Systematic Withdrawal Enrollment Form Prudential Financial

What is the Systematic Withdrawal Enrollment Form Prudential Financial

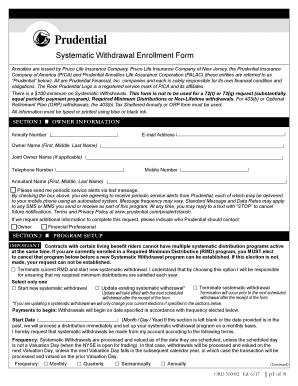

The Systematic Withdrawal Enrollment Form Prudential Financial is a crucial document that allows individuals to initiate regular withdrawals from their Prudential investment accounts. This form is particularly beneficial for those who require a steady income stream during retirement or for other financial needs. By completing this form, account holders can specify the amount and frequency of withdrawals, ensuring that their financial planning aligns with their personal goals.

How to use the Systematic Withdrawal Enrollment Form Prudential Financial

Using the Systematic Withdrawal Enrollment Form Prudential Financial involves a straightforward process. First, gather all necessary account information, including your Prudential account number and personal identification details. Next, fill out the form by indicating the desired withdrawal amount and frequency, such as monthly or quarterly. It is essential to review the completed form for accuracy before submission to avoid any delays in processing your withdrawals.

Steps to complete the Systematic Withdrawal Enrollment Form Prudential Financial

Completing the Systematic Withdrawal Enrollment Form Prudential Financial requires careful attention to detail. Follow these steps:

- Download the form from the Prudential website or obtain a physical copy.

- Fill in your personal information, including your name, address, and account number.

- Specify the amount you wish to withdraw and how often you want the withdrawals to occur.

- Sign and date the form to validate your request.

- Submit the completed form to Prudential via the specified method, either online or by mail.

Legal use of the Systematic Withdrawal Enrollment Form Prudential Financial

The legal use of the Systematic Withdrawal Enrollment Form Prudential Financial is governed by various regulations that ensure the integrity and security of electronic transactions. When filled out correctly, this form serves as a legally binding document, allowing for the authorized withdrawal of funds from your account. It is important to comply with all applicable laws regarding electronic signatures and documentation to maintain the form's validity.

Key elements of the Systematic Withdrawal Enrollment Form Prudential Financial

Several key elements are essential to the Systematic Withdrawal Enrollment Form Prudential Financial. These include:

- Account Information: Your Prudential account number and personal details.

- Withdrawal Amount: The specific dollar amount you wish to withdraw.

- Frequency of Withdrawals: Options for how often you want the withdrawals to occur.

- Signature: Your signature is required to authorize the withdrawals.

Form Submission Methods

The Systematic Withdrawal Enrollment Form Prudential Financial can be submitted through various methods. You may choose to complete the form online through Prudential's secure portal, which offers a quick and efficient way to process your request. Alternatively, you can print the form and mail it to the designated Prudential address. Ensure that you follow the submission guidelines provided on the form to avoid processing delays.

Quick guide on how to complete systematic withdrawal enrollment form prudential financial

Complete Systematic Withdrawal Enrollment Form Prudential Financial effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Systematic Withdrawal Enrollment Form Prudential Financial on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Systematic Withdrawal Enrollment Form Prudential Financial effortlessly

- Obtain Systematic Withdrawal Enrollment Form Prudential Financial and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize essential parts of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Systematic Withdrawal Enrollment Form Prudential Financial while ensuring exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the systematic withdrawal enrollment form prudential financial

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Systematic Withdrawal Enrollment Form Prudential Financial?

The Systematic Withdrawal Enrollment Form Prudential Financial is a document that allows policyholders to set up regular withdrawals from their investment accounts. This form streamlines the process, ensuring that your funds are disbursed according to your specific preferences and needs.

-

How do I complete the Systematic Withdrawal Enrollment Form Prudential Financial?

To complete the Systematic Withdrawal Enrollment Form Prudential Financial, you will need to provide your account information, the desired withdrawal amount, and frequency. Make sure all details are accurate to avoid delays in processing your request.

-

Are there any fees associated with the Systematic Withdrawal Enrollment Form Prudential Financial?

Processing the Systematic Withdrawal Enrollment Form Prudential Financial may incur certain fees, depending on your investment account. It’s always best to check with Prudential Financial directly for any specific fee structures related to your account.

-

What are the benefits of using the Systematic Withdrawal Enrollment Form Prudential Financial?

Using the Systematic Withdrawal Enrollment Form Prudential Financial provides you with the convenience of automatic withdrawals, allowing for better financial planning. It helps manage your cash flow effectively, ensuring that you can access your funds regularly without manual intervention.

-

Can I modify my withdrawals after submitting the Systematic Withdrawal Enrollment Form Prudential Financial?

Yes, you can modify your withdrawals after submitting the Systematic Withdrawal Enrollment Form Prudential Financial. Prudential Financial typically allows for changes, but you should contact customer service for guidance on the process and potential impacts on your account.

-

Is the Systematic Withdrawal Enrollment Form Prudential Financial secure to use?

Yes, the Systematic Withdrawal Enrollment Form Prudential Financial uses secure methods to protect your personal and financial information. Prudential Financial adheres to industry standards to ensure that your data remains confidential and safe throughout the process.

-

What integrations does the Systematic Withdrawal Enrollment Form Prudential Financial support?

The Systematic Withdrawal Enrollment Form Prudential Financial can be integrated with various financial management tools and platforms. This allows for easier tracking of your investments and withdrawals, optimizing your financial strategy more efficiently.

Get more for Systematic Withdrawal Enrollment Form Prudential Financial

- Credit application gescan com form

- Dhcs 6168 form

- Authorization to release educational records form lone star

- Fitzharris dental insurance form

- Permit to carry application hubbard county co hubbard mn form

- Pest control food services 213 745 1435 trouble call form

- Head start application form

- Council 4044 form

Find out other Systematic Withdrawal Enrollment Form Prudential Financial

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile