next, fill out the form carefully, ensuring that all sections are completed accurately. Once the form is filled out, it must be signed by the appropriate parties, typically the executor or trustee, to validate the document. Finally, submit the completed form to the Wisconsin Department of Revenue by the specified deadline to avoid penalties.

Steps to complete the Form P 706 Wisconsin Department Of Revenue Dor State Wi

Completing the Form P 706 requires attention to detail. Follow these steps:

- Collect all relevant financial documents, including income statements and expense records.

- Begin filling out the form, starting with basic information such as the name of the estate or trust and the taxpayer identification number.

- Provide detailed income information, including any taxable income generated by the estate or trust.

- List all deductions applicable to the estate or trust, ensuring to follow state guidelines.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Sign the form and date it, confirming that all information is true and accurate.

- Submit the form to the Wisconsin Department of Revenue by the required deadline.

Legal use of the Form P 706 Wisconsin Department Of Revenue Dor State Wi

The legal use of the Form P 706 is governed by Wisconsin state tax laws. It is essential for the form to be filled out accurately and submitted on time to avoid legal repercussions. Failure to comply with the requirements can result in penalties, including fines or additional taxes owed. The form serves as an official record of the estate's or trust's financial activities, making its proper use critical for legal and tax purposes.

Key elements of the Form P 706 Wisconsin Department Of Revenue Dor State Wi

Key elements of the Form P 706 include:

- Taxpayer Information: Essential details about the estate or trust, including name and identification number.

- Income Reporting: A section dedicated to reporting all sources of income generated by the estate or trust.

- Deductions: Areas to claim allowable deductions that can reduce the taxable income.

- Signature Section: A place for the executor or trustee to sign, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form P 706 are critical to ensure compliance with Wisconsin tax regulations. Typically, the form must be filed within nine months of the date of death of the individual whose estate is being reported. Extensions may be available under certain circumstances, but it is vital to check with the Wisconsin Department of Revenue for specific guidelines. Missing the deadline can result in penalties and interest on unpaid taxes.

Quick guide on how to complete form p 706 wisconsin department of revenue dor state wi

Complete Form P 706 Wisconsin Department Of Revenue Dor State Wi effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form P 706 Wisconsin Department Of Revenue Dor State Wi on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

Steps to update and eSign Form P 706 Wisconsin Department Of Revenue Dor State Wi with ease

- Obtain Form P 706 Wisconsin Department Of Revenue Dor State Wi then click Get Form to initiate.

- Use the tools we offer to finalize your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow supplies explicitly for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to store your modifications.

- Choose your preferred method to submit your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and eSign Form P 706 Wisconsin Department Of Revenue Dor State Wi and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form p 706 wisconsin department of revenue dor state wi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form P 706 Wisconsin Department Of Revenue Dor State Wi?

Form P 706 Wisconsin Department Of Revenue Dor State Wi is a vital tax form used for reporting inheritance tax in Wisconsin. This form is essential for ensuring compliance with state tax laws and managing the tax obligations of an estate. Understanding how to correctly fill out this form can help you avoid penalties.

-

How can airSlate SignNow help with Form P 706 Wisconsin Department Of Revenue Dor State Wi?

airSlate SignNow streamlines the process of completing and signing Form P 706 Wisconsin Department Of Revenue Dor State Wi by enabling users to fill out, eSign, and send their documents securely. Our platform provides templates and guided workflows to simplify document preparation. This efficiency can save valuable time and reduce errors.

-

Is airSlate SignNow affordable for small businesses needing Form P 706 Wisconsin Department Of Revenue Dor State Wi?

Yes, airSlate SignNow offers cost-effective pricing plans suited for businesses of all sizes, including small businesses that need to manage Form P 706 Wisconsin Department Of Revenue Dor State Wi. With tiered options, you can choose a plan that fits your budget, allowing you to eSign and send documents without breaking the bank.

-

What features does airSlate SignNow offer for managing Form P 706 Wisconsin Department Of Revenue Dor State Wi?

airSlate SignNow provides robust features including document templates, editing tools, secure eSigning, and automated workflows specifically for Form P 706 Wisconsin Department Of Revenue Dor State Wi. Additionally, the platform allows for easy collaboration among team members and stakeholders, ensuring everyone stays informed.

-

Are there integrations available with airSlate SignNow for Form P 706 Wisconsin Department Of Revenue Dor State Wi?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications, providing a comprehensive solution for managing Form P 706 Wisconsin Department Of Revenue Dor State Wi. These integrations enhance productivity by connecting with tools like CRM systems, cloud storage, and project management platforms.

-

What are the benefits of using airSlate SignNow for Form P 706 Wisconsin Department Of Revenue Dor State Wi?

Using airSlate SignNow for Form P 706 Wisconsin Department Of Revenue Dor State Wi offers benefits such as increased efficiency, improved accuracy, and enhanced security. Our solution enables instant eSigning and document sharing, which reduces turnaround times and streamlines your tax preparation process, making it easier to meet deadlines.

-

Can I track the status of my Form P 706 Wisconsin Department Of Revenue Dor State Wi documents with airSlate SignNow?

Yes, airSlate SignNow features robust tracking capabilities that allow you to monitor the status of your Form P 706 Wisconsin Department Of Revenue Dor State Wi documents. You will receive real-time notifications upon completion, ensuring you stay informed throughout the signing process. This transparency is crucial for effective document management.

Get more for Form P 706 Wisconsin Department Of Revenue Dor State Wi

- Mosaic escrow form

- Residential application for utility edmond ok form

- Request for change of information verification habdsite

- Online fillable forms to unlock rrsp in bc

- Owcp 957 fillable form 5476319

- Affidavit support and consent parental travel permit form

- Ocbc bank malaysia berhad 295400 w ocbc home loan form

- Site handover form pdf

Find out other Form P 706 Wisconsin Department Of Revenue Dor State Wi

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple