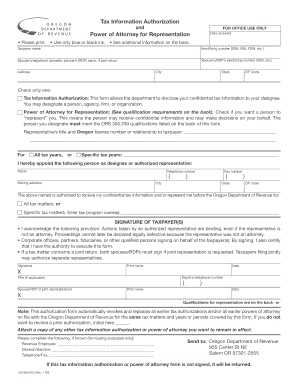

Oregon Department of Revenue Power of Attorney Form

What is the Oregon Department of Revenue Power of Attorney

The Oregon Department of Revenue Power of Attorney is a legal document that allows an individual to appoint another person to act on their behalf in matters related to tax filings and communications with the Oregon Department of Revenue. This form is essential for individuals who may be unable to manage their tax affairs due to various reasons, such as being out of the state or having health issues. The appointed representative can perform actions such as filing tax returns, receiving notices, and making tax payments.

How to use the Oregon Department of Revenue Power of Attorney

To utilize the Oregon Department of Revenue Power of Attorney, the taxpayer needs to complete the form accurately, ensuring all required information is provided. This includes the taxpayer's details, the representative's information, and the specific powers granted. Once completed, the form must be signed by the taxpayer and submitted to the Oregon Department of Revenue. It is advisable to keep a copy of the submitted form for personal records.

Steps to complete the Oregon Department of Revenue Power of Attorney

Completing the Oregon Department of Revenue Power of Attorney involves several key steps:

- Obtain the form from the Oregon Department of Revenue website or office.

- Fill in the taxpayer's name, address, and Social Security number.

- Provide the representative's name, address, and contact information.

- Specify the powers granted to the representative, such as filing returns or discussing tax matters.

- Sign and date the form to validate it.

- Submit the completed form to the Oregon Department of Revenue via mail, fax, or in person.

Key elements of the Oregon Department of Revenue Power of Attorney

Several key elements are essential for the Oregon Department of Revenue Power of Attorney to be effective:

- Taxpayer Information: Accurate details about the taxpayer must be included.

- Representative Information: Clear identification of the person being appointed as the representative.

- Powers Granted: Specific actions the representative is authorized to undertake must be defined.

- Signatures: The taxpayer's signature is required to authenticate the document.

Legal use of the Oregon Department of Revenue Power of Attorney

The Oregon Department of Revenue Power of Attorney is legally binding when executed in compliance with state laws. It must be filled out completely and accurately to ensure that the appointed representative can act on behalf of the taxpayer effectively. The form can be revoked at any time by the taxpayer, provided that the revocation is communicated to the Oregon Department of Revenue in writing.

Form Submission Methods

The completed Oregon Department of Revenue Power of Attorney can be submitted through various methods:

- Mail: Send the form to the appropriate address provided by the Oregon Department of Revenue.

- Fax: Fax the completed form to the designated fax number.

- In-Person: Deliver the form directly to a local Oregon Department of Revenue office.

Quick guide on how to complete oregon department of revenue power of attorney

Manage Oregon Department Of Revenue Power Of Attorney effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Handle Oregon Department Of Revenue Power Of Attorney on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign Oregon Department Of Revenue Power Of Attorney with ease

- Locate Oregon Department Of Revenue Power Of Attorney and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns regarding lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Oregon Department Of Revenue Power Of Attorney to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon department of revenue power of attorney

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon Department of Revenue power of attorney?

The Oregon Department of Revenue power of attorney allows an individual to authorize another person to act on their behalf concerning tax matters. This document ensures that the designated representative can communicate directly with the Oregon Department of Revenue and handle tax-related issues effectively.

-

How can airSlate SignNow help with the Oregon Department of Revenue power of attorney?

airSlate SignNow provides an efficient platform to create, edit, and eSign the Oregon Department of Revenue power of attorney document. By utilizing our easy-to-use interface, you can streamline the process and ensure that the form is correctly filled out and submitted in no time.

-

Is there a cost associated with using airSlate SignNow for the Oregon Department of Revenue power of attorney?

Yes, airSlate SignNow offers competitive pricing plans tailored to meet diverse business needs. Whether you're a small business or a large enterprise, our solutions for managing the Oregon Department of Revenue power of attorney are cost-effective and designed to provide maximum value.

-

What features does airSlate SignNow offer for the Oregon Department of Revenue power of attorney?

airSlate SignNow includes features like customizable templates, secure eSigning, and document tracking specifically for the Oregon Department of Revenue power of attorney. These tools empower users to manage and finalize their documents efficiently while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other applications when managing the Oregon Department of Revenue power of attorney?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as Google Drive, Dropbox, and CRM systems. This capability allows users to easily access and manage their Oregon Department of Revenue power of attorney documents within their preferred workflows.

-

How does airSlate SignNow ensure the security of my Oregon Department of Revenue power of attorney documentation?

At airSlate SignNow, the security of your documents is our top priority. We implement advanced encryption, secure servers, and compliance with legal standards to ensure that your Oregon Department of Revenue power of attorney and other documents remain safe and confidential.

-

What is the process for eSigning the Oregon Department of Revenue power of attorney with airSlate SignNow?

eSigning the Oregon Department of Revenue power of attorney with airSlate SignNow is simple and user-friendly. After preparing your document, you can invite signers via email, and they can eSign from anywhere, ensuring a quick turnaround and reducing the hassle of manual signatures.

Get more for Oregon Department Of Revenue Power Of Attorney

- Duplicate title application pdf goshen county wyoming goshencounty form

- Linear and quadratic regression practice algebra 1 brenneman answers form

- Contractor registration application city of waxahachie form

- Human inheritance review and reinforce answer key form

- Bcfpers org form

- Recruitment agreement template form

- Recruitment fee agreement template form

- Recruitment agency service level agreement template form

Find out other Oregon Department Of Revenue Power Of Attorney

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation