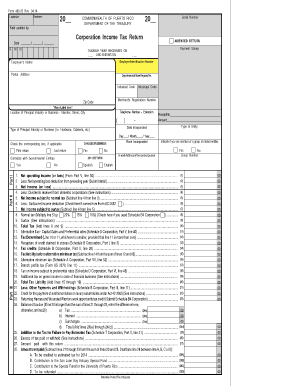

Check the Corresponding Box, If Applicable Hacienda Gobierno Form

What is the Check The Corresponding Box, If Applicable Hacienda Gobierno

The Check The Corresponding Box, If Applicable Hacienda Gobierno form is an official document used in various governmental and administrative processes. It typically requires individuals to indicate specific choices or conditions that apply to their situation. This form is crucial for ensuring that the correct information is provided, which can impact eligibility for certain programs or benefits. Understanding the purpose and requirements of this form is essential for compliance and proper processing.

How to use the Check The Corresponding Box, If Applicable Hacienda Gobierno

Using the Check The Corresponding Box, If Applicable Hacienda Gobierno form involves several straightforward steps. First, gather all necessary information related to your application or request. Next, carefully read the instructions provided with the form to understand what is required. As you fill out the form, make sure to check the corresponding boxes that apply to your situation. This ensures that the reviewing authority can easily identify your specific circumstances, leading to more efficient processing.

Steps to complete the Check The Corresponding Box, If Applicable Hacienda Gobierno

Completing the Check The Corresponding Box, If Applicable Hacienda Gobierno form involves a few key steps:

- Review the form thoroughly to understand all sections and requirements.

- Gather any supporting documents needed to provide accurate information.

- Fill in your personal details as requested, ensuring accuracy.

- Check the boxes that correspond to your situation, making sure to follow any specific instructions.

- Double-check your entries for accuracy before submission.

Legal use of the Check The Corresponding Box, If Applicable Hacienda Gobierno

The legal use of the Check The Corresponding Box, If Applicable Hacienda Gobierno form is governed by specific regulations that ensure its validity. When completed correctly, this form can serve as a legally binding document. It is essential to comply with all applicable laws regarding eSignatures and electronic submissions to maintain its legal standing. Understanding these legal frameworks helps in avoiding potential disputes or issues related to the form's acceptance.

Required Documents

To effectively complete the Check The Corresponding Box, If Applicable Hacienda Gobierno form, certain documents may be required. These can include identification, proof of residency, or any documentation that supports the claims made on the form. Ensuring that you have all necessary documents ready can facilitate a smoother process and reduce the likelihood of delays or rejections.

Form Submission Methods

The Check The Corresponding Box, If Applicable Hacienda Gobierno form can typically be submitted through various methods, including online, by mail, or in person. The method of submission may depend on the specific requirements of the agency or department requesting the form. Online submission is often preferred for its speed and efficiency, while mail or in-person submissions may be necessary in some cases.

Eligibility Criteria

Eligibility criteria for the Check The Corresponding Box, If Applicable Hacienda Gobierno form can vary based on the specific program or benefit associated with the form. Generally, applicants must meet certain conditions related to residency, income level, or other demographic factors. Familiarizing yourself with these criteria before completing the form can help ensure that you qualify for the intended benefits or services.

Quick guide on how to complete check the corresponding box if applicable hacienda gobierno

Complete Check The Corresponding Box, If Applicable Hacienda Gobierno seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can locate the right form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without interruptions. Manage Check The Corresponding Box, If Applicable Hacienda Gobierno on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

The simplest way to adjust and electronically sign Check The Corresponding Box, If Applicable Hacienda Gobierno without hassle

- Obtain Check The Corresponding Box, If Applicable Hacienda Gobierno and click Get Form to begin.

- Make use of the tools available to finalize your document.

- Emphasize signNow portions of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or overlooked files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Check The Corresponding Box, If Applicable Hacienda Gobierno and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the check the corresponding box if applicable hacienda gobierno

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to 'Check The Corresponding Box, If Applicable Hacienda Gobierno'?

The phrase 'Check The Corresponding Box, If Applicable Hacienda Gobierno' typically refers to a requirement in certain forms dealing with governmental documents. By using airSlate SignNow, you can easily include this option in your electronic forms, ensuring that users can comply with all necessary regulations efficiently.

-

How does airSlate SignNow simplify the eSigning process?

airSlate SignNow streamlines the eSigning process by allowing users to send, sign, and manage documents seamlessly. With features like 'Check The Corresponding Box, If Applicable Hacienda Gobierno', you can ensure all legal requirements are met without the hassle of print, sign, and scan.

-

What are the pricing plans available for airSlate SignNow?

airSlate SignNow offers several pricing plans to cater to different business needs, making it cost-effective. Each plan gives you access to essential features, enabling you to manage eSignatures and documents efficiently, including 'Check The Corresponding Box, If Applicable Hacienda Gobierno' when necessary.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with various applications, making it easier to incorporate into your existing workflows. This means you can automate processes that involve 'Check The Corresponding Box, If Applicable Hacienda Gobierno' and enhance your document management system.

-

What features can I expect from airSlate SignNow?

airSlate SignNow comes packed with features like document templates, eSigning, and advanced routing options. Specific features like the ability to 'Check The Corresponding Box, If Applicable Hacienda Gobierno' make it simple to ensure compliance with government regulations.

-

What benefits can businesses gain from using airSlate SignNow?

Businesses can save time and reduce paperwork errors by using airSlate SignNow for electronic signatures. By ensuring compliance with instructions like 'Check The Corresponding Box, If Applicable Hacienda Gobierno', you facilitate smoother interactions with relevant agencies and clients.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive documents. This includes secure encryption and protocols to ensure that actions like 'Check The Corresponding Box, If Applicable Hacienda Gobierno' are carried out without compromising document integrity.

Get more for Check The Corresponding Box, If Applicable Hacienda Gobierno

- Southward village fort myers form

- San joaquin birth certificate form

- New appointment fax form 9 2 10 childrenamp39s mercy hospital childrensmercy

- Dismissal change form dismissal change form fulton county schools school fultonschools

- School counseling referral form fulton county schools school fultonschools

- School registration form template word

- Peer evaluation of form

- Travel waiver sample form

Find out other Check The Corresponding Box, If Applicable Hacienda Gobierno

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple