Form 2848 June

What is the Form 2848 June

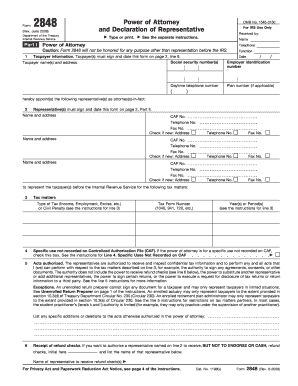

The Form 2848, officially known as the Power of Attorney and Declaration of Representative, is a document used in the United States to authorize an individual to represent a taxpayer before the Internal Revenue Service (IRS). This form is essential for taxpayers who wish to appoint someone, such as an attorney, accountant, or other qualified person, to handle their tax matters. The June version of the form may include specific updates or changes relevant to that time period, ensuring compliance with current IRS regulations.

How to use the Form 2848 June

To effectively use the Form 2848 June, taxpayers need to fill it out accurately, providing necessary information such as the taxpayer's name, address, and Social Security number. The appointed representative's details must also be included. Once completed, the form allows the representative to communicate with the IRS on behalf of the taxpayer, making it easier to resolve tax issues, respond to inquiries, and manage audits. It is important to ensure that the form is signed by both the taxpayer and the representative to validate the authorization.

Steps to complete the Form 2848 June

Completing the Form 2848 June involves several key steps:

- Start by downloading the most recent version of Form 2848 from the IRS website or a trusted source.

- Fill in the taxpayer's information, including name, address, and identification number.

- Provide details about the representative, including their name, address, and credentials.

- Specify the tax matters the representative is authorized to handle, such as income tax or employment tax.

- Sign and date the form to confirm the authorization.

- Ensure the representative also signs the form to acknowledge their acceptance of the role.

Legal use of the Form 2848 June

The Form 2848 June is legally binding when completed correctly and signed by both parties. It complies with IRS regulations, allowing the appointed representative to act on behalf of the taxpayer in various tax-related matters. The form must be submitted to the IRS to grant the representative the authority to discuss and resolve issues regarding the taxpayer's account. It is crucial to keep a copy of the completed form for personal records, as it serves as proof of the authorization granted.

IRS Guidelines

The IRS provides specific guidelines for the use of Form 2848. Taxpayers should ensure that the form is filled out completely and accurately to avoid delays in processing. The IRS may reject incomplete or incorrectly filled forms, which can hinder the representative's ability to act on behalf of the taxpayer. It is advisable to regularly check the IRS website for any updates to the form or changes in the submission process, ensuring compliance with current regulations.

Form Submission Methods (Online / Mail / In-Person)

The completed Form 2848 June can be submitted to the IRS through various methods. Taxpayers may choose to send it by mail, ensuring it reaches the appropriate IRS office based on the type of tax matter involved. Alternatively, some taxpayers may have the option to submit the form electronically, depending on their specific circumstances. In-person submission is also possible, although it may require scheduling an appointment at a local IRS office. Each submission method has its own processing time, so it is important to consider the urgency of the request when deciding how to submit the form.

Quick guide on how to complete form 2848 june

Handle Form 2848 June seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly with no delays. Manage Form 2848 June on any device using the airSlate SignNow Android or iOS applications and simplify any document-based procedure today.

Steps to modify and eSign Form 2848 June effortlessly

- Find Form 2848 June and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select relevant sections of your documents or redact sensitive information using tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from the device of your choice. Modify and eSign Form 2848 June and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2848 june

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2848 June and how does it work with airSlate SignNow?

Form 2848 June is a power of attorney form that allows you to authorize someone to represent you before the IRS. With airSlate SignNow, you can easily fill out and eSign Form 2848 June, ensuring a fast and legally binding process without the need for printing and mailing.

-

Is there a cost associated with using airSlate SignNow for Form 2848 June?

Yes, airSlate SignNow offers various pricing plans to suit your needs. Depending on your usage, you can choose a plan that allows you to eSign documents like Form 2848 June efficiently, at a cost-effective rate that saves both time and resources.

-

What features does airSlate SignNow provide for managing Form 2848 June?

airSlate SignNow provides features such as document templates, real-time tracking, and automated notifications for Form 2848 June. This ensures that you can manage your forms effortlessly, receive reminders for signatures, and keep all parties informed throughout the eSigning process.

-

Can I integrate airSlate SignNow with other applications for Form 2848 June?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications such as Google Drive, Salesforce, and more. This allows you to manage Form 2848 June alongside your other essential business tools, enhancing workflow efficiency.

-

How secure is it to use airSlate SignNow for Form 2848 June?

Your data's security is a top priority for airSlate SignNow. All documents, including Form 2848 June, are encrypted with industry-standard protocols, ensuring that your sensitive information is protected during transmission and storage.

-

What are the benefits of using airSlate SignNow for Form 2848 June over traditional methods?

Using airSlate SignNow for Form 2848 June offers signNow benefits, including saving time and reducing paper usage. The digital process allows for instant sending and receiving of signed documents, while traditional methods can be slow and cumbersome, requiring printing and mailing.

-

Is it easy to use airSlate SignNow for filling out Form 2848 June?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it simple to fill out and eSign Form 2848 June. With our intuitive interface, you can quickly navigate through the form and add your signature without any technical skills.

Get more for Form 2848 June

Find out other Form 2848 June

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online