Form 941 Employers Quarterly Federal Tax Return Clover

What is the Form 941 Employers Quarterly Federal Tax Return Clover

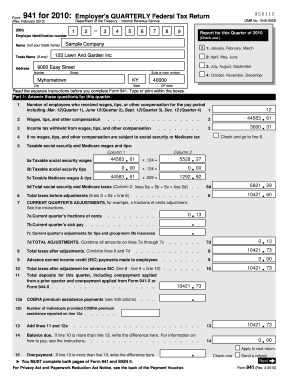

The Form 941 Employers Quarterly Federal Tax Return Clover is a crucial document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for ensuring compliance with federal tax regulations and helps the IRS track tax liabilities for businesses. Employers must file this form quarterly, detailing the total wages paid, the taxes withheld, and any adjustments from previous filings. Understanding this form is vital for maintaining accurate tax records and avoiding penalties.

Steps to complete the Form 941 Employers Quarterly Federal Tax Return Clover

Completing the Form 941 Employers Quarterly Federal Tax Return Clover involves several key steps:

- Gather necessary information: Collect details about your business, including the Employer Identification Number (EIN), total wages paid, and taxes withheld.

- Fill out the form: Enter the required information in the appropriate sections, ensuring accuracy to avoid discrepancies.

- Calculate total taxes: Determine the total amount of federal income tax withheld, Social Security tax, and Medicare tax for the quarter.

- Review and verify: Double-check all entries for accuracy and completeness before submission.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

How to use the Form 941 Employers Quarterly Federal Tax Return Clover

The Form 941 Employers Quarterly Federal Tax Return Clover serves multiple purposes for employers. It is primarily used to report the amount of federal income tax withheld from employees’ paychecks, along with Social Security and Medicare taxes. Employers must use this form to reconcile the amounts withheld during the quarter with the amounts reported on their payroll records. Proper use of this form helps ensure compliance with federal tax laws and contributes to accurate tax reporting for both employers and employees.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the Form 941 Employers Quarterly Federal Tax Return Clover. The due dates for each quarter are:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

It is essential for employers to file the form on time to avoid potential penalties and interest on unpaid taxes.

Legal use of the Form 941 Employers Quarterly Federal Tax Return Clover

The legal use of the Form 941 Employers Quarterly Federal Tax Return Clover is governed by federal tax laws. This form must be completed accurately and filed on time to maintain compliance with the Internal Revenue Service (IRS) regulations. Employers are legally obligated to report all wages paid and taxes withheld, and failure to do so can result in penalties. Additionally, using electronic signatures through a compliant platform can enhance the legal standing of the submitted form, ensuring it meets all necessary legal requirements.

Key elements of the Form 941 Employers Quarterly Federal Tax Return Clover

Several key elements are essential when completing the Form 941 Employers Quarterly Federal Tax Return Clover:

- Employer Identification Number (EIN): This unique number identifies your business for tax purposes.

- Wages paid: Total wages paid to employees during the quarter.

- Taxes withheld: Amount of federal income tax, Social Security tax, and Medicare tax withheld from employee wages.

- Adjustments: Any adjustments for overreported or underreported taxes from previous quarters.

- Signature: The form must be signed by an authorized person to validate the information provided.

Quick guide on how to complete form 941 employers quarterly federal tax return clover

Handle Form 941 Employers Quarterly Federal Tax Return Clover effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly and without complications. Manage Form 941 Employers Quarterly Federal Tax Return Clover on any device with the airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

How to modify and electronically sign Form 941 Employers Quarterly Federal Tax Return Clover with ease

- Find Form 941 Employers Quarterly Federal Tax Return Clover and click on Access Form to initiate the process.

- Take advantage of the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact confidential information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Finish button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or shared link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Form 941 Employers Quarterly Federal Tax Return Clover and ensure excellent communication throughout the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 941 employers quarterly federal tax return clover

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 941 Employers Quarterly Federal Tax Return Clover?

The Form 941 Employers Quarterly Federal Tax Return Clover is a tax form used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. This form is essential for businesses to maintain compliance with federal tax requirements and to avoid penalties.

-

How can airSlate SignNow help with the Form 941 Employers Quarterly Federal Tax Return Clover?

airSlate SignNow simplifies the process of preparing and submitting the Form 941 Employers Quarterly Federal Tax Return Clover by providing intuitive eSignature solutions. With our platform, you can easily send, eSign, and store your tax forms securely, ensuring that your submissions are timely and accurate.

-

What features does airSlate SignNow offer for handling Form 941 Employers Quarterly Federal Tax Return Clover?

airSlate SignNow offers a range of features for handling the Form 941 Employers Quarterly Federal Tax Return Clover, including customizable templates, automated workflows, and real-time tracking of document status. These features enhance efficiency and help ensure that all necessary signatures and approvals are obtained promptly.

-

Is airSlate SignNow cost-effective for businesses needing to file Form 941 Employers Quarterly Federal Tax Return Clover?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to file the Form 941 Employers Quarterly Federal Tax Return Clover. Our flexible pricing plans cater to businesses of all sizes, ensuring that you have access to essential tools without breaking the bank.

-

Can airSlate SignNow integrate with other software to manage Form 941 Employers Quarterly Federal Tax Return Clover?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and HR software, making it easier to manage the Form 941 Employers Quarterly Federal Tax Return Clover. These integrations streamline workflows and enhance data accuracy by eliminating the need for manual data entry.

-

What are the benefits of using airSlate SignNow for the Form 941 Employers Quarterly Federal Tax Return Clover?

Using airSlate SignNow for the Form 941 Employers Quarterly Federal Tax Return Clover offers numerous benefits, including time savings, improved accuracy, and enhanced collaboration among team members. Our platform ensures that your documents are secure and compliant, allowing you to focus on running your business.

-

How secure is airSlate SignNow when filing the Form 941 Employers Quarterly Federal Tax Return Clover?

airSlate SignNow prioritizes security by employing advanced encryption protocols and secure cloud storage for all your documents, including the Form 941 Employers Quarterly Federal Tax Return Clover. Our commitment to data protection ensures that your sensitive information remains safe and confidential.

Get more for Form 941 Employers Quarterly Federal Tax Return Clover

- Miladys stolen card form

- Printable optumrx refill forms

- Nhjb 2775 dfps new hampshire judicial branch form

- Pasco county schools volunteer application form

- Sodexo appli online form

- Workers compensation refusal form docx

- Fillable form 20p ont reg no 25898 affidavit for

- Pd 49 applications made by requisition courts gov bc form

Find out other Form 941 Employers Quarterly Federal Tax Return Clover

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement