FDIC 453110, Substitute Form W 9, Request for Taxpayer Print W9

What is the FDIC 453110, Substitute Form W-9, Request For Taxpayer Identification?

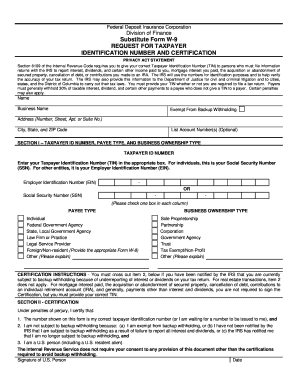

The FDIC 453110, Substitute Form W-9, Request For Taxpayer Identification is a crucial document used in the United States for tax purposes. This form is typically requested by financial institutions, businesses, or other entities that need to collect taxpayer identification information from individuals or entities. It serves to provide the necessary details to report income paid to the taxpayer to the Internal Revenue Service (IRS). The information collected includes the taxpayer's name, address, and Social Security Number (SSN) or Employer Identification Number (EIN).

Steps to Complete the FDIC 453110, Substitute Form W-9

Completing the FDIC 453110, Substitute Form W-9 involves several straightforward steps:

- Begin by entering your name as it appears on your tax return.

- Provide your business name if it differs from your personal name.

- Fill in your address, ensuring it matches the address on your tax documents.

- Indicate your taxpayer identification number, either your SSN or EIN.

- Sign and date the form to certify that the information provided is accurate.

It is essential to ensure that all information is correct to avoid any issues with the IRS.

Legal Use of the FDIC 453110, Substitute Form W-9

The FDIC 453110, Substitute Form W-9 is legally binding when completed and signed correctly. The form must be filled out accurately to comply with IRS regulations. It is important to note that providing false information on this form can lead to penalties, including fines and legal repercussions. The form is often required for tax reporting purposes, making its accurate completion vital for both the taxpayer and the requesting entity.

How to Obtain the FDIC 453110, Substitute Form W-9

The FDIC 453110, Substitute Form W-9 can be obtained through various channels. Typically, it is provided by the entity requesting the information, such as a bank or business. Additionally, the form can be accessed online through the IRS website or other financial institution websites. It is advisable to ensure that you are using the most current version of the form to comply with IRS requirements.

Key Elements of the FDIC 453110, Substitute Form W-9

Several key elements are essential to the FDIC 453110, Substitute Form W-9:

- Taxpayer Information: Name, business name (if applicable), and address.

- Tax Identification Number: Either SSN or EIN, which is crucial for accurate tax reporting.

- Certification: A signature and date affirming the accuracy of the information provided.

Each of these elements plays a vital role in ensuring that the form meets IRS standards and facilitates proper tax reporting.

Examples of Using the FDIC 453110, Substitute Form W-9

The FDIC 453110, Substitute Form W-9 is commonly used in various scenarios:

- A freelancer providing services to a company may be asked to submit this form to ensure proper tax reporting.

- Individuals opening a bank account may need to complete the form as part of the account setup process.

- Businesses hiring independent contractors often require this form to report payments made to the contractors.

These examples illustrate the form's significance in facilitating accurate tax reporting and compliance.

Quick guide on how to complete fdic 453110 substitute form w 9 request for taxpayer print w9

Prepare FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9 effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your papers swiftly and without any hindrances. Manage FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9 with ease

- Locate FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9 and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate the printing of new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Alter and eSign FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fdic 453110 substitute form w 9 request for taxpayer print w9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9?

The FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9 is a crucial form used by businesses to request taxpayer identification information from vendors or contractors. This form helps ensure accurate tax reporting and compliance with the IRS regulations. By utilizing airSlate SignNow, you can easily generate and eSign this essential document swiftly and securely.

-

How can airSlate SignNow help with filling out the FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9?

airSlate SignNow streamlines the process of completing the FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9 by providing an intuitive interface and user-friendly templates. Users can quickly fill in necessary details and eSign the form, enabling faster processing and reducing the chances of errors. This efficiency is particularly beneficial for businesses handling multiple vendors.

-

Is there a cost associated with using airSlate SignNow for the FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Depending on the features you require, costs may vary, but its cost-effective solutions ensure that businesses of all sizes can access the tools necessary for managing the FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9 effectively. Visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing the FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9?

airSlate SignNow features include customizable templates, cloud storage, collaboration tools, and secure eSigning options, all designed to simplify the management of the FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9. These features not only enhance productivity but also ensure compliance and security during document exchanges. This makes it an optimal choice for businesses seeking efficiency.

-

Can I integrate airSlate SignNow with my existing systems for the FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9?

Absolutely! airSlate SignNow offers integrations with various platforms, including CRM systems, project management tools, and accounting software. This connectivity allows you to streamline workflows when managing the FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9, enabling a seamless experience between different applications and enhancing overall operational efficiency.

-

What are the benefits of using airSlate SignNow for the FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9?

Using airSlate SignNow for the FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9 provides numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. The electronic signing process saves time and ensures documents are processed quickly and securely. Ultimately, it helps businesses maintain accurate records and enhances their overall productivity.

-

Is airSlate SignNow secure for handling FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9?

Yes, airSlate SignNow prioritizes security and uses advanced encryption protocols to protect sensitive information transmitted through the FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9. The platform is compliant with industry regulations, ensuring that your documents are handled with the utmost care and confidentiality. Feel confident using our service for your document management needs.

Get more for FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9

Find out other FDIC 453110, Substitute Form W 9, Request For Taxpayer Print W9

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast