Form it 196 PDF

What is the Form It 196 Pdf

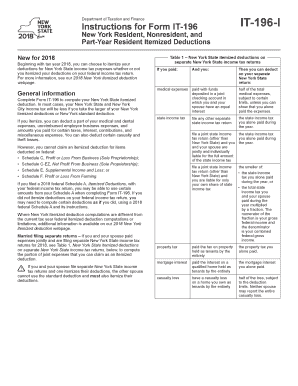

The Form It 196 is a tax document used by individuals and businesses in the United States to report certain types of income. This form is essential for ensuring compliance with state tax regulations. The Form It 196 pdf is specifically designed to facilitate the electronic submission of information, making it easier for taxpayers to fulfill their obligations. It captures various income sources and deductions, allowing for accurate tax calculations.

How to use the Form It 196 Pdf

Using the Form It 196 pdf involves several straightforward steps. First, download the form from a reliable source. Next, fill in the required fields, ensuring that all information is accurate and complete. After completing the form, you can submit it electronically through approved channels or print it for mailing. It is crucial to follow the specific instructions provided with the form to avoid any errors that could lead to penalties.

Steps to complete the Form It 196 Pdf

Completing the Form It 196 pdf requires careful attention to detail. Here are the steps to follow:

- Download the Form It 196 pdf from a trusted source.

- Open the form using a compatible PDF reader.

- Enter your personal information, including name, address, and Social Security number.

- Provide details about your income sources and any applicable deductions.

- Review the completed form for accuracy.

- Save the document and submit it electronically or print it for mailing.

Legal use of the Form It 196 Pdf

The legal use of the Form It 196 pdf is governed by specific regulations that ensure its validity. For the form to be considered legally binding, it must be filled out accurately and submitted in accordance with state tax laws. Additionally, electronic submissions must comply with the ESIGN Act, which establishes the legality of electronic signatures and documents in the United States.

Filing Deadlines / Important Dates

Filing deadlines for the Form It 196 vary depending on the tax year and the specific circumstances of the taxpayer. Generally, forms must be filed by the tax deadline, which is typically April 15 for individual taxpayers. It is essential to be aware of any changes to deadlines that may arise due to state regulations or federal extensions.

Required Documents

When completing the Form It 196 pdf, certain documents are necessary to support the information provided. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Any prior year tax returns for reference

Gathering these documents beforehand can streamline the process of completing the form and ensure accuracy.

Quick guide on how to complete form it 196 pdf

Complete Form It 196 Pdf effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary forms and securely keep them online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without delays. Handle Form It 196 Pdf on any device using the airSlate SignNow Android or iOS apps and simplify any document-related process today.

How to edit and eSign Form It 196 Pdf with ease

- Obtain Form It 196 Pdf and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced paperwork, tedious form hunting, or errors that necessitate reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form It 196 Pdf and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 196 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form it 196 2021, and how does it work?

The form it 196 2021 is a crucial document for various business operations. It simplifies the process of eSigning and managing forms electronically, reducing paperwork and streamlining workflows. With airSlate SignNow, you can easily fill out and eSign the form it 196 2021, making it accessible from anywhere at any time.

-

How can I integrate form it 196 2021 into my existing workflows?

Integrating form it 196 2021 into your workflows is seamless with airSlate SignNow. The platform allows you to upload the form and set up automated workflows that include eSigning and document management. Additionally, you can connect with various applications, ensuring that the form it 196 2021 fits within your existing systems.

-

What are the pricing options for using airSlate SignNow for form it 196 2021?

airSlate SignNow offers competitive pricing plans suitable for different business sizes and needs. Each plan includes features for handling the form it 196 2021, such as eSigning capabilities and document storage. You can choose a monthly or annual subscription based on your budget and usage requirements.

-

What features does airSlate SignNow offer for managing form it 196 2021?

AirSlate SignNow provides several features for managing the form it 196 2021, including custom templates, real-time tracking, and secure cloud storage. Users can also collaborate with others by sharing the document for feedback or additional signatures. These features enhance efficiency and ensure compliance.

-

Is airSlate SignNow secure for handling form it 196 2021?

Yes, airSlate SignNow offers a high level of security for handling the form it 196 2021. The platform uses industry-standard encryption to protect your documents and data. Furthermore, it complies with major security regulations to provide peace of mind when using electronic signatures.

-

Can I customize the form it 196 2021 to suit my business needs?

Absolutely! AirSlate SignNow allows you to customize the form it 196 2021 according to your specific business requirements. You can add fields, change layouts, and incorporate branding elements to ensure the form aligns with your company's identity.

-

What are the benefits of using airSlate SignNow for form it 196 2021?

The benefits of using airSlate SignNow for the form it 196 2021 include increased efficiency, reduced paperwork, and faster turnaround times. The platform streamlines the signing process, which can lead to enhanced productivity and better customer satisfaction. Transitioning to an electronic format also minimizes the risk of lost documents.

Get more for Form It 196 Pdf

Find out other Form It 196 Pdf

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free