Maine Use Tax Form

What is the Maine Use Tax Form

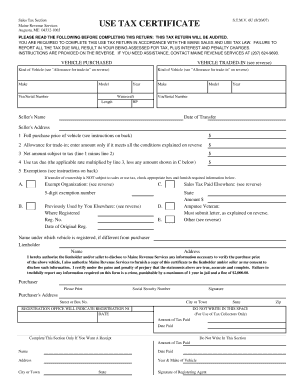

The Maine Use Tax Form is a document used by residents and businesses in Maine to report and pay use tax on purchases made outside of the state that are used, stored, or consumed within Maine. This tax applies to items purchased without paying Maine sales tax, ensuring that all consumers contribute fairly to state revenue. The form is essential for compliance with state tax laws and helps maintain a level playing field for local businesses.

Steps to Complete the Maine Use Tax Form

Completing the Maine Use Tax Form involves several straightforward steps:

- Gather necessary information: Collect details about your purchases, including dates, amounts, and descriptions of the items.

- Access the form: Obtain the Maine Use Tax Form, which can be downloaded from the state’s tax website or filled out online.

- Fill out the form: Enter your personal information, including your name, address, and any applicable business identification numbers.

- Report purchases: List all taxable items, including the purchase price and the date of purchase.

- Calculate the tax owed: Apply the appropriate use tax rate to the total amount of taxable purchases.

- Review and submit: Double-check all entries for accuracy before submitting the form online or via mail.

Legal Use of the Maine Use Tax Form

The Maine Use Tax Form is legally binding when completed and submitted according to state regulations. To ensure its validity, it must be signed and dated by the taxpayer. Compliance with eSignature laws is crucial for digital submissions, as it guarantees that the form is recognized by the state as an official document. Using a reliable eSignature solution can enhance the legal standing of your submission.

Form Submission Methods

The Maine Use Tax Form can be submitted through various methods to accommodate different preferences:

- Online: Fill out and submit the form electronically via the state’s tax portal, ensuring a quicker processing time.

- By mail: Print the completed form and send it to the appropriate state tax office address.

- In-person: Deliver the form directly to a local tax office if personal assistance is needed.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Maine Use Tax Form to avoid penalties. Typically, the form is due on the same date as your state income tax return. For most taxpayers, this means it must be filed by April fifteenth each year. However, if you are a business, different deadlines may apply based on your reporting period. Always check the Maine Revenue Services website for the most current deadlines.

Penalties for Non-Compliance

Failing to file the Maine Use Tax Form or underreporting your tax liability can result in penalties. The state may impose fines, interest on unpaid taxes, and potential legal action. To avoid these consequences, it is advisable to file accurately and on time. If you believe you may have made an error in previous filings, consider consulting a tax professional for guidance on how to correct it.

Quick guide on how to complete maine use tax form

Effortlessly Prepare Maine Use Tax Form on Any Device

Digital document management has gained traction among organizations and individuals alike. It presents an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without holdups. Manage Maine Use Tax Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Modify and Electronically Sign Maine Use Tax Form with Ease

- Locate Maine Use Tax Form and then select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight signNow sections of the documents or obscure sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your updates.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Maine Use Tax Form and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maine use tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of maine sales tax when using airSlate SignNow?

Maine sales tax is important for businesses using airSlate SignNow to ensure compliance with local tax regulations when handling transactions electronically. Our platform helps you manage and document transactions effectively, allowing you to easily track sales tax compliance for your records. By integrating sales tax management, you can streamline your eSigning process.

-

How does airSlate SignNow handle maine sales tax in transactions?

airSlate SignNow allows businesses to include maine sales tax directly within the documents you send for eSigning. This feature ensures that recipients clearly see the total amount due, including applicable sales tax, making it easier to finalize transactions. Proper handling of maine sales tax helps maintain transparency and trust with your clients.

-

Is there an additional cost for handling maine sales tax in airSlate SignNow?

There are no additional fees specifically for handling maine sales tax when using airSlate SignNow. Our pricing model is designed to be cost-effective, allowing businesses access to full eSigning features, including tax management at no extra charge. This means you can focus on closing deals without worrying about hidden costs.

-

Can I customize sales tax options for maine sales tax in airSlate SignNow?

Yes, you can easily customize sales tax settings in airSlate SignNow to reflect the correct maine sales tax rates applicable to your business. This flexibility allows you to adjust tax amounts based on the specific nature of the transaction and ensure compliance. Personalization ensures your documents meet local tax requirements efficiently.

-

Does airSlate SignNow integrate with other accounting software for maine sales tax?

airSlate SignNow seamlessly integrates with popular accounting software, making it easier to manage maine sales tax. This integration allows you to automatically sync your eSigned documents with your accounting system, ensuring that sales tax calculations and records are consistently updated. Streamlining this process saves you valuable time and reduces errors.

-

What benefits does airSlate SignNow provide for managing maine sales tax?

Using airSlate SignNow simplifies the management of maine sales tax by providing clear documentation and automatic calculations within your eSign workflows. This reduces the risk of errors while ensuring compliance with state tax laws. The service streamlines the document signing process so you can focus on growing your business rather than tax complexities.

-

How can airSlate SignNow help my business stay compliant with maine sales tax?

airSlate SignNow helps your business maintain compliance with maine sales tax by providing tools to generate accurate tax documents and records. The platform allows you to monitor transactions for tax validity, reducing the chances of audit issues. By using our service, you can systematically address tax requirements with minimal manual effort.

Get more for Maine Use Tax Form

- Dental claim form dencover dental insurance

- Msha printable card form

- Direct behavior rating forms

- Emergency contact form save the children savethechildren

- Lefs follow up and discharge visit body mechanix physical therapy form

- Gao 12 554 housing assistance gao form

- The risks of preferred stock portfolios form

- International data transfer agreement template form

Find out other Maine Use Tax Form

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free