Tax Taxes 2023

Understanding the 2021 IRS Notice

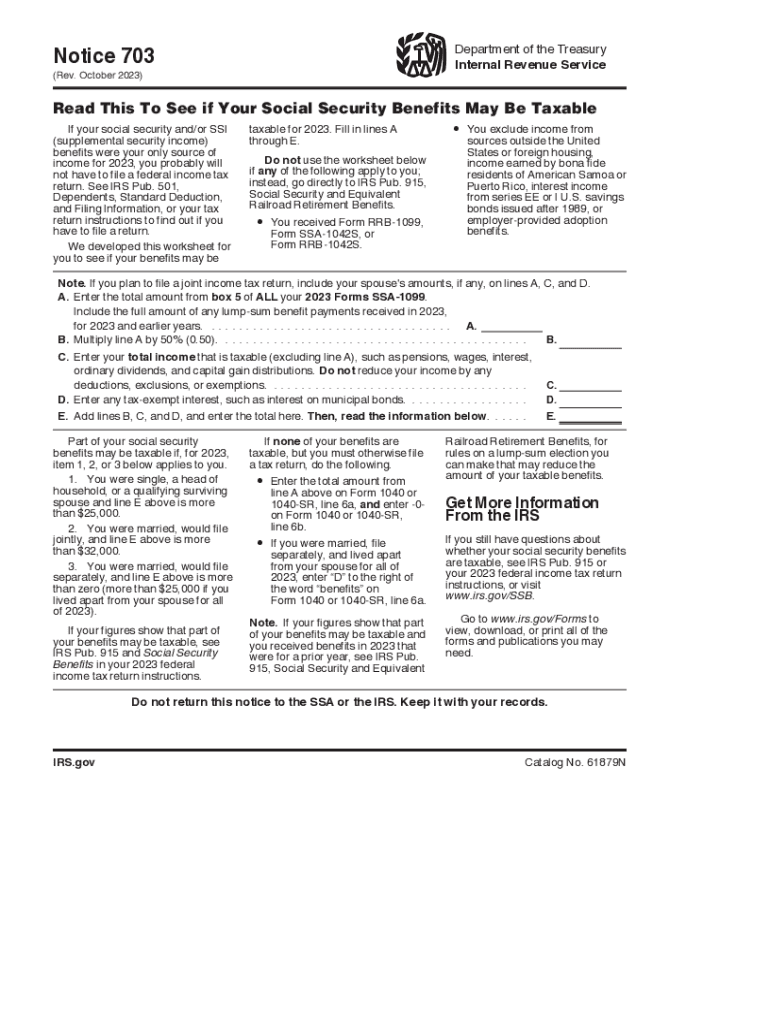

The 2021 IRS notice serves as an official communication from the Internal Revenue Service regarding various tax-related issues. It can include important information about tax liabilities, changes in tax law, or requests for additional documentation. Understanding the content of this notice is crucial for taxpayers to ensure compliance and avoid potential penalties.

Key Elements of the 2021 IRS Notice

Each IRS notice typically contains several key elements, including:

- Taxpayer Identification: Your name, address, and taxpayer identification number.

- Notice Date: The date the notice was issued, which is important for tracking deadlines.

- Tax Year: The specific tax year the notice pertains to.

- Reason for the Notice: A clear explanation of why the notice was sent, such as discrepancies in reported income or missing forms.

- Response Instructions: Detailed steps on how to respond or rectify any issues raised in the notice.

Steps to Respond to the 2021 IRS Notice

Responding to an IRS notice involves several steps to ensure you address the issue appropriately:

- Review the Notice: Carefully read the notice to understand what is required.

- Gather Documentation: Collect any necessary documents that support your case or clarify the issue.

- Prepare Your Response: Follow the instructions provided in the notice to draft your response.

- Submit Your Response: Send your response to the address specified in the notice, ensuring it is postmarked by any deadlines indicated.

IRS Guidelines for Notices

The IRS provides guidelines on how to handle notices, emphasizing the importance of timely responses. Taxpayers should be aware that failing to respond can lead to further action, including penalties or additional assessments. The IRS website offers resources and FAQs that can help clarify any confusion regarding notices.

Filing Deadlines and Important Dates

Each IRS notice will specify important dates that taxpayers must adhere to. These can include deadlines for responding to the notice or dates for submitting additional documentation. Keeping track of these dates is essential to avoid penalties and ensure compliance with IRS regulations.

Required Documents for Compliance

When responding to a 2021 IRS notice, specific documents may be required. Commonly requested items include:

- Tax returns for the relevant year.

- W-2 forms or 1099s that report income.

- Any additional documentation that supports your claims or clarifies discrepancies.

Penalties for Non-Compliance

Failure to respond to an IRS notice in a timely manner can result in penalties, including interest on unpaid taxes and additional fees. Understanding the potential consequences of non-compliance is crucial for taxpayers to maintain good standing with the IRS and avoid financial repercussions.

Quick guide on how to complete tax taxes

Complete Tax Taxes effortlessly on any device

Digital document management has become a common practice for businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents swiftly and without delay. Manage Tax Taxes on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to alter and eSign Tax Taxes with minimal effort

- Obtain Tax Taxes and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that function by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional hand-signed signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Tax Taxes to ensure excellent communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax taxes

Create this form in 5 minutes!

How to create an eSignature for the tax taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's pricing structure for the 703 plan?

The 703 plan offers competitive pricing tailored to fit various business needs. With a focus on affordability, airSlate SignNow ensures that organizations can access essential eSigning features without exceeding their budget. You can choose between monthly or annual billing for greater savings.

-

What key features are included in the 703 plan?

The 703 plan includes fundamental features such as unlimited eSignatures, custom branding options, and advanced document management tools. These features are designed to enhance your eSigning experience, making it seamless and efficient for businesses of all sizes. Additionally, users can benefit from real-time tracking and notifications for document statuses.

-

How does airSlate SignNow improve document workflows for users of the 703 plan?

Users of the 703 plan can streamline their document workflows by utilizing airSlate SignNow's automation tools, which help eliminate bottlenecks. The platform allows you to create templates for frequently used documents, making it easier to manage multiple files. This ultimately enhances productivity and reduces processing time.

-

Are there any integrations available with the 703 plan?

Yes, the 703 plan offers seamless integrations with popular applications like Google Workspace, Microsoft Office, and Salesforce. These integrations allow you to work within your preferred platforms while enjoying the benefits of airSlate SignNow's eSigning capabilities. This flexibility helps enhance collaboration and improves operational efficiency.

-

What benefits can businesses expect from using the 703 plan?

With the 703 plan, businesses can expect to increase efficiency, reduce paper usage, and ensure compliance with industry standards. The ease of use and speed of airSlate SignNow empowers teams to close deals faster and enhance customer satisfaction. It's a strategic investment for any organization looking to modernize their document management processes.

-

Can I try the 703 plan before committing?

Yes, airSlate SignNow offers a free trial for the 703 plan, allowing potential users to explore its features and functionalities. This hands-on experience helps you understand how the platform meets your eSigning needs before making a financial commitment. Sign up today to see how it can benefit your business.

-

Is customer support available for users of the 703 plan?

Absolutely! airSlate SignNow provides dedicated customer support for users of the 703 plan through various channels, including email, chat, and phone. The support team is equipped to assist with any questions or issues that might arise, ensuring you have a smooth eSigning experience.

Get more for Tax Taxes

Find out other Tax Taxes

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation