Bir Printed Receipt Form

What is the BIR Printed Receipt

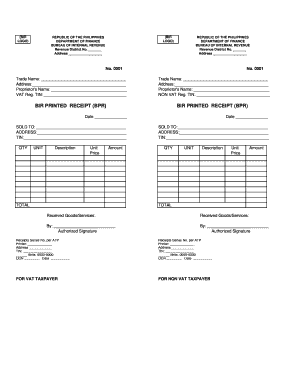

The BIR printed receipt is an official document issued by the Bureau of Internal Revenue (BIR) in the Philippines, serving as proof of payment for taxes or services rendered. This receipt is crucial for businesses and individuals as it validates transactions and demonstrates compliance with tax obligations. It includes essential information such as the taxpayer's name, Tax Identification Number (TIN), date of transaction, and the amount paid. Understanding the structure and purpose of the BIR printed receipt is vital for accurate record-keeping and tax reporting.

How to Obtain the BIR Printed Receipt

To obtain a BIR printed receipt, taxpayers must follow specific procedures set by the Bureau of Internal Revenue. First, businesses need to register with the BIR and secure the necessary permits. Once registered, they can apply for the official receipt book, which must be printed by a BIR-accredited printer. Taxpayers must complete the application form and submit it along with the required documents, such as proof of registration and payment of applicable fees. After processing, the BIR will issue the receipt book, enabling businesses to issue printed receipts for their transactions.

Steps to Complete the BIR Printed Receipt

Completing a BIR printed receipt involves several key steps to ensure accuracy and compliance. First, the issuer must fill in the date of the transaction and the name of the customer. Next, the amount received should be clearly stated, along with a description of the goods or services provided. It is essential to include the taxpayer's TIN and the receipt number for tracking purposes. Finally, the authorized signatory must sign the receipt to validate it. Ensuring all fields are correctly filled minimizes the risk of disputes and aids in proper tax reporting.

Legal Use of the BIR Printed Receipt

The BIR printed receipt holds legal significance as it serves as proof of payment and compliance with tax laws. It is essential for businesses to issue these receipts for every transaction to maintain transparency and accountability. In the event of an audit, these receipts can be used to substantiate income and expenses, ensuring that the business meets its tax obligations. Failure to issue or properly document BIR printed receipts can lead to penalties and complications with the BIR.

Key Elements of the BIR Printed Receipt

A BIR printed receipt must contain several key elements to be considered valid. These include:

- Taxpayer Identification Number (TIN): The unique identifier for the taxpayer.

- Receipt Number: A sequential number for tracking purposes.

- Date of Transaction: The date when the payment was made.

- Amount Received: The total amount paid by the customer.

- Description of Goods/Services: A brief description of what the payment is for.

- Authorized Signature: The signature of the person issuing the receipt.

Examples of Using the BIR Printed Receipt

The BIR printed receipt can be used in various scenarios, including:

- Issuing receipts for sales made by retail businesses.

- Providing proof of payment for services rendered by freelancers or contractors.

- Documenting transactions for tax deductions or credits during tax filing.

Each example highlights the importance of maintaining accurate records and ensuring compliance with tax regulations.

Quick guide on how to complete bir printed receipt

Effortlessly Prepare Bir Printed Receipt on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Bir Printed Receipt on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

Steps to Modify and Electronically Sign Bir Printed Receipt with Ease

- Find Bir Printed Receipt and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require new printed copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Transform and electronically sign Bir Printed Receipt and ensure excellent communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bir printed receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a BIR printed invoice sample?

A BIR printed invoice sample is a template that adheres to the Bureau of Internal Revenue's standards in the Philippines. It includes all necessary details required for official invoicing, ensuring compliance with tax regulations. Utilizing a BIR printed invoice sample can streamline your invoicing process, making it easier for businesses to manage their finances.

-

How can airSlate SignNow help with BIR printed invoice samples?

airSlate SignNow offers a user-friendly platform that allows businesses to easily create, send, and eSign BIR printed invoice samples. The solution ensures that your invoices meet regulatory standards while saving you time on document management. You can customize templates to suit your business’s needs, enhancing your invoicing efficiency.

-

Is there a cost associated with using airSlate SignNow for BIR printed invoices?

Yes, airSlate SignNow provides various pricing plans designed to accommodate different business sizes, including those needing BIR printed invoice samples. While there may be a nominal subscription fee, businesses can save signNow time and resources through our efficient invoicing tools. Check our pricing page for more details and to find a plan that fits your budget.

-

Can I integrate airSlate SignNow with my existing accounting software for BIR printed invoices?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software to streamline your invoice management. This ensures that your BIR printed invoice samples are correctly logged and accounted for without duplicate data entry, enhancing accuracy and efficiency in your financial reports.

-

What features does airSlate SignNow offer for BIR printed invoice management?

airSlate SignNow includes features like customizable templates, automated reminders, and real-time tracking for BIR printed invoice samples. You can also collaborate with team members and clients directly on the platform for improved communication. These features help simplify the invoicing process and ensure compliance with tax regulations.

-

Are there any limits on the number of BIR printed invoices I can create with airSlate SignNow?

The number of BIR printed invoices you can create depends on the pricing plan you select with airSlate SignNow. Higher-tier plans typically offer more extensive capabilities, including unlimited invoice creation. Visit our website to compare different plans and choose one that aligns with your business needs.

-

How secure is the process of using airSlate SignNow for BIR printed invoices?

Security is a top priority at airSlate SignNow. Our platform employs advanced security measures, including encryption and user authentication, to protect your BIR printed invoice samples from unauthorized access. This ensures that your financial information remains confidential and secure throughout the document management process.

Get more for Bir Printed Receipt

- Mafia application form

- 1199 coordination of benefits form for child

- Florida lodging tax exemption form government travelers pdf

- Daily positive behavior tracking form doc

- Ap biology reading guide fred and theresa holtzclaw chapter 9 form

- Master lease agreement pdf form

- Texas veterans commission nursing home statement form

- Form packetsunlawful detainer evictions

Find out other Bir Printed Receipt

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy