Alcohol Tax Return City of Elgin Form

What is the Alcohol Tax Return City Of Elgin

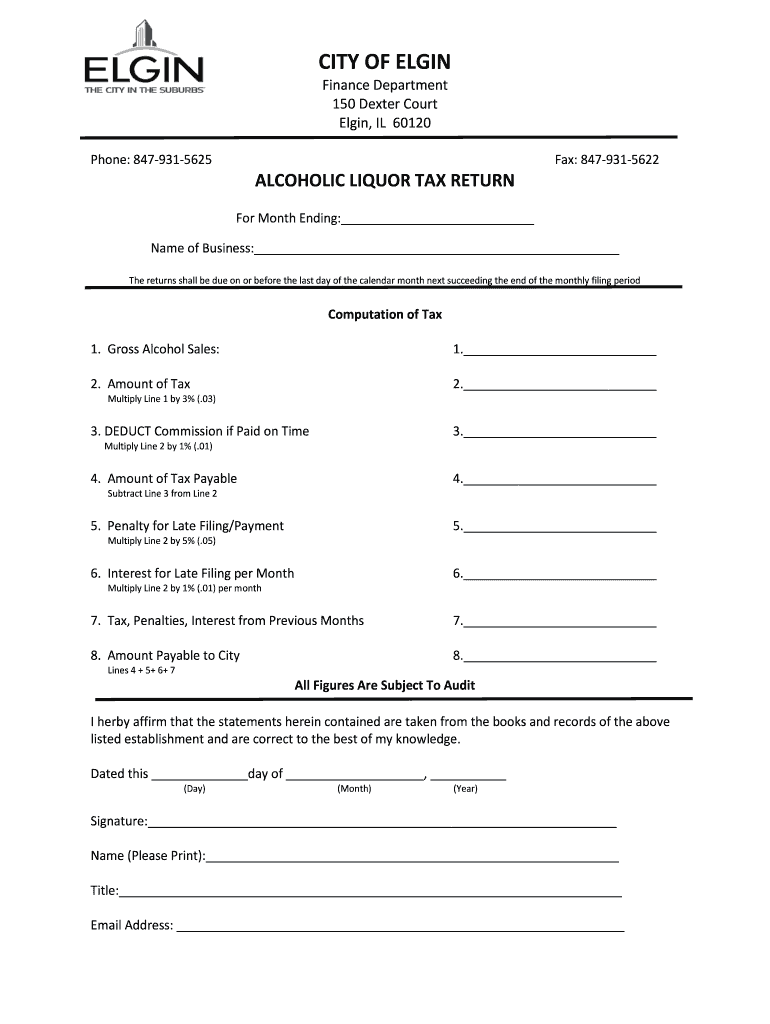

The Alcohol Tax Return City of Elgin is a specific form required for businesses that sell alcoholic beverages within the city. This form is essential for reporting the sales and taxes associated with alcohol sales, ensuring compliance with local tax regulations. It is designed to collect information on the quantity and type of alcohol sold, as well as the corresponding taxes owed to the city. Proper completion of this form is crucial for maintaining good standing with local authorities and avoiding potential penalties.

Steps to complete the Alcohol Tax Return City Of Elgin

Completing the Alcohol Tax Return City of Elgin involves several key steps to ensure accuracy and compliance. First, gather all necessary sales data, including total sales of alcoholic beverages for the reporting period. Next, calculate the total tax owed based on the applicable tax rates for different types of alcohol. Afterward, fill out the form with the required information, ensuring that all figures are accurate and reflect your records. Finally, review the completed form for any errors before submitting it to the appropriate city department.

Legal use of the Alcohol Tax Return City Of Elgin

The Alcohol Tax Return City of Elgin serves as a legally binding document when filed correctly. It is essential to adhere to local laws and regulations regarding alcohol sales and taxation. The information provided in the return must be truthful and accurate, as any discrepancies can lead to legal consequences, including fines or other penalties. Businesses must keep copies of their returns and supporting documentation for record-keeping and potential audits.

Form Submission Methods

The Alcohol Tax Return City of Elgin can be submitted through various methods to accommodate different business needs. Businesses may choose to file the form online, which offers a convenient and efficient way to ensure timely submission. Alternatively, the form can be mailed to the appropriate city department, or submitted in person at designated locations. Each method has its own guidelines and deadlines, so it is important to select the one that best fits your operational workflow.

Required Documents

To successfully complete the Alcohol Tax Return City of Elgin, certain documents are required. These typically include sales records for the reporting period, previous tax returns, and any relevant licenses or permits related to alcohol sales. Having these documents on hand will facilitate accurate reporting and help ensure compliance with local regulations. It is advisable to maintain organized records to streamline the preparation of future tax returns.

Filing Deadlines / Important Dates

Filing deadlines for the Alcohol Tax Return City of Elgin are crucial for businesses to adhere to in order to avoid penalties. Typically, returns are due on a quarterly basis, with specific dates set by the city. It is important for businesses to keep track of these dates and plan accordingly to ensure timely submissions. Missing a deadline can result in late fees or other penalties, impacting the overall financial health of the business.

Quick guide on how to complete alcohol tax return city of elgin

Prepare Alcohol Tax Return City Of Elgin effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Alcohol Tax Return City Of Elgin on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign Alcohol Tax Return City Of Elgin without difficulty

- Find Alcohol Tax Return City Of Elgin and click Get Form to initiate.

- Use the tools we offer to complete your document.

- Select pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you would like to share your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Alcohol Tax Return City Of Elgin and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

Create this form in 5 minutes!

How to create an eSignature for the alcohol tax return city of elgin

How to generate an electronic signature for the Alcohol Tax Return City Of Elgin online

How to generate an electronic signature for the Alcohol Tax Return City Of Elgin in Google Chrome

How to generate an electronic signature for signing the Alcohol Tax Return City Of Elgin in Gmail

How to generate an electronic signature for the Alcohol Tax Return City Of Elgin straight from your mobile device

How to make an electronic signature for the Alcohol Tax Return City Of Elgin on iOS

How to generate an eSignature for the Alcohol Tax Return City Of Elgin on Android

People also ask

-

What is the Alcohol Tax Return City Of Elgin process?

The Alcohol Tax Return City Of Elgin process involves submitting specific tax forms to the local government to comply with regulations related to alcohol sales. It's essential for businesses involved in alcohol distribution to stay informed about deadlines and requirements to avoid penalties.

-

How can airSlate SignNow help with my Alcohol Tax Return City Of Elgin?

airSlate SignNow offers an efficient platform for creating, signing, and submitting your Alcohol Tax Return City Of Elgin documents. Our user-friendly interface simplifies the process, ensuring that you can complete your tax returns quickly and accurately, saving you valuable time.

-

What are the costs associated with filing an Alcohol Tax Return City Of Elgin using airSlate SignNow?

Using airSlate SignNow for your Alcohol Tax Return City Of Elgin is cost-effective, with competitive pricing plans tailored to meet the needs of various businesses. You can choose a plan that fits your budget while benefiting from unlimited document signing and storage.

-

Are there any features specific to Alcohol Tax Return City Of Elgin in airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed to streamline the Alcohol Tax Return City Of Elgin process, such as customizable templates and automated reminders for filing deadlines. These tools help ensure accuracy and compliance with local regulations.

-

Can I integrate airSlate SignNow with other tools for my Alcohol Tax Return City Of Elgin?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and financial software, allowing you to manage your Alcohol Tax Return City Of Elgin efficiently. This integration ensures that your tax data is consistent across platforms, reducing the risk of errors.

-

Is airSlate SignNow secure for submitting my Alcohol Tax Return City Of Elgin?

Yes, airSlate SignNow prioritizes security with end-to-end encryption and compliance with data protection regulations. You can confidently submit your Alcohol Tax Return City Of Elgin knowing that your sensitive information is protected.

-

What support does airSlate SignNow provide for Alcohol Tax Return City Of Elgin users?

airSlate SignNow offers comprehensive support for users navigating the Alcohol Tax Return City Of Elgin. Our dedicated customer service team is available to assist you with any questions or issues you may encounter while using our platform.

Get more for Alcohol Tax Return City Of Elgin

Find out other Alcohol Tax Return City Of Elgin

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document