Indemnity Bond for Lost Instrument Formhow to Fill Out 2016-2026

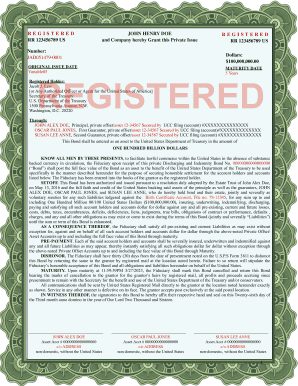

Understanding the Registered Private Offset

The registered private offset serves as a legal instrument that protects individuals and businesses from financial loss related to lost instruments, such as checks or bonds. This form is essential for those who need to assert their rights when an instrument is misplaced or stolen. By completing this form, you can secure a promise from the issuer to reimburse you for any losses incurred due to the lost instrument.

Steps to Complete the Registered Private Offset

Filling out the registered private offset involves several key steps:

- Gather necessary information, including the details of the lost instrument, such as its number, date of issue, and amount.

- Provide your personal information, including your name, address, and contact details.

- Clearly state the circumstances of the loss, ensuring to include any relevant details that may support your claim.

- Review the form for accuracy before signing and dating it to affirm your intent.

Legal Use of the Registered Private Offset

The registered private offset is legally binding and must be used in accordance with state and federal regulations. It is crucial to ensure that the information provided is truthful and accurate, as any discrepancies may lead to legal repercussions. This form protects your rights and ensures that you can recover losses associated with the lost instrument.

Required Documents for the Registered Private Offset

To complete the registered private offset, you will typically need the following documents:

- A copy of the lost instrument, if available.

- Identification documents, such as a driver’s license or passport.

- Any correspondence related to the lost instrument, including previous claims or notifications to the issuer.

Who Issues the Registered Private Offset

The registered private offset is issued by financial institutions or entities that originally provided the lost instrument. This can include banks, credit unions, or other financial organizations. It is essential to contact the issuer directly to ensure proper processing of your claim.

Examples of Using the Registered Private Offset

Common scenarios for utilizing the registered private offset include:

- When a check issued for payment is lost in the mail.

- If a bond certificate is misplaced or stolen.

- In cases where a payment needs to be stopped due to fraud or theft.

Eligibility Criteria for the Registered Private Offset

To be eligible for the registered private offset, individuals must demonstrate ownership of the lost instrument and provide proof of identity. Additionally, the loss must be reported within a specified timeframe set by the issuing entity. It is advisable to review the specific requirements of the issuer to ensure compliance.

Quick guide on how to complete discharging indemnity secured funding bond form

The simplest method to locate and sign Indemnity Bond For Lost Instrument Formhow To Fill Out

Across the entirety of your organization, ineffective procedures regarding document approval can consume a signNow amount of productive time. Executing documents such as Indemnity Bond For Lost Instrument Formhow To Fill Out is a typical part of operations in every sector, which is why the effectiveness of each contract’s lifecycle has a considerable impact on the organization’s overall performance. With airSlate SignNow, executing your Indemnity Bond For Lost Instrument Formhow To Fill Out is as straightforward and quick as possible. This platform provides you with the latest version of nearly any document. Even better, you can sign it instantly without needing to install external software on your computer or print anything out as physical copies.

Steps to obtain and sign your Indemnity Bond For Lost Instrument Formhow To Fill Out

- Browse our collection by category or utilize the search bar to locate the document you require.

- Review the document preview by clicking on Learn more to confirm it’s the correct one.

- Select Get form to start editing right away.

- Fill out your document and incorporate any required information using the toolbar.

- Once finished, click the Sign tool to sign your Indemnity Bond For Lost Instrument Formhow To Fill Out.

- Select the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to complete editing and move on to document-sharing choices if necessary.

With airSlate SignNow, you possess everything needed to manage your documents efficiently. You can locate, fill out, edit, and even send your Indemnity Bond For Lost Instrument Formhow To Fill Out in a single tab with no difficulty. Optimize your operations by using one, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

Create this form in 5 minutes!

How to create an eSignature for the discharging indemnity secured funding bond form

How to make an electronic signature for your Discharging Indemnity Secured Funding Bond Form in the online mode

How to generate an electronic signature for your Discharging Indemnity Secured Funding Bond Form in Google Chrome

How to create an electronic signature for signing the Discharging Indemnity Secured Funding Bond Form in Gmail

How to generate an eSignature for the Discharging Indemnity Secured Funding Bond Form from your smart phone

How to generate an electronic signature for the Discharging Indemnity Secured Funding Bond Form on iOS devices

How to generate an eSignature for the Discharging Indemnity Secured Funding Bond Form on Android

People also ask

-

What is a discharging and indemnity bond?

A discharging and indemnity bond is a legal agreement that ensures a party is protected from future claims regarding a particular obligation or contract. With this bond, the issuer legally agrees to discharge their responsibility and indemnify others against potential losses. This bond is commonly used in various industries to bolster confidence in business transactions.

-

How does airSlate SignNow facilitate the execution of a discharging and indemnity bond?

airSlate SignNow streamlines the process of creating and signing a discharging and indemnity bond by providing a user-friendly digital platform. Our eSignature solutions allow businesses to prepare, send, and sign these documents electronically, ensuring quick and secure execution. You can also track document status in real-time, making the entire process efficient and transparent.

-

What are the pricing options for using airSlate SignNow for discharging and indemnity bonds?

airSlate SignNow offers cost-effective pricing plans tailored to business needs, including options for signing discharging and indemnity bonds. Our transparent pricing includes various tiers, ensuring you only pay for the features you need. You can start with a free trial to explore our services before committing to a paid plan.

-

What features does airSlate SignNow offer for discharging and indemnity bonds?

airSlate SignNow includes features such as customizable templates, document tracking, and audit trails that enhance the creation and management of discharging and indemnity bonds. The platform supports multiple file formats and integrates seamlessly with other applications. This ensures that businesses have all the tools necessary to handle their legal agreements efficiently.

-

How can a discharging and indemnity bond benefit my business?

Utilizing a discharging and indemnity bond can protect your business from potential liability and future claims, providing peace of mind. It also enhances trust with clients and partners, demonstrating a commitment to fulfilling obligations safely. This security makes it easier to navigate contract agreements and business dealings confidently.

-

Can I integrate airSlate SignNow with other software tools for managing discharging and indemnity bonds?

Yes, airSlate SignNow offers integration capabilities with popular software tools such as CRM systems, project management apps, and cloud storage services. This means you can streamline your workflow for managing discharging and indemnity bonds while keeping all your documents organized. These integrations enhance efficiency and enable better collaboration among teams.

-

Is it secure to sign a discharging and indemnity bond using airSlate SignNow?

Absolutely! airSlate SignNow utilizes state-of-the-art security measures, including encryption and secure servers, to protect your documents. When signing a discharging and indemnity bond through our platform, you can trust that your information is safeguarded against unauthorized access. Compliance with industry standards ensures your documents remain confidential and legally binding.

Get more for Indemnity Bond For Lost Instrument Formhow To Fill Out

Find out other Indemnity Bond For Lost Instrument Formhow To Fill Out

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form