Deductible Verification Form Discovery Benefits

What is the Deductible Verification Form Discovery Benefits

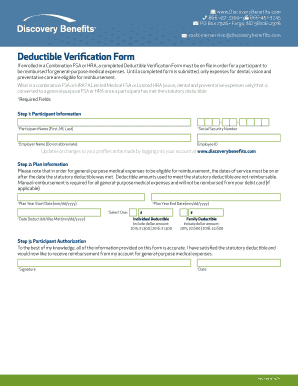

The Deductible Verification Form Discovery Benefits is a crucial document used to confirm the eligibility of certain medical expenses under a health plan. This form helps individuals and organizations verify deductible amounts and ensure that they are accurately reported for insurance claims. It serves as a formal request for information regarding the deductible status, which is essential for both the insured and the insurance provider.

How to Use the Deductible Verification Form Discovery Benefits

Using the Deductible Verification Form Discovery Benefits involves several straightforward steps. First, gather all necessary personal and insurance information, including policy numbers and details about the medical services received. Next, fill out the form accurately, ensuring that all required fields are completed. Once the form is filled out, it can be submitted electronically or via mail, depending on the requirements of the insurance provider. Always keep a copy for your records to track the submission and any follow-up actions.

Steps to Complete the Deductible Verification Form Discovery Benefits

Completing the Deductible Verification Form Discovery Benefits requires careful attention to detail. Follow these steps for accurate completion:

- Begin by entering your personal information, including your name, address, and contact details.

- Provide your insurance policy number and the name of your insurance provider.

- List the medical services for which you are verifying the deductible.

- Attach any necessary documentation, such as invoices or previous claim statements.

- Review the form for accuracy before submission to avoid delays.

Legal Use of the Deductible Verification Form Discovery Benefits

The Deductible Verification Form Discovery Benefits is legally binding when completed and submitted according to the applicable regulations. It is essential to ensure compliance with federal and state laws regarding health insurance documentation. Using a reliable platform for digital signatures can enhance the legal standing of the form, as it provides a digital certificate and maintains compliance with eSignature laws such as ESIGN and UETA.

Key Elements of the Deductible Verification Form Discovery Benefits

Key elements of the Deductible Verification Form Discovery Benefits include:

- Personal Information: The form requires the insured's full name, address, and contact information.

- Insurance Details: This includes the policy number and the name of the insurance provider.

- Medical Services: A detailed list of services for which the deductible is being verified.

- Supporting Documentation: Any relevant documents that substantiate the claim, such as bills or previous correspondence with the insurance company.

Form Submission Methods

The Deductible Verification Form Discovery Benefits can be submitted through various methods, ensuring flexibility for users. Common submission methods include:

- Online Submission: Many insurance providers allow for electronic submission through their websites or secure portals.

- Mail: The form can be printed and sent via postal service to the appropriate insurance department.

- In-Person: Some individuals may prefer to deliver the form directly to their insurance agent or office.

Quick guide on how to complete deductible verification form discovery benefits

Prepare Deductible Verification Form Discovery Benefits effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Deductible Verification Form Discovery Benefits on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Deductible Verification Form Discovery Benefits without stress

- Obtain Deductible Verification Form Discovery Benefits and then click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to record your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Deductible Verification Form Discovery Benefits to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the deductible verification form discovery benefits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Deductible Verification Form Discovery Benefits?

The Deductible Verification Form Discovery Benefits is a document that helps users verify and manage their health deductibles effectively. This form plays a pivotal role in ensuring that customers receive accurate information regarding their healthcare expenses. Using airSlate SignNow, you can quickly eSign this document and streamline the verification process.

-

How does airSlate SignNow enhance the Deductible Verification Form Discovery Benefits process?

With airSlate SignNow, the process of handling the Deductible Verification Form Discovery Benefits is simplified through an easy-to-use interface. Users can eSign documents from anywhere, allowing for faster approval and processing times. This ensures that verifying deductibles becomes hassle-free and efficient.

-

What are the pricing options for using airSlate SignNow for the Deductible Verification Form Discovery Benefits?

airSlate SignNow offers flexible pricing plans designed to accommodate various business needs for processing the Deductible Verification Form Discovery Benefits. Users can choose from individual, business, or enterprise plans, ensuring that they find a package that suits their budget and scale. Each plan is cost-effective, maximizing your return on investment.

-

Is it possible to integrate airSlate SignNow with other tools when managing the Deductible Verification Form Discovery Benefits?

Yes, airSlate SignNow supports seamless integrations with a wide variety of tools and platforms, enhancing the management of the Deductible Verification Form Discovery Benefits. This means you can connect it with your CRM, ERP, or any other software you may be using, promoting a more cohesive operational workflow.

-

What features does airSlate SignNow offer for the Deductible Verification Form Discovery Benefits?

airSlate SignNow provides multiple features for handling the Deductible Verification Form Discovery Benefits, including eSignature capabilities, customizable templates, and advanced security measures. These features help ensure that your documents are signed securely and efficiently, reducing turnaround times for critical documents.

-

How can airSlate SignNow improve the customer experience related to the Deductible Verification Form Discovery Benefits?

By using airSlate SignNow for the Deductible Verification Form Discovery Benefits, customers can expect a streamlined and user-friendly experience. The platform allows for quick document signing and reduced paperwork, minimising delays and enhancing overall customer satisfaction. Improved efficiency translates to better service delivery in healthcare.

-

What kind of support does airSlate SignNow provide for issues related to the Deductible Verification Form Discovery Benefits?

airSlate SignNow offers robust customer support for users managing the Deductible Verification Form Discovery Benefits. The support team is available to help with any questions or concerns, providing assistance through various channels. Whether it's technical issues or usage tips, you can count on our experts to help you effectively.

Get more for Deductible Verification Form Discovery Benefits

Find out other Deductible Verification Form Discovery Benefits

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document