I 312 the South Carolina Department of Revenue Sctax Form

What is the I-312 The South Carolina Department Of Revenue Sctax?

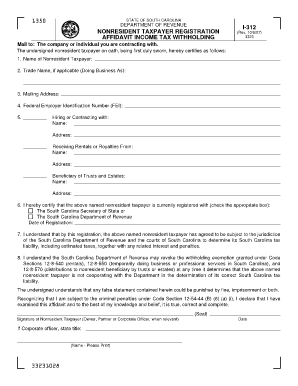

The I-312 form is a tax document issued by the South Carolina Department of Revenue. It is primarily used for reporting specific tax-related information and ensuring compliance with state tax regulations. This form is essential for individuals and businesses who need to report their tax obligations accurately. Understanding the purpose and requirements of the I-312 is crucial for proper tax filing and avoiding potential penalties.

How to use the I-312 The South Carolina Department Of Revenue Sctax

Using the I-312 form involves several steps to ensure accurate completion. First, gather all necessary financial documents related to your income and expenses. Next, access the form through the South Carolina Department of Revenue website or other official sources. Carefully fill out the form, ensuring that all information is accurate and complete. Once completed, the form can be submitted electronically or via mail, depending on your preference and the specific guidelines provided by the Department of Revenue.

Steps to complete the I-312 The South Carolina Department Of Revenue Sctax

To complete the I-312 form, follow these steps:

- Gather all relevant financial information, including income statements and expense records.

- Obtain the I-312 form from the South Carolina Department of Revenue website.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the form electronically or by mail, following the submission guidelines provided.

Legal use of the I-312 The South Carolina Department Of Revenue Sctax

The I-312 form is legally binding when completed and submitted according to the regulations set forth by the South Carolina Department of Revenue. To ensure its legal standing, all required signatures must be included, and the form must adhere to the state's tax laws. Utilizing a reliable electronic signature solution can further enhance the legal validity of the document, ensuring compliance with eSignature laws such as ESIGN and UETA.

Key elements of the I-312 The South Carolina Department Of Revenue Sctax

Key elements of the I-312 form include:

- Identification information for the taxpayer, including name and address.

- Details regarding income and deductions applicable to the tax year.

- Signature and date fields to validate the submission.

- Instructions for submission and any additional documentation required.

Filing Deadlines / Important Dates

Filing deadlines for the I-312 form are crucial for compliance. Typically, the form must be submitted by the state’s tax deadline, which aligns with federal tax filing dates. It is important to stay informed about any changes to these deadlines, as late submissions may result in penalties or interest charges. Always check the South Carolina Department of Revenue website for the most current information regarding filing dates.

Quick guide on how to complete i 312 the south carolina department of revenue sctax

Effortlessly Prepare I 312 The South Carolina Department Of Revenue Sctax on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Handle I 312 The South Carolina Department Of Revenue Sctax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign I 312 The South Carolina Department Of Revenue Sctax with Ease

- Find I 312 The South Carolina Department Of Revenue Sctax and click on Get Form to initiate the process.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign I 312 The South Carolina Department Of Revenue Sctax to ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the i 312 the south carolina department of revenue sctax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the I 312 The South Carolina Department Of Revenue Sctax form?

The I 312 The South Carolina Department Of Revenue Sctax form is a tax form required for certain tax reporting related to South Carolina. It is essential for businesses to complete this form accurately to comply with state regulations and avoid potential penalties.

-

How does airSlate SignNow help with the I 312 The South Carolina Department Of Revenue Sctax form?

airSlate SignNow streamlines the process of completing the I 312 The South Carolina Department Of Revenue Sctax form by allowing users to eSign and manage documents quickly and efficiently. The platform reduces time spent on paperwork and enhances overall productivity, ensuring compliance with state requirements.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans tailored to meet diverse business needs, providing flexibility to users. Our plans include features that facilitate easy document management, such as electronic signatures for the I 312 The South Carolina Department Of Revenue Sctax and other forms, ensuring you get the best value.

-

Are there any features specifically for handling tax forms like the I 312 The South Carolina Department Of Revenue Sctax?

Yes, airSlate SignNow includes features specifically designed to help manage tax forms such as the I 312 The South Carolina Department Of Revenue Sctax. These features include customizable templates and automated workflows that simplify the eSigning process, making filing faster and more accurate.

-

Can I integrate airSlate SignNow with other tools for tax management?

Absolutely! airSlate SignNow offers multiple integrations with accounting and tax management tools to enhance your experience when dealing with forms like the I 312 The South Carolina Department Of Revenue Sctax. These integrations allow for seamless data transfer, reducing manual entry and ensuring data accuracy.

-

What benefits does airSlate SignNow provide for small businesses handling the I 312 The South Carolina Department Of Revenue Sctax?

For small businesses, airSlate SignNow provides a cost-effective solution for managing important documents like the I 312 The South Carolina Department Of Revenue Sctax. Easy-to-use features help streamline the eSigning process, improving efficiency and allowing business owners to focus on growth rather than paperwork.

-

How secure is airSlate SignNow when dealing with sensitive information related to the I 312 The South Carolina Department Of Revenue Sctax?

Security is a top priority for airSlate SignNow. When handling sensitive documents such as the I 312 The South Carolina Department Of Revenue Sctax, our platform implements industry-standard encryption and compliance protocols to ensure that your data is safe and secure throughout the entire process.

Get more for I 312 The South Carolina Department Of Revenue Sctax

- Shawnee county cddo behavior data summary form

- Fax 39n39 go manifest submission form emanifest ecustoms

- Missed punch form template 404803691

- Es0350 form

- Chronic fatigue syndromefibromyalgia symptom bb anapsid form

- Interval recording 420757458 form

- Horse judges score sheet template form

- Polyamorous relationship agreement template form

Find out other I 312 The South Carolina Department Of Revenue Sctax

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself