Irs Form 2210 for

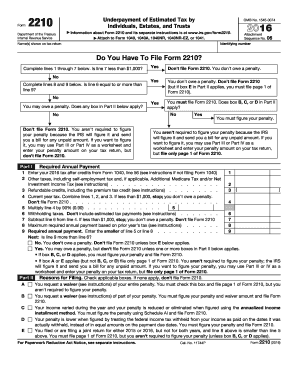

What is the IRS Form 2210?

The IRS Form 2210 is a tax form used by individuals and businesses to calculate any penalties for underpayment of estimated taxes. This form helps taxpayers determine if they owe a penalty for not paying enough tax throughout the year, either through withholding or estimated tax payments. The form is particularly relevant for those whose income fluctuates or who do not have sufficient withholding from their paychecks. Understanding this form is essential for ensuring compliance with tax obligations and avoiding unnecessary penalties.

Steps to Complete the IRS Form 2210

Completing the IRS Form 2210 involves several key steps to ensure accuracy and compliance. Follow these steps for effective completion:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year using the appropriate tax tables or software.

- Determine the amount of tax you have paid through withholding and estimated payments.

- Compare your total tax liability with what you have already paid to identify any shortfall.

- Fill out the form by providing the required information, including your income, payments, and any applicable exceptions.

- Review the completed form for accuracy before submission.

Penalties for Non-Compliance

Failing to comply with the requirements of the IRS Form 2210 can result in penalties. If you underpay your taxes, the IRS may impose a penalty based on the amount owed and the duration of the underpayment. The penalty is typically calculated as a percentage of the unpaid tax, which can accumulate over time. It is essential to file the form correctly and on time to avoid these penalties, which can add significant costs to your tax liability.

IRS Guidelines for Using Form 2210

The IRS provides specific guidelines for using Form 2210, which include instructions on eligibility, filing requirements, and calculations. Taxpayers should refer to the IRS instructions accompanying the form to understand the criteria for avoiding penalties, such as safe harbor provisions. Additionally, the guidelines outline how to report any penalties on your tax return, ensuring that all information is accurately recorded.

How to Obtain the IRS Form 2210

The IRS Form 2210 can be obtained directly from the IRS website, where it is available for download in PDF format. Taxpayers can also request a physical copy by contacting the IRS or visiting local tax offices. It is advisable to ensure you have the most current version of the form, as tax regulations may change from year to year.

Legal Use of the IRS Form 2210

The IRS Form 2210 is legally recognized as a valid document for reporting tax information. To ensure its legal standing, taxpayers must complete the form accurately and submit it according to IRS guidelines. Using a reliable electronic signature platform can facilitate the signing and submission process, enhancing the form's legal validity. Compliance with eSignature laws, such as the ESIGN Act, is crucial for maintaining the document's integrity.

Quick guide on how to complete irs form 2210 for

Effortlessly Prepare Irs Form 2210 For on Any Device

Online document management has gained traction among companies and individuals alike. It serves as a perfect eco-conscious alternative to conventional printed and signed paperwork, allowing you to locate the right template and securely keep it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents swiftly without interruptions. Manage Irs Form 2210 For on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The Easiest Way to Edit and eSign Irs Form 2210 For With Ease

- Find Irs Form 2210 For and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize key parts of the documents or obscure sensitive details with the tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method for sending your form: via email, SMS, or an invitation link, or download it to your computer.

Eliminate issues with lost or misplaced documents, the hassle of searching for forms, or errors that require the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Irs Form 2210 For to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 2210 for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 2210 penalty and why might I incur it?

The form 2210 penalty is imposed by the IRS for underpayment of estimated taxes throughout the year. If you fail to pay the required amount based on your income, you may face a penalty when filing your taxes. Understanding how this penalty works is essential to avoid costly fines.

-

How can airSlate SignNow help in managing the form 2210 penalty?

airSlate SignNow streamlines the process of signing and submitting tax-related documents, including those linked to the form 2210 penalty. By using our platform, businesses can easily eSign and send essential documents, helping ensure timely compliance with IRS requirements and avoiding potential penalties.

-

What features does airSlate SignNow offer to prevent form 2210 penalties?

With airSlate SignNow, you can set up reminders for estimated tax payments to help avoid the form 2210 penalty. Our automated workflows ensure that you stay organized and on track with your tax obligations, minimizing the risk of underpayment and the associated penalties.

-

Are there any pricing plans available for airSlate SignNow that address the form 2210 penalty needs?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. Each plan provides access to features that can help simplify document management and tax compliance processes, ultimately aiding in the avoidance of the form 2210 penalty.

-

Can I integrate airSlate SignNow with my accounting software to manage the form 2210 penalty?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions. This integration allows you to manage your tax documentation regarding the form 2210 penalty efficiently, ensuring that all necessary filings are completed on time.

-

What are the benefits of using airSlate SignNow related to the form 2210 penalty?

Using airSlate SignNow reduces the risk of incurring a form 2210 penalty by simplifying the signing and submission of tax documents. Our platform enhances efficiency and accuracy, enabling you to focus on your core business activities while keeping your tax obligations in check.

-

Is airSlate SignNow compliant with IRS regulations regarding the form 2210 penalty?

Yes, airSlate SignNow is designed with compliance in mind, adhering to IRS regulations. This ensures that all eSigned documents related to the form 2210 penalty are legally binding and accepted by tax authorities, providing peace of mind for our users.

Get more for Irs Form 2210 For

- My voice my choice idaho form

- Weather scavenger hunt form

- X ray and ultrasound outpatient order form lake forest hospital lfh

- Pdffillercom asb form

- Veterinary certificate to eu aphis aphis usda form

- Birth birth application for certified copy of maryland birth record maryland department of health and mental hygiene dhmh form

- Complete a non degree application virginia state university form

- Recharge agreement template form

Find out other Irs Form 2210 For

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney