New Mexico Cit 1 Form

What is the New Mexico CIT 1?

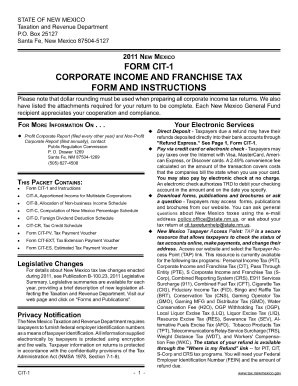

The New Mexico CIT 1 form is a crucial document used for corporate income tax purposes in the state of New Mexico. This form is primarily utilized by corporations to report their income, calculate tax liabilities, and ensure compliance with state tax regulations. It serves as a means for the state to assess the financial activities of businesses operating within its jurisdiction.

How to use the New Mexico CIT 1

Using the New Mexico CIT 1 form involves several steps to ensure accurate reporting of income and tax obligations. Corporations must first gather all necessary financial information, including gross receipts, deductions, and credits. Once the data is compiled, it can be entered into the form, following the guidelines provided by the New Mexico Taxation and Revenue Department. After completing the form, it should be reviewed for accuracy before submission.

Steps to complete the New Mexico CIT 1

Completing the New Mexico CIT 1 form requires careful attention to detail. Here are the key steps:

- Gather financial records, including income statements and expense reports.

- Fill out the form with accurate figures, ensuring all sections are completed.

- Calculate the total tax liability based on the reported income.

- Review the form for any errors or omissions.

- Submit the completed form by the specified deadline.

Legal use of the New Mexico CIT 1

The New Mexico CIT 1 form is legally binding and must be filed in accordance with state law. Corporations are required to submit this form annually to report their income and pay any taxes owed. Failure to file the form or inaccuracies in reporting can result in penalties, interest, or other legal consequences.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the New Mexico CIT 1 form. Typically, the form is due on the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. It is essential to be aware of these deadlines to avoid late fees and penalties.

Who Issues the Form

The New Mexico CIT 1 form is issued by the New Mexico Taxation and Revenue Department. This agency is responsible for administering tax laws and ensuring compliance among businesses operating within the state. Corporations can obtain the form directly from the department's website or through authorized tax professionals.

Quick guide on how to complete new mexico cit 1

Complete New Mexico Cit 1 effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle New Mexico Cit 1 on any platform using the airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to edit and eSign New Mexico Cit 1 with ease

- Find New Mexico Cit 1 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize applicable sections of the documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign New Mexico Cit 1 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new mexico cit 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is new mexico cit 1 and how does it relate to airSlate SignNow?

New mexico cit 1 refers to our tailored offerings for businesses in New Mexico that utilize airSlate SignNow. This solution allows users to seamlessly send and eSign documents, ensuring compliance with local regulations. By leveraging new mexico cit 1, businesses can streamline their document workflows efficiently.

-

How much does the new mexico cit 1 package cost?

The pricing for the new mexico cit 1 package varies depending on the specific features and number of users required. Generally, airSlate SignNow offers competitive rates designed to provide value for your investment. For detailed pricing tailored to your needs, we recommend visiting our pricing page or contacting our sales team directly.

-

What features can I expect with new mexico cit 1?

With new mexico cit 1, you can expect features such as customizable templates, real-time tracking, and secure cloud storage for your documents. Additionally, this package includes advanced eSignature capabilities that comply with local or federal regulations in New Mexico. These features are designed to enhance your document management experience.

-

What are the benefits of using new mexico cit 1?

The primary benefits of using new mexico cit 1 include increased efficiency in document processing and improved compliance with legal requirements in New Mexico. Users also benefit from enhanced security and the convenience of accessing documents from anywhere. Overall, this package helps businesses save time and reduce errors in their workflows.

-

Can new mexico cit 1 integrate with other software tools?

Yes, new mexico cit 1 is designed to integrate seamlessly with various software tools, including CRM systems, cloud storage solutions, and productivity apps. This flexibility allows businesses in New Mexico to enhance their workflows by connecting airSlate SignNow with the tools they already use. Check our integration page for a full list of supported applications.

-

Is customer support available for new mexico cit 1 users?

Absolutely! Customers using new mexico cit 1 have access to dedicated customer support to assist with any questions or issues. Our support team is equipped to help with everything from setup to troubleshooting to ensure a smooth experience with airSlate SignNow. Support is available via chat, email, and phone.

-

How can I get started with new mexico cit 1?

Getting started with new mexico cit 1 is easy! Simply visit our website to sign up for a free trial or contact our sales team for more information. Once registered, you'll have access to explore all the features and benefits of airSlate SignNow tailored to New Mexico businesses.

Get more for New Mexico Cit 1

Find out other New Mexico Cit 1

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract