Actuarial Guideline 35 Form

What is the Actuarial Guideline 35

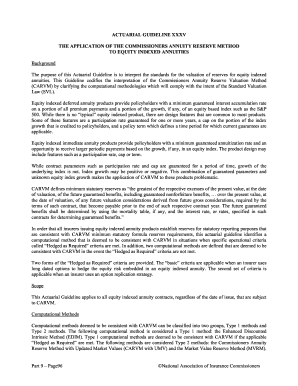

The Actuarial Guideline 35 is a regulatory framework established to provide guidance on the valuation of certain insurance liabilities. It is particularly relevant for life insurance and annuity products, ensuring that actuaries use consistent methods when calculating reserves. This guideline aims to enhance transparency and reliability in financial reporting, thereby protecting policyholders and maintaining market stability.

How to Use the Actuarial Guideline 35

Using the Actuarial Guideline 35 involves understanding its provisions and applying them to the valuation process for insurance products. Actuaries should familiarize themselves with the specific methodologies outlined in the guideline, which include assumptions about mortality, interest rates, and expenses. By adhering to these standards, actuaries can ensure that their calculations meet regulatory expectations and provide accurate representations of the liabilities.

Steps to Complete the Actuarial Guideline 35

Completing the Actuarial Guideline 35 requires a systematic approach. Here are the key steps:

- Review the specific requirements of the guideline.

- Gather necessary data, including policyholder information and financial assumptions.

- Apply the prescribed valuation methods to calculate reserves.

- Document the process and results thoroughly for compliance and audit purposes.

- Submit the completed valuation to the appropriate regulatory body.

Legal Use of the Actuarial Guideline 35

The legal use of the Actuarial Guideline 35 is crucial for compliance with state regulations. Actuaries must ensure that their valuations align with the guideline to avoid potential penalties. Compliance not only protects the actuary but also upholds the integrity of the insurance industry. It is essential to stay informed about any updates or changes to the guideline to maintain legal standing.

Key Elements of the Actuarial Guideline 35

Several key elements define the Actuarial Guideline 35, including:

- Valuation Methods: Specifies the techniques actuaries should use for accurate reserve calculations.

- Assumptions: Outlines the necessary assumptions regarding mortality rates, interest rates, and expenses.

- Documentation: Emphasizes the importance of thorough documentation to support the valuation process.

- Compliance Requirements: Details the legal obligations actuaries must fulfill when applying the guideline.

Examples of Using the Actuarial Guideline 35

Examples of applying the Actuarial Guideline 35 can help illustrate its practical implications. For instance, an actuary may use the guideline to evaluate the reserves for a new life insurance product. By following the prescribed methods and assumptions, the actuary can ensure that the calculated reserves are sufficient to meet future policyholder claims. Another example could involve adjusting existing reserves in response to updated mortality data, demonstrating the guideline's relevance in ongoing financial assessments.

Quick guide on how to complete actuarial guideline 35

Effortlessly Prepare actuarial guideline 35 on Any Device

Managing documents online has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to easily access the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any holdups. Handle actuarial guideline 35 on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Modify and eSign actuarial guideline 35 Effortlessly

- Find actuarial guideline 35 and click Get Form to begin.

- Utilize the resources we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information thoroughly and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that require new copies to be printed. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Edit and eSign actuarial guideline 35 and guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to actuarial guideline 35

Create this form in 5 minutes!

How to create an eSignature for the actuarial guideline 35

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask actuarial guideline 35

-

What is the actuarial guideline 35 and how does it impact my business?

The actuarial guideline 35 (AG 35) outlines critical standards for calculating reserves and capital requirements in insurance, directly impacting how businesses assess risk. Understanding AG 35 enables companies to maintain compliance while ensuring financial stability. Proper adherence can improve your business's credibility and operational efficiencies.

-

How does airSlate SignNow support compliance with actuarial guideline 35?

airSlate SignNow offers secure document management and eSigning solutions that help you maintain compliance with the actuarial guideline 35. By ensuring that all communications and agreements are documented and easily accessible, we streamline the compliance process. Our platform enables better tracking of signed documents, which is vital in adhering to AG 35 regulations.

-

What features of airSlate SignNow can help with actuarial guideline 35 documentation?

Our platform provides various features crucial for documentation related to actuarial guideline 35. You can create, send, and securely store documents, ensuring they are easily retrievable for audits. Additionally, our templates help standardize the documentation process, making it simpler to comply with AG 35.

-

Is airSlate SignNow a cost-effective solution for businesses dealing with actuarial guideline 35?

Yes, airSlate SignNow is a cost-effective solution tailored for businesses needing to comply with actuarial guideline 35. Our pricing plans are designed to accommodate various business sizes, ensuring you only pay for what you need. This affordability allows you to allocate resources efficiently while maintaining compliance.

-

Can airSlate SignNow integrate with other tools to manage actuarial guideline 35 compliance?

Absolutely! airSlate SignNow seamlessly integrates with various business applications that help manage compliance with actuarial guideline 35. By integrating with tools such as CRM and accounting software, you can streamline workflows and ensure all your documentation is in sync with AG 35 requirements.

-

What benefits can my organization expect from using airSlate SignNow in relation to actuarial guideline 35?

Using airSlate SignNow, your organization can enhance its efficiency in managing compliance with actuarial guideline 35. The platform facilitates quicker document processing and reduces the risk of errors, which is crucial for financial data accuracy. Additionally, it provides peace of mind through secure storage and easy access to essential documents.

-

How can I ensure all my documents comply with actuarial guideline 35 using airSlate SignNow?

To ensure compliance with actuarial guideline 35 using airSlate SignNow, utilize our robust template and workflow features. These tools help standardize document formats and processes, making it easier to adhere to AG 35 requirements. Additionally, you can set reminders and workflows that ensure timely review and approval of documents.

Get more for actuarial guideline 35

- The old spaghetti factory application jobs ampamp careers form

- Employee corrective counseling form this form is u

- Ta hiring mou sample teaching artists guild form

- Application hourly osf 3 09 doc bis working papers no 335 form

- Hs football 12 docx pleasval k12 ia form

- Photo permission release for preschool form

- Carbondale community high school schedule change request form

- Blank non compliance report form

Find out other actuarial guideline 35

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form