Louisiana Department of Revenue Form Cift 620

What is the Louisiana Department of Revenue Form Cift 620

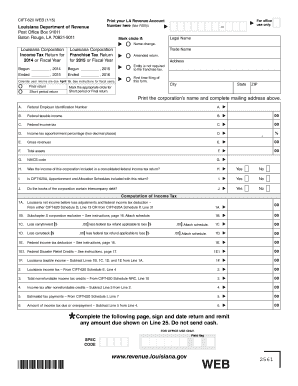

The Louisiana Department of Revenue Form Cift 620 is a tax form specifically designed for corporations and partnerships operating within the state. This form is used to report income, deductions, and credits for various tax purposes. It is essential for ensuring compliance with Louisiana tax laws and regulations, helping businesses accurately calculate their tax liabilities. Understanding the purpose and requirements of Form Cift 620 is crucial for any entity subject to Louisiana taxation.

Steps to Complete the Louisiana Department of Revenue Form Cift 620

Completing the Louisiana Form Cift 620 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, expense reports, and prior tax returns. Next, carefully fill out the form, ensuring that all sections are completed accurately. Pay special attention to the calculation of taxable income, deductions, and credits to avoid errors. Once the form is filled out, review it thoroughly for any mistakes before submitting it to the Louisiana Department of Revenue.

How to Obtain the Louisiana Department of Revenue Form Cift 620

The Louisiana Department of Revenue Form Cift 620 can be obtained directly from the Louisiana Department of Revenue's official website. The form is available in a fillable PDF format, allowing users to complete it digitally. Additionally, physical copies of the form may be requested from local tax offices or downloaded from various tax resource websites. Ensuring you have the latest version of the form is important, as tax laws and regulations may change.

Legal Use of the Louisiana Department of Revenue Form Cift 620

The legal use of Form Cift 620 is governed by Louisiana tax laws, which stipulate that all corporations and partnerships must report their financial activities accurately. The form must be signed and dated by an authorized representative of the business to be considered valid. Compliance with the legal requirements surrounding this form is essential, as failure to do so can result in penalties or audits by the Louisiana Department of Revenue.

Key Elements of the Louisiana Department of Revenue Form Cift 620

Form Cift 620 includes several key elements that are crucial for accurate reporting. These elements typically consist of sections for reporting gross income, allowable deductions, and tax credits. Additionally, the form requires detailed information about the business entity, including its legal structure, address, and federal identification number. Understanding these components is vital for ensuring that the form is completed correctly and submitted on time.

Form Submission Methods for the Louisiana Department of Revenue Form Cift 620

Submitting the Louisiana Form Cift 620 can be done through various methods. Businesses have the option to file the form online through the Louisiana Department of Revenue's e-filing system, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. It is important to choose a submission method that aligns with the business's operational capabilities and compliance requirements.

Quick guide on how to complete louisiana department of revenue form cift 620

Complete Louisiana Department Of Revenue Form Cift 620 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without any delays. Manage Louisiana Department Of Revenue Form Cift 620 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The simplest way to modify and electronically sign Louisiana Department Of Revenue Form Cift 620 without stress

- Obtain Louisiana Department Of Revenue Form Cift 620 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure confidential information with tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether via email, SMS, invitation link, or download it to your PC.

Put aside concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from a device of your choosing. Edit and electronically sign Louisiana Department Of Revenue Form Cift 620 and ensure efficient communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the louisiana department of revenue form cift 620

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Louisiana Department of Revenue Form CIFT 620?

The Louisiana Department of Revenue Form CIFT 620 is a corporate income and franchise tax return form that businesses use to report their income and calculate their tax liability. It is essential for compliance with state tax regulations and ensuring that your business meets its financial obligations.

-

How can airSlate SignNow help with filing the Louisiana Department of Revenue Form CIFT 620?

AirSlate SignNow streamlines the process of filling out and signing the Louisiana Department of Revenue Form CIFT 620 by providing an easy-to-use digital platform. This allows you to fill in the form, eSign it, and submit it electronically, simplifying your tax filing process.

-

What are the key features of airSlate SignNow for handling tax forms like the Louisiana Department of Revenue Form CIFT 620?

AirSlate SignNow offers features such as customizable templates, secure eSigning, and easy document sharing, all of which are beneficial when managing tax forms like the Louisiana Department of Revenue Form CIFT 620. These tools help ensure accuracy and compliance while saving time.

-

Is there a cost associated with using airSlate SignNow for the Louisiana Department of Revenue Form CIFT 620?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. These plans range from basic eSigning functionalities to comprehensive document management solutions, all designed to simplify your workflow when dealing with the Louisiana Department of Revenue Form CIFT 620.

-

Can I integrate airSlate SignNow with other applications for ease of use with the Louisiana Department of Revenue Form CIFT 620?

Absolutely! AirSlate SignNow is designed to integrate seamlessly with various applications such as Google Drive, Dropbox, and CRMs, enhancing the efficiency of managing documents, including the Louisiana Department of Revenue Form CIFT 620. This allows for a smoother workflow across different platforms.

-

What are the benefits of using airSlate SignNow for the Louisiana Department of Revenue Form CIFT 620?

Using airSlate SignNow for the Louisiana Department of Revenue Form CIFT 620 provides numerous benefits, including increased accuracy, streamlined document signing, and reduced turnaround time. This cost-effective solution allows businesses to focus on core operations rather than getting bogged down in administrative tasks.

-

Is airSlate SignNow compliant with Louisiana tax laws for the Louisiana Department of Revenue Form CIFT 620?

Yes, airSlate SignNow ensures compliance with Louisiana tax laws, making it an ideal choice for businesses preparing the Louisiana Department of Revenue Form CIFT 620. The platform remains updated with legal requirements, helping you stay compliant and avoid potential penalties.

Get more for Louisiana Department Of Revenue Form Cift 620

- Verification of program completion form

- Child care fire drill report scchildcare form

- Form sf3102

- Inventory form for drug and medical supplies

- Formulario para solicitud de usuarios del sepp

- Sec 2 2 probability independent and dependent probabilities form

- Georgia scholarship program form

- Exemption application instructionsread carefully decal ga form

Find out other Louisiana Department Of Revenue Form Cift 620

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement