San Diego Business Tax Form

What is the San Diego Business Tax

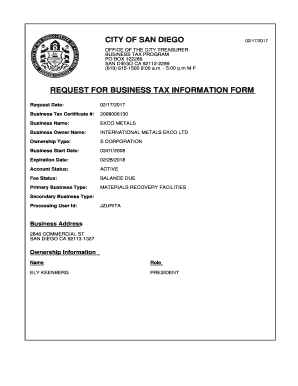

The San Diego business tax is a requirement for businesses operating within the city limits. This tax is imposed on various business activities, including retail, service, and manufacturing operations. The purpose of the tax is to generate revenue for the city, which helps fund essential services and infrastructure. Each business must register and obtain a business tax certificate, which serves as proof of compliance with local regulations.

Steps to complete the San Diego Business Tax

Completing the San Diego business tax involves several steps to ensure compliance and proper registration. First, businesses must determine their tax classification based on the nature of their operations. Next, they should gather necessary documentation, including identification and business formation details. Once prepared, businesses can fill out the application for the business tax certificate, which can be done online or in person. After submission, businesses will receive their tax certificate, which must be renewed annually.

Legal use of the San Diego Business Tax

The San Diego business tax must be used in accordance with local laws and regulations. This includes maintaining accurate records of business activities and ensuring timely tax payments. The business tax certificate must be displayed prominently at the business location. Failure to comply with the legal requirements can result in penalties, including fines or revocation of the business license.

Required Documents

To apply for the San Diego business tax certificate, businesses must provide certain documents. These typically include:

- Proof of identity, such as a driver's license or passport

- Business formation documents, like Articles of Incorporation or a partnership agreement

- Federal Employer Identification Number (EIN) if applicable

- Any relevant permits or licenses required for specific business activities

Form Submission Methods

Businesses can submit their application for the San Diego business tax certificate through various methods. The most convenient option is online submission via the city’s official website. Alternatively, businesses can submit their applications by mail or in person at designated city offices. Each method has its own processing times, so it is essential to choose the one that best fits your needs.

Penalties for Non-Compliance

Failure to comply with the San Diego business tax regulations can lead to significant penalties. Businesses that do not register or pay their taxes on time may face fines, interest on unpaid amounts, and potential legal action. It is crucial for business owners to stay informed about their tax obligations and ensure timely compliance to avoid these consequences.

Quick guide on how to complete san diego business tax

Complete San Diego Business Tax effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage San Diego Business Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign San Diego Business Tax seamlessly

- Find San Diego Business Tax and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or mask sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to deliver your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow attends to your document management needs with just a few clicks from any device you prefer. Modify and eSign San Diego Business Tax and ensure smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the san diego business tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a San Diego business tax certificate?

A San Diego business tax certificate is a document required for operating a business legally in San Diego. This certificate verifies that you have registered your business with the city and have met all local tax obligations. Obtaining it is a crucial step for compliance and can help you avoid any potential fines.

-

How much does a San Diego business tax certificate cost?

The cost of a San Diego business tax certificate varies depending on your business type and size. Generally, the fees range from $50 to several hundred dollars. It's an important investment for your business that ensures compliance with local laws.

-

How do I apply for a San Diego business tax certificate?

To apply for a San Diego business tax certificate, you need to fill out the application form available on the City of San Diego's website. Ensure that you have all necessary documentation ready, including business details and identification. Once submitted, you will receive confirmation and further instructions.

-

What are the benefits of having a San Diego business tax certificate?

Having a San Diego business tax certificate legitimizes your business and can enhance your credibility with customers. It also protects you from legal penalties and allows you to open a business bank account. Furthermore, it is often required for various business licenses and permits.

-

Can I renew my San Diego business tax certificate online?

Yes, you can renew your San Diego business tax certificate online through the City of San Diego's official website. The online renewal process is straightforward, and it typically involves confirming your business information and paying the renewal fee. This makes it convenient to maintain your compliance.

-

Do I need a San Diego business tax certificate for an online business?

Yes, even if your business operates online, you still need a San Diego business tax certificate if you're based in San Diego. Local regulations require all businesses to register regardless of their operational model. This ensures you comply with local tax requirements.

-

How does airSlate SignNow assist with the San Diego business tax certificate process?

airSlate SignNow provides an easy-to-use platform for preparing and signing documents, including applications for a San Diego business tax certificate. Our solution streamlines the document workflow, allowing you to gather necessary signatures and manage submissions efficiently. This can save you time and help ensure accuracy in your application.

Get more for San Diego Business Tax

Find out other San Diego Business Tax

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template