Et 4310 2014

What is the ET 4310?

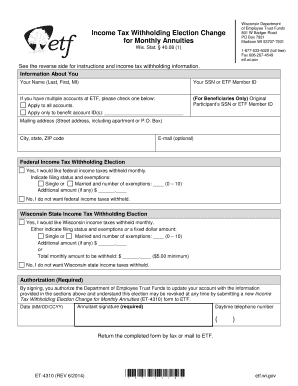

The ET 4310 is a tax form used in Wisconsin, specifically designed for individuals who are seeking to claim benefits from the Wisconsin Retirement System (WRS). This form is essential for those who have participated in the WRS and wish to report their retirement account information accurately. It serves as a formal declaration of the individual's retirement benefits and is crucial for tax reporting purposes.

How to Use the ET 4310

Using the ET 4310 involves several key steps to ensure accurate completion. First, gather all necessary documentation related to your retirement benefits, including any previous tax forms and personal identification details. Next, fill out the form with accurate information regarding your retirement account, including contributions and any distributions received. After completing the form, review it for accuracy before submission to avoid delays in processing.

Steps to Complete the ET 4310

Completing the ET 4310 requires careful attention to detail. Follow these steps:

- Gather all relevant documents, such as previous tax returns and WRS statements.

- Fill in your personal information, including your name, address, and Social Security number.

- Detail your retirement account contributions and distributions accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the appropriate state agency.

Legal Use of the ET 4310

The ET 4310 is legally binding when completed correctly and submitted to the appropriate authorities. It complies with the regulations set forth by the Internal Revenue Service (IRS) and the Wisconsin Department of Revenue. Ensuring that the form is filled out accurately and submitted on time is crucial to avoid any legal complications or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the ET 4310 are critical for compliance. Typically, the form must be submitted by the annual tax deadline, which is April 15 for most individuals. However, it is advisable to check for any specific dates or extensions that may apply to your situation. Staying informed about these deadlines helps prevent unnecessary penalties and ensures timely processing of your tax return.

Required Documents

To complete the ET 4310, you will need several important documents, including:

- Your Social Security number.

- Documentation of your retirement contributions.

- Any previous tax forms related to your retirement account.

- Identification information, such as a driver's license or state ID.

Form Submission Methods

The ET 4310 can be submitted through various methods to accommodate different preferences. You may choose to file the form online through the Wisconsin Department of Revenue's website, mail it directly to the relevant office, or submit it in person. Each method has its own processing times and requirements, so select the one that best suits your needs.

Quick guide on how to complete et 4310 79342932

Prepare Et 4310 effortlessly on any device

Online document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly and without delays. Handle Et 4310 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign Et 4310 effortlessly

- Locate Et 4310 and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your method of delivering the form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require re-printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Et 4310 and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct et 4310 79342932

Create this form in 5 minutes!

How to create an eSignature for the et 4310 79342932

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the et 4310 and how does it work?

The et 4310 is an electronic tool that allows businesses to efficiently manage the signing and sending of documents. With airSlate SignNow, you can easily upload, send, and sign documents online, ensuring a smooth workflow that saves time and resources.

-

How much does airSlate SignNow charge for using et 4310?

Pricing for airSlate SignNow, incorporating the et 4310 features, starts at a competitive rate that varies depending on the plan you select. Each plan offers different functionalities to suit various business needs, and you can choose the one that best fits your budget and requirements.

-

What features are included with et 4310?

The et 4310 comes packed with essential features such as document templates, in-app signing, and easy integration with other platforms. These features streamline your document management process, allowing for faster and more efficient business operations.

-

Can I integrate et 4310 with other tools we use?

Yes, airSlate SignNow supports integrations with various applications, making it simple to incorporate the et 4310 into your existing workflow. By connecting with tools like CRM systems, project management software, and cloud storage services, you can enhance the functionality of your document processes.

-

What are the benefits of using et 4310 for my business?

Using the et 4310 provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for your documents. Additionally, the user-friendly interface of airSlate SignNow makes it easy for team members to adapt quickly and start utilizing the system effectively.

-

Is the et 4310 secure for handling sensitive documents?

Absolutely! The et 4310 prioritizes security, employing industry-standard encryption and compliance measures to protect your sensitive data. With airSlate SignNow, you can rest assured that your documents are handled with the utmost security and confidentiality.

-

What support options are available for users of et 4310?

AirSlate SignNow provides excellent customer support for et 4310 users, including detailed documentation, webinars, and a responsive support team. Whether you have questions about setup or need assistance with specific features, you can count on assistance whenever you need it.

Get more for Et 4310

Find out other Et 4310

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF